- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, because the land is in Illinois (IL). The good news is that you are allowed to have a cost basis that is the fair market value (FMV) on the date of death of your father. This is usually much higher than what he paid for it. Depending on the selling price there may be little to no gain. Also the time from your father's death to the date of sale will be a factor in helping to arrive at the FMV unless you already have the stepped up basis amount.

The selling price is also the determining factor for filing the IL return. It may not have any tax liability once your cost and selling expenses are used to offset the selling price.

You can enter the sale of your inherited land using the information below, When you get to the IL return be sure nonresident is selected and watch the screens to make the necessary adjustments.

- Under Wages & Income scroll to Investments & Savings

- Select Start/Revisit beside Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

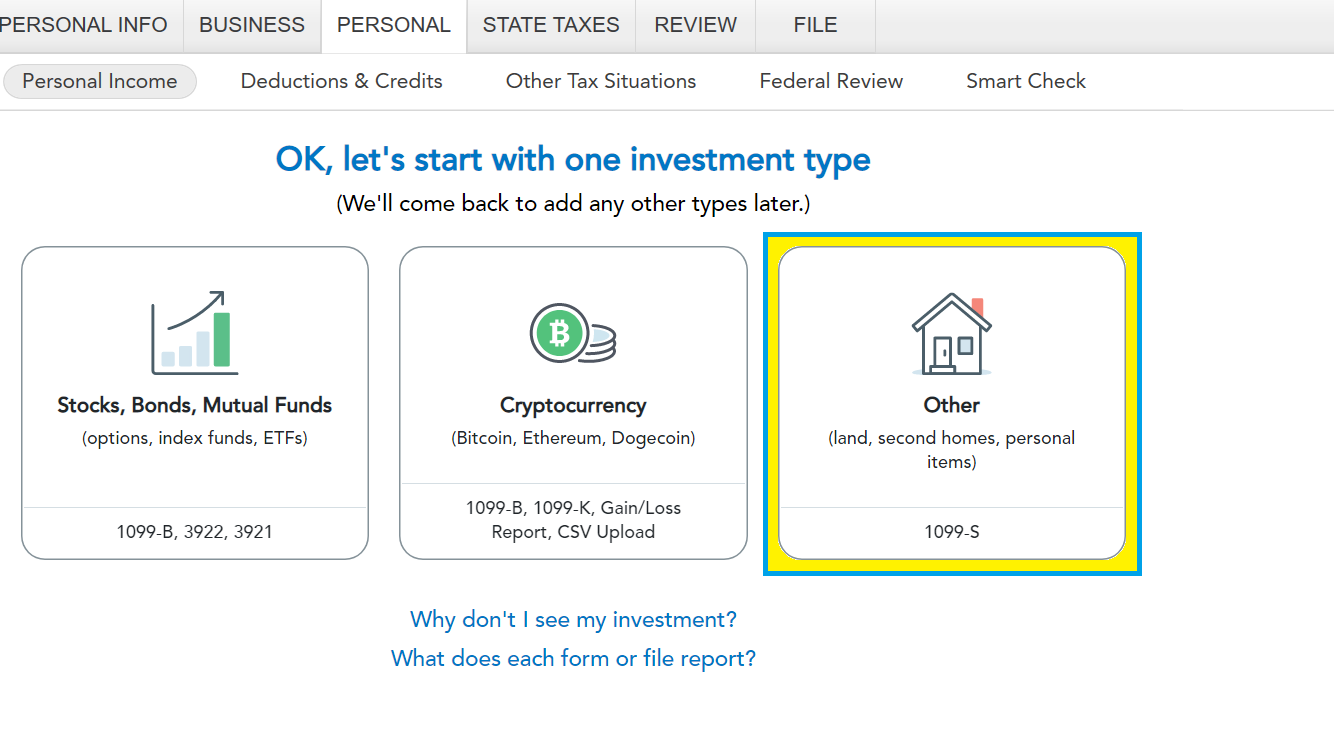

- Select Add Investments or continue to go through the screens to select 'Other' > Continue

- Begin to enter the sale description > Under Type select Other > Under How did you receive select 'I Inherited it' (if applicable)

- For TurboTax Desktop you would enter the description 'Inherited Property' and select 'Long Term' as the hold period

- Enter your sale date and 'Various' as the Acquired date

- Continue to complete the screens until you arrive back at the Wages & Income main page.

Inherited property is always considered to have a long term holding period which provides favored tax treatment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"