- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

You do report your NY income and tax paid there on your New York Non-Resident return.

On your California Resident return, report all your income and you will get credit for tax paid to NY.

Click this link for instructions on How to File a Non-Resident Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

I'm not sure if I'm setting this up correctly. So I went back to the NY nonresident form and just entered in the income tax information like normal, but instead of refunding my entire NY income tax amount, it's still saying I owe money. However, for CA form, it's giving me a credit back for the full amount that I would've owed CA. My income taxes in CA should be lower than the income taxes I paid NY so I technically should be getting money back here. I'm not sure if I'm just still not entering in the NY information correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

If you were taxed correctly on your NY income, you should about break even (maybe get a little back, or owe a bit).

CA probably won't give you a refund, since you didn't pay any tax to them.

Review your main State Tax Forms to see what the calculations were.

Since we can't see your return in this forum, click this for info on How to Get a Live Review .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

NY taxed me ~3500 on this years W2 form and originally before I fixed the CA return it said I would owe CA ~3200. After I fixed the CA form it credited me that same amount so it put me at $0 so I won't be getting anything back from CA (which makes sense to me), but now after adjusting NY it says I owe them $33? I'm unsure why I would owe anything to NY period when I'm trying to correct that I haven't worked in NY at all during 2019 so I shouldn't have been taxed by NY to begin with. So do I just owe NY $33 now for some reason and then that difference of $300 is just lost?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

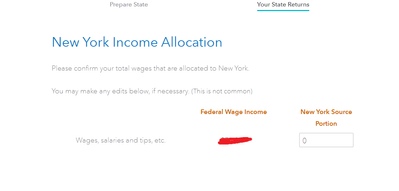

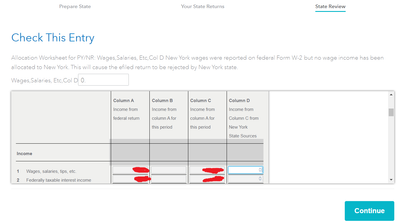

I am not sure why you are having to pay $33 for the State of New York, make sure that you are filing Non-Resident and that it shows that you received $0 income from the State of New York. Here is how you can check your State Return:

1. While in your Tax Home,

2. Select State from the left side of your screen,

3. Select Your State Returns from the top of your screen,

4. Follow the on-screen prompts to ensure that everything was entered correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

@ReginaM I double checked and I am in fact filing a nonresident NY form. I have tried putting $0 income from NY before but it won't let me submit it and keeps telling me to fix my error. It won't let me file my returns until I put something other than 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was taxed in the wrong state. How do I get the nonresident form to accept 0 allocation?

You probably owe NY $33 because there were recent changes in the Payroll Withholding Tables that are affecting you.

Your employer just held $33 less tax than they should have on your income. You can change your NY withholding, or better yet, have your employer withhold only CA tax, so you don't need to file to NY at all.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Waylon182

New Member

dholt1

New Member

dg2022

New Member

iampeng

Level 1

kd764

Returning Member