- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still tax...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Yes, Colorado is taxing unemployment in full so you must add back the federal exclusion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

How do you do that in filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

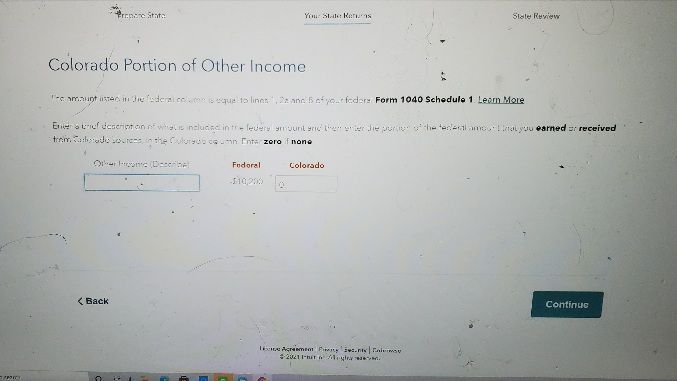

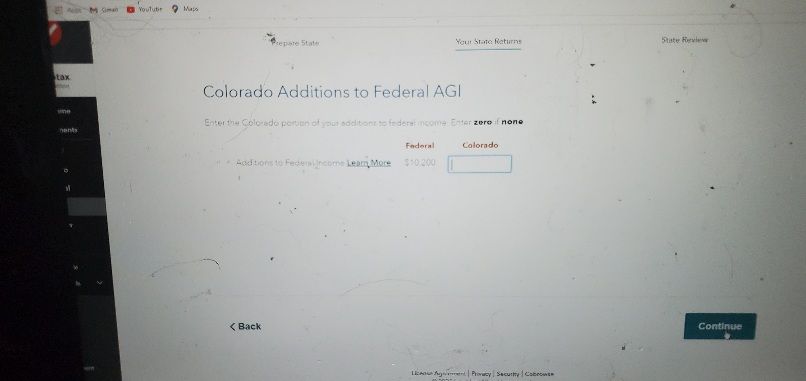

I get to the screen that says federal -10200. What do I put in for colorado then the next screen says federal 10200 what do I put in for colorado

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

TurboTax will take care of this for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Yea but I don't know what numbers I need to put in those two screens for the unemployment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

I'm not sure which screens you are referring to. You will enter your 1099-G (unemployment) form in the federal portion of the return and it will be carried over to your state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Assuming you live in Colorado, you will enter the amount of unemployment you received in the Colorado boxes here. If the amount of unemployment received was greater than $10,200, you will enter the maximum amount of $10,200.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

I do not live in colorado but earned unemployment in colorado so I can enter -10200 in for colorado on screen 1 and then 10200 on screen number 2 since that affects colorado

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

I just dont know what i need to enter on the above 2 screens

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Can i assume i enter -10200 and 10200 on those screens respectively?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Colorado, the federal exclusion of the first $10,200 of unemployment benefits is still taxable for 2020. Is this amount added back as an adj. for the state return?

Yes, because that amount is attributed to Colorado.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jabry1116

New Member

kfreedom355

New Member

kima-7772009

Level 1

IFoxHoleI

Level 2

Kat271

Returning Member