- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Line 9, IT-540-2D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 9, IT-540-2D

In filling out my Louisiana return and noting that I do not have a federal disaster credit, it appears that my answer on line 9 should be zero. Instead, the form has a hugh number with no explanation given.Has anyone seen similar?

Can anyone please explain?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 9, IT-540-2D

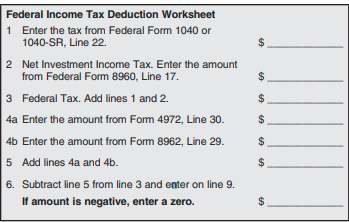

Per the State of Louisiana, if you have not claimed federal disaster relief credits, your Line 9 would be calculated based on the worksheet below. It would only be 0 if the ending number was a negative number. I have attached a snippet from the IT-540 instructions for additional reference.

However, if your property was damaged or stolen because of a federally declared disaster, you can claim this loss on your federal return. Property includes personal or business property like homes, vehicles, and other items.

As part of tax reform relief for those affected by natural disasters, you can now deduct your total loss (minus $500 and any amount covered by insurance) along with your usual Standard Deduction for tax year 2020. This means you’ll be able to claim everything you lost over $500 without having to itemize deductions on your taxes.

To enter your losses on your federal return, please follow the steps below:

- Open your return.

- Click on Federal on the left of the page.

- Click on Deductions & Credits at the top of the page.

- Scroll down to Deductions and Credits and click start next to Disasters, theft, and other property loss or damage.

- Follow the on-screen instructions.

Once you claim a credit on your federal return, your IT-540 Line 9 will change.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rtoler

Returning Member

gavrielsullivan

New Member

bees_knees254

New Member

Hypatia

Level 1

Glklynn

New Member