- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: IL Tax Filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

I sold some property that I inherited from my Dad in IL, but I live in TX. Do I have to file an IL tax return and claim that on an IL tax return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

Yes, because the land is in Illinois (IL). The good news is that you are allowed to have a cost basis that is the fair market value (FMV) on the date of death of your father. This is usually much higher than what he paid for it. Depending on the selling price there may be little to no gain. Also the time from your father's death to the date of sale will be a factor in helping to arrive at the FMV unless you already have the stepped up basis amount.

The selling price is also the determining factor for filing the IL return. It may not have any tax liability once your cost and selling expenses are used to offset the selling price.

You can enter the sale of your inherited land using the information below, When you get to the IL return be sure nonresident is selected and watch the screens to make the necessary adjustments.

- Under Wages & Income scroll to Investments & Savings

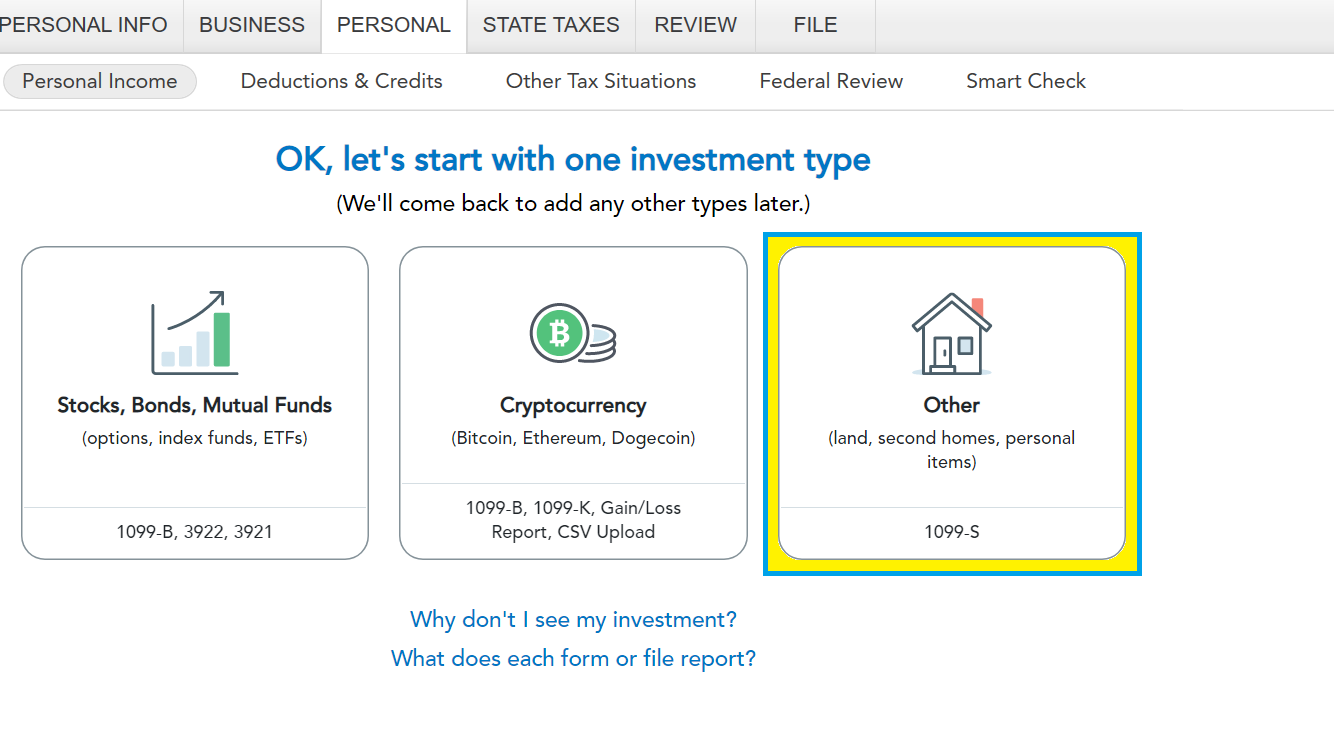

- Select Start/Revisit beside Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Select Add Investments or continue to go through the screens to select 'Other' > Continue

- Begin to enter the sale description > Under Type select Other > Under How did you receive select 'I Inherited it' (if applicable)

- For TurboTax Desktop you would enter the description 'Inherited Property' and select 'Long Term' as the hold period

- Enter your sale date and 'Various' as the Acquired date

- Continue to complete the screens until you arrive back at the Wages & Income main page.

Inherited property is always considered to have a long term holding period which provides favored tax treatment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

He put it in our names before he passed, so I don't believe we get the stepped up basis do we?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

It depends on how it was retitled. If he just gifted you the whole property out right before his date of death then there would be no step up basis. If he added your names to the title and his was still there as well, then you inherited his portion at death, so there will be some step up basis there. Finally, if the title went to a grantor (revocable) trust and then you inherited, there will be step up basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

He just titled it to my brothers and me. Do we get his cost basis? Or do we have no basis(there was no trust or anything like that)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IL Tax Filing

Your basis will depend upon how the title transferred to you and your siblings under Illinois state law.

If the property was gifted to you and your siblings, the basis may become more complicated. IRS Publication 551 Basis of Assets, page 9, states:

Property Received as a Gift

To figure the basis of property you receive as a gift, you must know its adjusted basis to the donor (likely the father's cost) just before it was given to you, its fair market value (FMV) at the time it was given to you, and any gift tax paid on it.

FMV Less Than Donor's Adjusted Basis

If the fair market value (FMV) of the property at the time of the gift is less than the donor's adjusted basis, your basis depends on whether you have a gain or a loss when you dispose of the property.

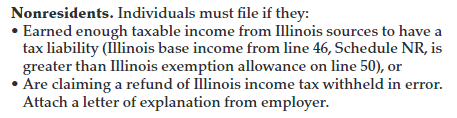

An Illinois nonresident state income tax return may need to be filed because the land was Illinois sourced. The Illinois nonresident filing requirements are here per The TaxBook, page IL-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MattPeck

New Member

Ihavefaith18

New Member

ModestMouse

New Member

kellygunter32

New Member

cindiawi

New Member