- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Massachusetts does not show calculated 2024 estimated tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts does not show calculated 2024 estimated tax

When I went through my Massachusetts State return, we had a large 2023 refund coming because of a decline in income. When TurboTax asked how much we wanted to use to pay 2024 estimates, I entered the whole amount. When I checked the return, I see it shows no calculations for the total estimated taxes we should pay. That is, the "2023 Massachusetts Massachusetts Tax Return Summary" lists only "Taxable Income", "Total Tax," Total Payments/Credits", "Refund Applied to ES Tax," and "No Refund or Amount due" with a $0.00 following it. with no list of vouchers as in the Federal return. An earlier draft of the Massachusetts return had calculated a smaller 2023 return, but also had not shown any total estimated tax to be paid. I can't believe that I somehow managed to come out with a 2023 Refund that exactly matched the 2024 estimate. The return or the filing instructions at the start should show what the actual estimate is so we don't accidentally overpay if the previous year's refund happens to be more than the next year's estimate.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts does not show calculated 2024 estimated tax

The estimated tax payment vouchers for 2024 will be generated based upon your answers in the state interview section for Massachusetts. The program will prompt you to enter any anticipated changes to your income for 2024 as compared to 2023 and will adjust your required estimated tax payments as needed.

To review your entries, log back into TurboTax.

- Go to the state taxes tab and select continue for your Massachusetts return.

- Continue through the screens until you you see the screen titled "Apply Refund to 2024 Estimated Tax?".

- On this screen, you would enter the amount of the overpayment you want to apply from your 2023 overpayment to your 2024 estimated tax payments. Once you have entered an amount here, select Continue.

- Select Continue on the screen titled "Massachusetts Estimated Taxes for 2024."

- Proceed through the screens until you see the page titled "Estimated Tax Worksheet." This is where you will enter any anticipated changes to your income for 2024. Your estimates for 2024 will be generated based upon your input on this screen.

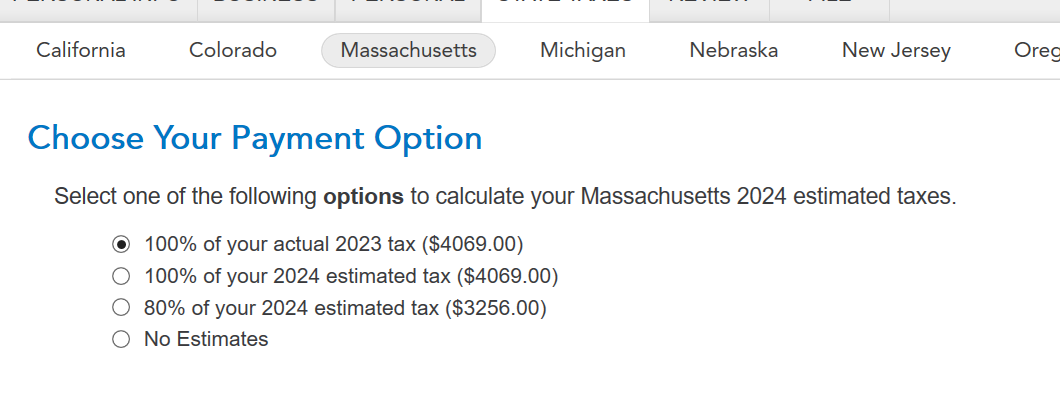

- On the next screen titled "Choose Your Payment Option" select the amount you want to use to apply your overpayment. Your options are either 100% of your actual 2023 tax, 100% of your 2024 estimated tax, or 80% of your 2024 estimated tax. You also have the option to select no estimates if you choose.

- On the screen titled "Apply Overpayment", you have the option of choosing how you want this overpayment applied.

8. On the next screen titled "Apply Entire Overpayment to 2024", you will be prompted to confirm that you indeed to want to apply the overpayment.

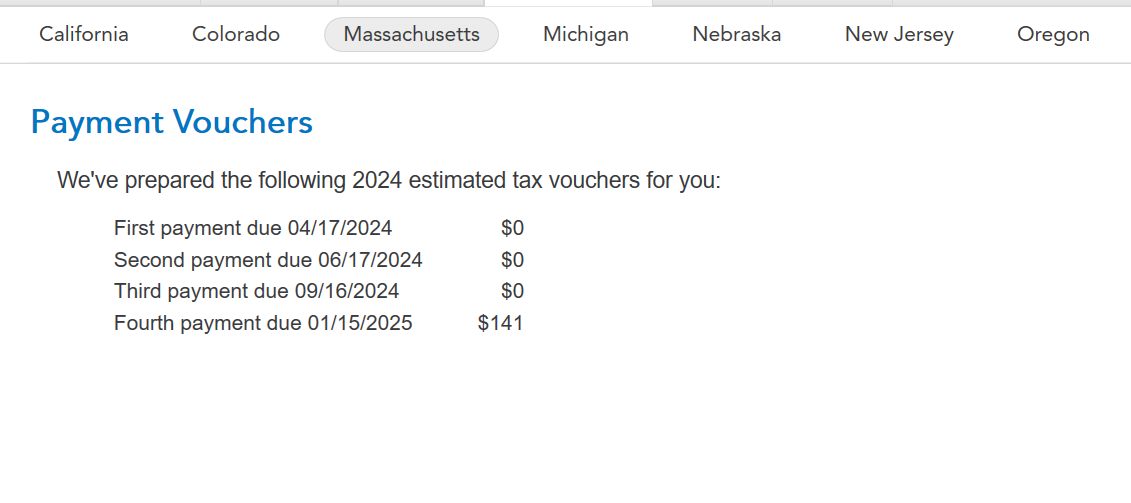

9. Continue through the next few screens and make entries as required. Once you reach the screen titled "Payment Vouchers,", you will be given a break down of any remaining estimated tax payments.

10. To review how your overpayment is being applied, select Forms on the top right of the program to access your forms.

11. On the left, scroll down to Massachusetts and select Estimated Wks. This will provide a breakdown of how your overpayment is being applied to your 2024 estimated taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lodami

New Member

paul22mcintosh

New Member

douglasjia

Level 3

philsmithgeologist

New Member

halberman

Level 1