- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

If there is no withholding amount you will owe.

file an amended state return attaching a photocopy of your W-2 showing state tax withheld. Start with 2018 earliest year.

you must do that within three years of filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

Sir/Man,

Thanks for your response. Will you please explain me in depth how to check W2 showing tax withheld and how to file an amended state return? And I have only 2 years of filling 2019 & 2020.

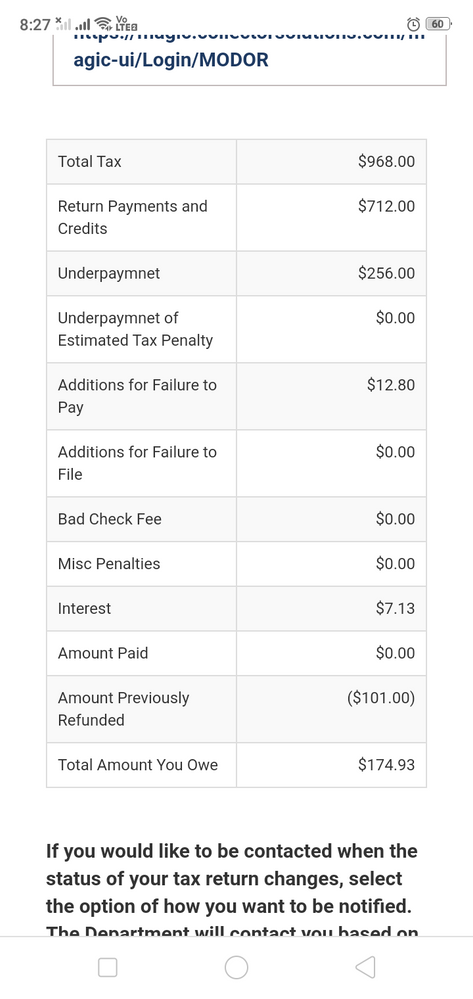

I have send the attachment of chart that Mo state department has send me. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

The amount of tax withheld from your pay may not necessarily cover 100% of the taxes you owe. Taxes withheld rarely are an exact match for taxes owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

Now please suggest me what am I supposed to do how can I solve this. Please help me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

If your employer verified that your W2's were correct, and if you entered them correctly on your tax return, and if you're pretty sure your tax return is otherwise correct, then you should pay the tax bill you received from Missouri.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

Actually i am really not sure whether I filled it right or wrong. Will you please help me to check whether I filled my returns in right way or not. I really don't have any ideas on how to check our returns. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO state department has hold my state tax from past 2year.they are saying that I have a withholding amount and I owe money to them.I might have filled in something wrong?

Unfortunately no one here can see your tax return. And no one here can know whether you entered all your required information into your tax return, or whether you entered it correctly. You may have to seek other assistance.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

swaairforce

New Member

swayzedavid22

New Member

stolencry

New Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

johntheretiree

Level 2