- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, work in NY where does my dividend, interest, and capital losses/gains get allocated

I live in NJ, but work in NY so where does my dividend, interest and capital losses/gains get allocated?

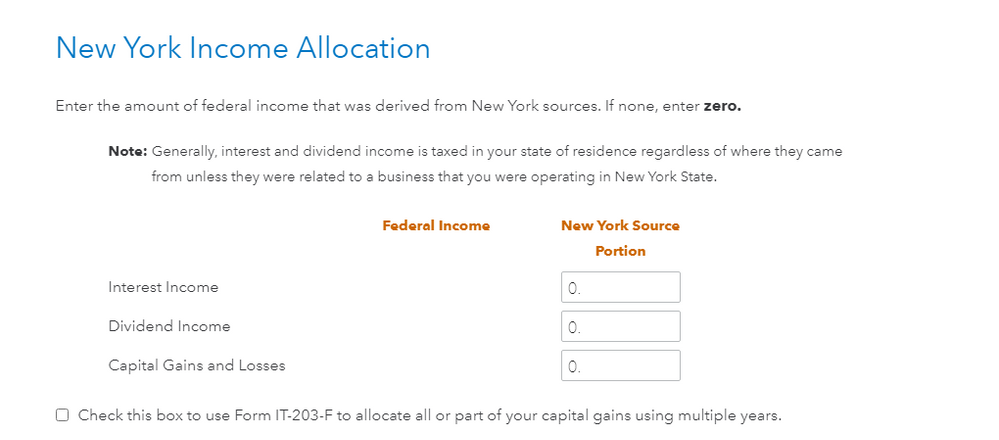

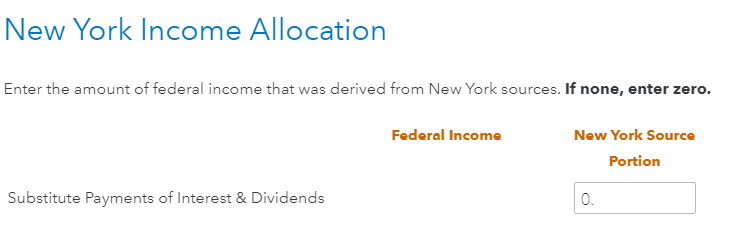

In my non-resident NY form there is a section for: "Nonresident other allocations". In it I have my dividend, interest, and capital losses. It's asking to set a "New York Source Portion". Should I set all of these to 0 and then it'll get automatically allocated to New Jersey which is where I lived?

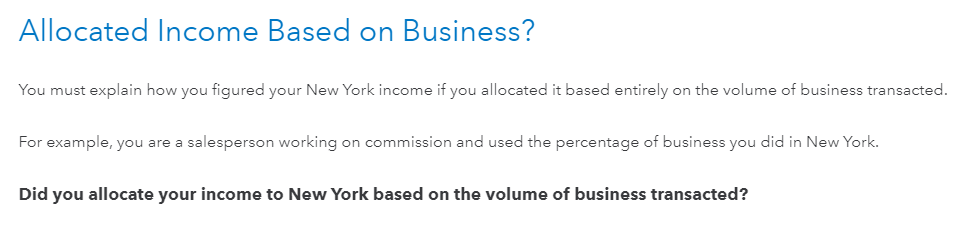

Also, it asked "Allocated Income based on Business". I put Yes and gave the reason: "RESIDE IN NJ, SO DIVIDEND, INTEREST, & CAPITAL GAINS/LOSS BEING ALLOCATED THERE". Is this valid?

Screenshot below with my Federal Income numbers removed for privacy reasons.

Topics:

March 16, 2023

10:15 PM