- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Your basis will depend upon how the title transferred to you and your siblings under Illinois state law.

If the property was gifted to you and your siblings, the basis may become more complicated. IRS Publication 551 Basis of Assets, page 9, states:

Property Received as a Gift

To figure the basis of property you receive as a gift, you must know its adjusted basis to the donor (likely the father's cost) just before it was given to you, its fair market value (FMV) at the time it was given to you, and any gift tax paid on it.

FMV Less Than Donor's Adjusted Basis

If the fair market value (FMV) of the property at the time of the gift is less than the donor's adjusted basis, your basis depends on whether you have a gain or a loss when you dispose of the property.

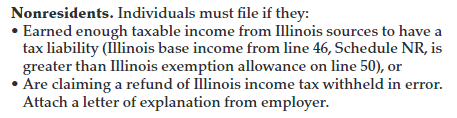

An Illinois nonresident state income tax return may need to be filed because the land was Illinois sourced. The Illinois nonresident filing requirements are here per The TaxBook, page IL-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"