- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

I am using TurboTax Home and Business 2022 downloaded and running on a Mac.

In prior years, it was easy to see where to enter my 529 information on my VA state return.

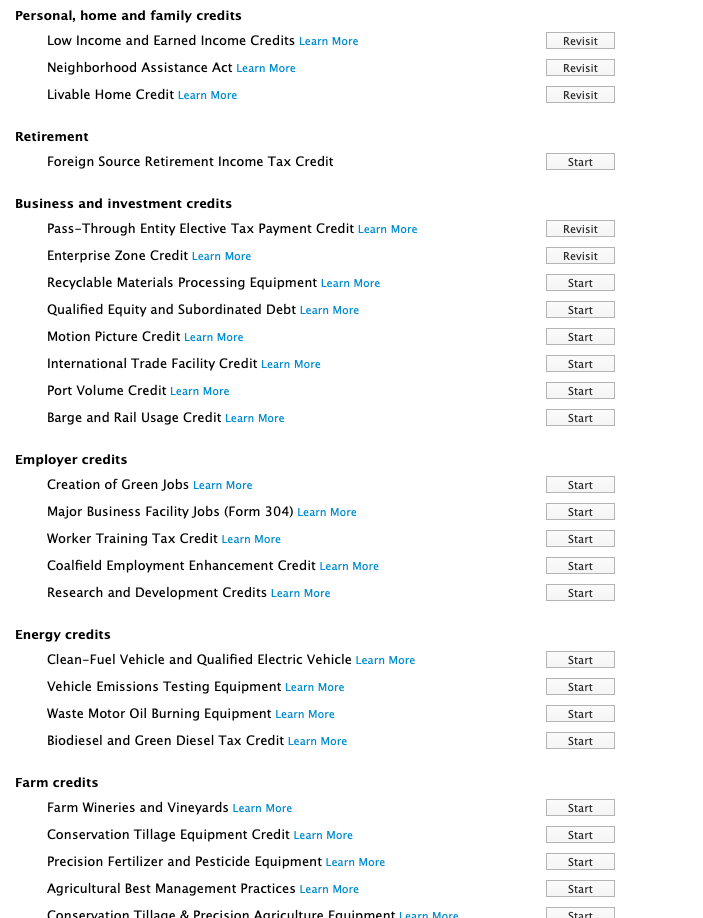

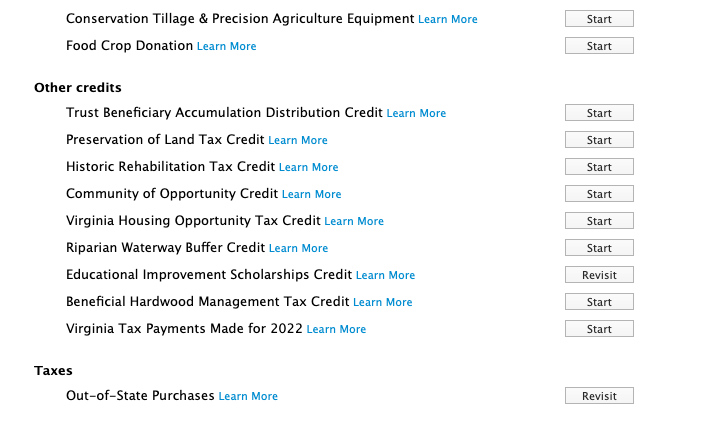

This years, however, there is no area to enter Educational Information. A shot of screen is below.

So where do I enter my VA 529 Contributions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

In the Virginia state return, from the main screen, click on Edit for the Income section.

Then scroll down to the Education section and click on Edit for Virginia College Savings Prepaid Tuition (Section 529) Plan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

I am trying to report my 529 contributions for the 2022 tax year. When I look at what Virginia handles differently, Education or 529 are not listed. If I search and jump to form 1099-Q, I am redirected to Personal->Deductions and Credits and asked whose education expenses were paid with the distribution reported on form 1099Q. I did not take a distribution but made a contribution. Does TurboTax Virginia not allow me to report and deduct contributions to a Virginia 529 plan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

It should. Unfortunately, there is not a direct path or a search term you can use to get to the Virginia 529 plan contributions section of your Virginia return.

The steps and screenshots provided above by TeresaM are the current steps to take for your 2022 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

I had the exact same experience/problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

You are referring me to INCOME. That is where I would enter a Distribution from the plan.

That is not what I am trying to achieve. I am trying to enter a Contribution to the plan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

TeresaM is referring to Income from plan.

Our problem is where to enter a Contribution to the plan. Thus screenshot from TeresaM is not helpful or relevant to the question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

It is true that the 529 questions are in the Income section, but they ask about contributions and also about distributions. Please follow this path.

@rapscallion83

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

TeresaM,

You seem to be using some other version of TurboTax.

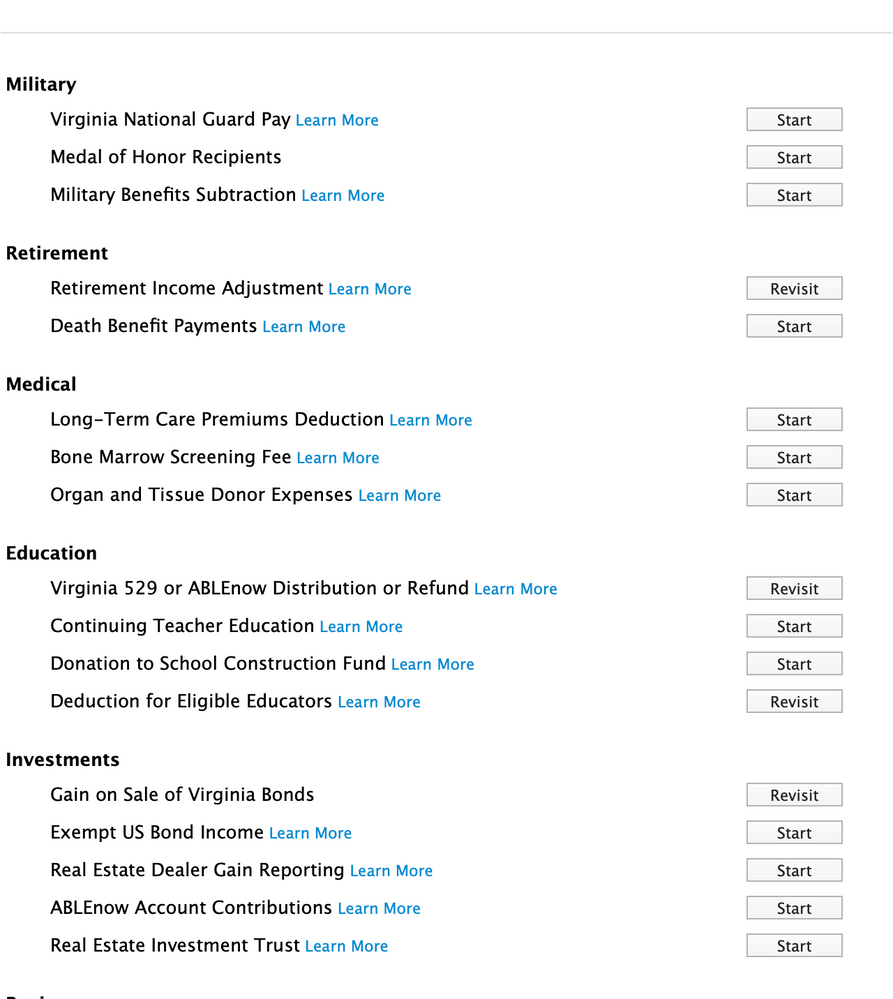

I am using Home + Business 2022 TurboTax on a Mac and I am not presented with the screens you are showing. First I am shown this screen:

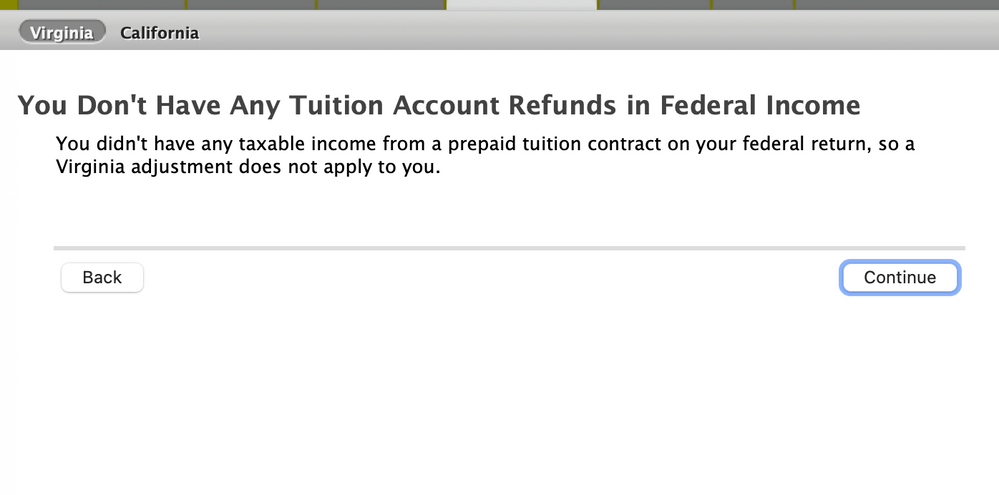

When I click on Virginia 529 or AbleNow Distribution or Refund I am taken to a screen that shows:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

This is the Windows Desktop/Download version and it matches the Online version but does look different than your screen shots.

1. Please make sure you update your software. Is it giving a message that it has successfully updated.

2. Virginia returns are not due until May 1st, so if you finish the federal, that still gives some time to resolve the state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

TeresaM-

I am indeed using latest version of TurboTax. I run UPDATE every time that I start it up. It is Application 2022r26.056 with a Build Date of April 18, 2023 at 11:16:013am.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

It is a very good habit to run the updates.

I do not currently have access to a Mac Desktop version but it looks as if some items were moved in the Easy Step interview interface.

I was able to add information in Forms mode in the Windows version and that should also work in Mac, as a workaround.

- To go to Forms mode, click on the Forms button and it will pull up a list of all the forms in the return on the left side.

- Scroll down through the federal and in the list of Virginia forms, look for Deductions Statement.

- Open that form and under Virginia529 Plan Smart Worksheet you will be able to make the entries.

- The blue entries show what I have manually typed in and the black ones are calculated.

- When you are finished, you can click back on Easy Step to return to the interview interface.

I hope this helps.

@rapscallion83

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my contribution to a Virginia 529 plan to get a deduction on my Virginia State taxes?

Thank you. That mostly worked. It didn't show a Deductions Statement in my form list so I had to goto OPEN FORM and then look for it.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

georgiesboy

New Member

soccerfan1357

Level 1

dkrawchu1

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ir63

Level 2

willowpoe

New Member