The screenshot you have provided above is not Form 5500-EZ. Please see this link for the actual form for 2024. The form is only required when the plan has $250,000 or more in assets at the end of the year.

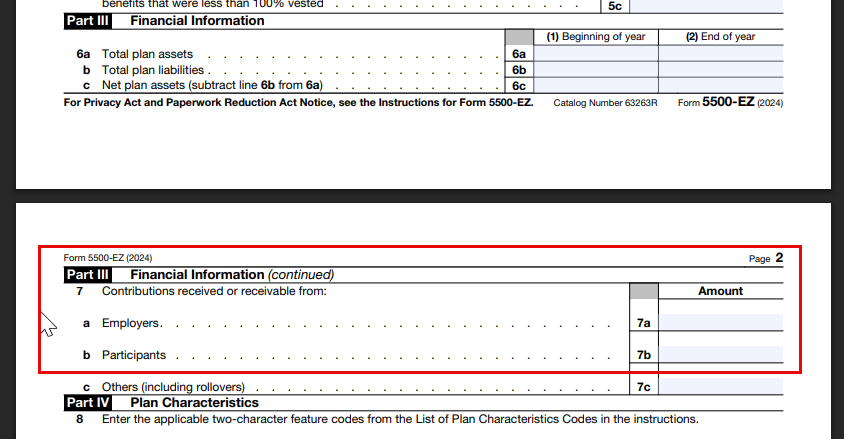

You would enter the employer contributions under Part III, line 7a. Employee contributions would be entered under Part III, line 7b.

Please be aware, this form is not supported within TurboTax per this FAQ.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"