- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Massachusetts State Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts State Return

I'm using the Turbo Tax Deluxe software.

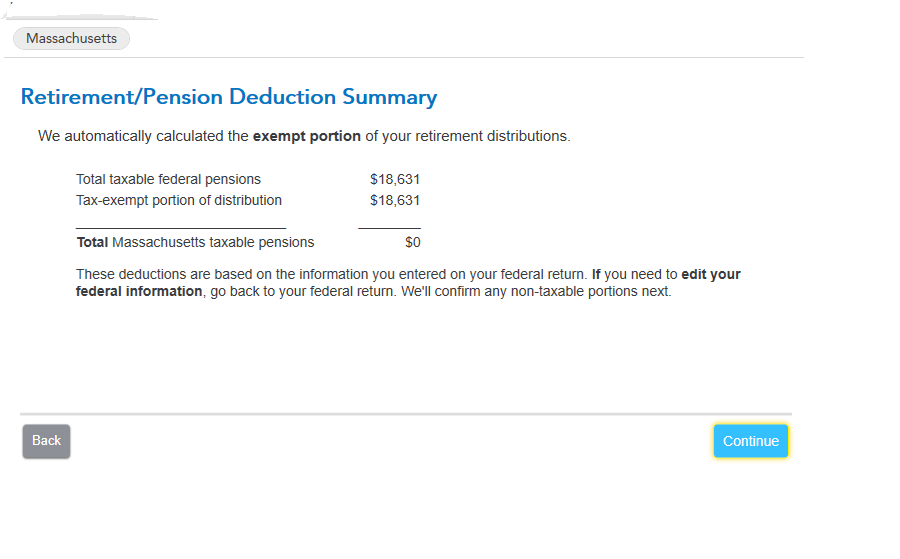

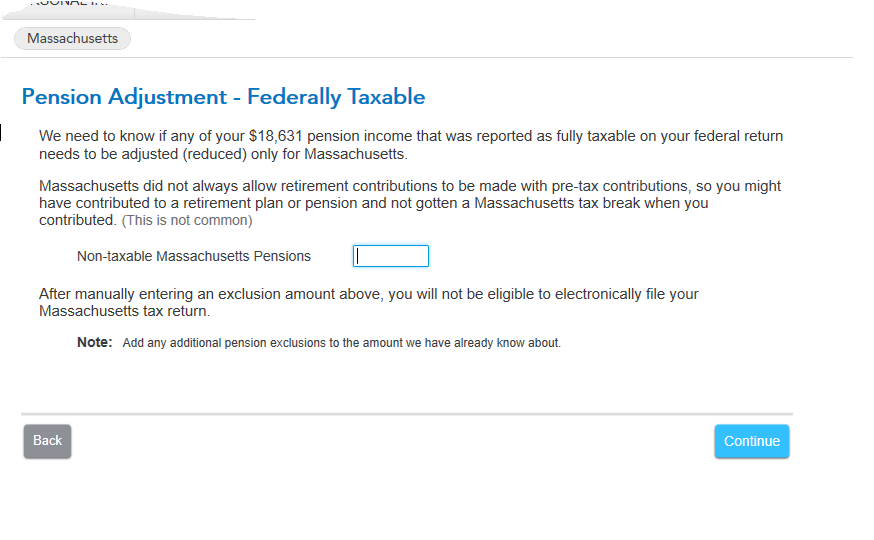

I've entered two items to my post. Its the 2nd one that I'm confused about. How would I know if this amount needed to be adjusted? Or do I enter the $18,631 into the box: Non-taxable Massachusetts pension or do I leave it blank?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts State Return

It depends on the type of retirement distribution you have for how to answer the question. If you do not have a tax-exempt pension as described on page 10 shown below, then see page 20 and page 21 for further guidance and worksheets.

Please see 2019 Massachusetts Form 1 Instructions: page 10:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts State Return

After reading what you sent me. I'm still not understanding it. My Statement of Annuity Paid ( Form CSA 1099-R) does not withhold state tax. When I entered that amount of $18, 631in the box: Non-Taxable Massachusetts Pensions it shows a refund for me of $1130.00. But if I leave it blank the refund shows less. I'm guessing that I should leave that box blank. With that amount filled in it indicates that I will not be eligible to electronically file my Mass state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts State Return

That refund I mentioned is my Mass refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts State Return

Certain types of pension funds are not taxable in the State of Massachusetts. If your pension is any one of these, it is non-taxable in the State of Massachusetts. Otherwise your will pension/retirement will be taxable to you.

According to the State of Massachusetts instructions these pensions are non-taxable:

- Pension income received from a contributory annuity, pension, endowment or retirement fund of the U.S. Government or the Commonwealth of Massachusetts and its political subdivisions.

- Pensions from other states or its political subdivisions which do not tax such income from Massachusetts or its political subdivisions may be eligible to be deducted from Massachusetts taxable income.

- Noncontributory pension income or survivorship benefits received from the U.S. uniformed services (Army, Navy, Marine Corps, Air Force, Coast Guard, commissioned corps of the Public Health Service and National Oceanic and Atmospheric Administration) are exempt from taxation in Massachusetts.

- Massachusetts state court judges who were appointed on or after January 2, 1975 are participants in the Massachusetts contributory retirement system and their pensions are nontaxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkatz71

New Member

daupet1

New Member

Omar80

Level 3

chinyoung

New Member

Katie1996

Level 1