- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Live in NJ, work in NY where does my dividend, interest, and capital losses/gains get allocated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, work in NY where does my dividend, interest, and capital losses/gains get allocated

I live in NJ, but work in NY so where does my dividend, interest and capital losses/gains get allocated?

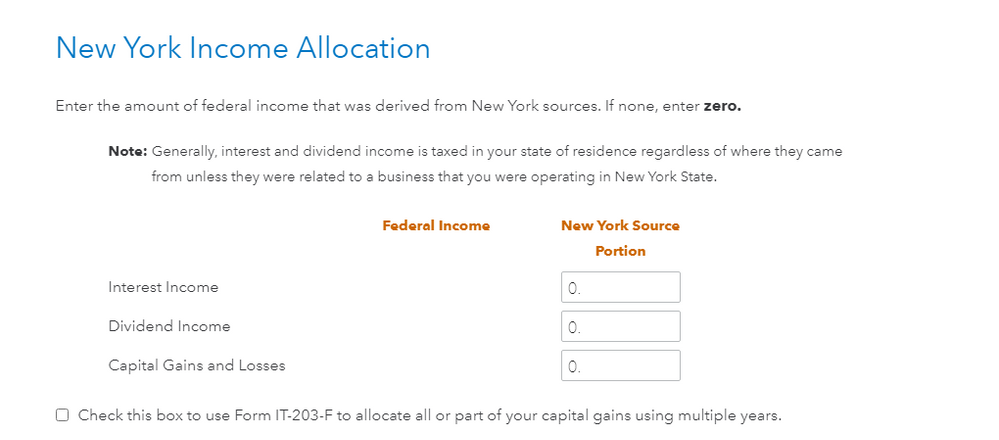

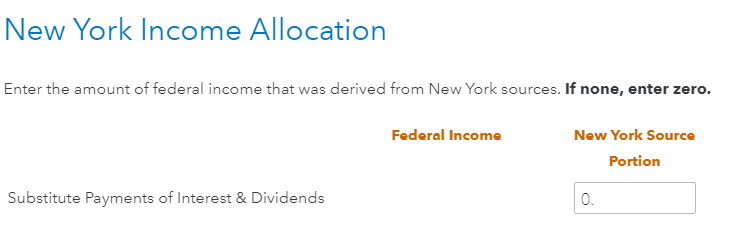

In my non-resident NY form there is a section for: "Nonresident other allocations". In it I have my dividend, interest, and capital losses. It's asking to set a "New York Source Portion". Should I set all of these to 0 and then it'll get automatically allocated to New Jersey which is where I lived?

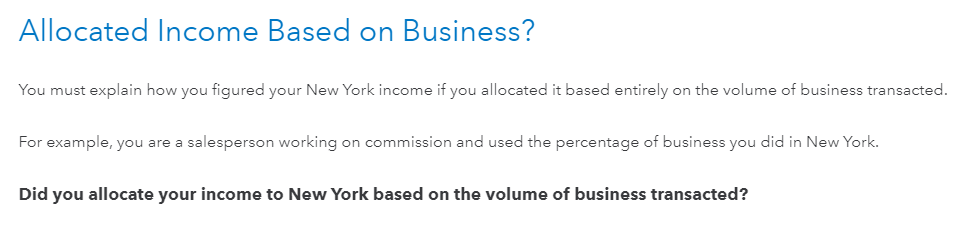

Also, it asked "Allocated Income based on Business". I put Yes and gave the reason: "RESIDE IN NJ, SO DIVIDEND, INTEREST, & CAPITAL GAINS/LOSS BEING ALLOCATED THERE". Is this valid?

Screenshot below with my Federal Income numbers removed for privacy reasons.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, work in NY where does my dividend, interest, and capital losses/gains get allocated

If you worked in NY all year, all your wages were earned in New York state. You will get a credit in NJ for taxes withheld in NY so you won't be double taxed. Nothing else is taxable to NY since you are a New Jersey resident.

Therefore, allocate Zero for dividends, interest, etc since all should be sourced to NJ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, work in NY where does my dividend, interest, and capital losses/gains get allocated

If you worked in NY all year, all your wages were earned in New York state. You will get a credit in NJ for taxes withheld in NY so you won't be double taxed. Nothing else is taxable to NY since you are a New Jersey resident.

Therefore, allocate Zero for dividends, interest, etc since all should be sourced to NJ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dalibella

Level 3

scatkins

Level 2

user17539892623

Returning Member

exintrovert

New Member

djpmarconi

Level 1