- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Form 511-NR from Turbotax Premier forms not correct

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

I submitted the forms produced to Oklahoma that Turbotax said I should get a refund of $152. Oklahoma says the amount of the return should be $30. Oklahoma gave me information on what lines were entered incorrectly by Turbotax. I called for support and was handed off to a tax expert who could only help me if I was filing online. I need support for the CD version. Any ideas on who I should contact for assistance?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

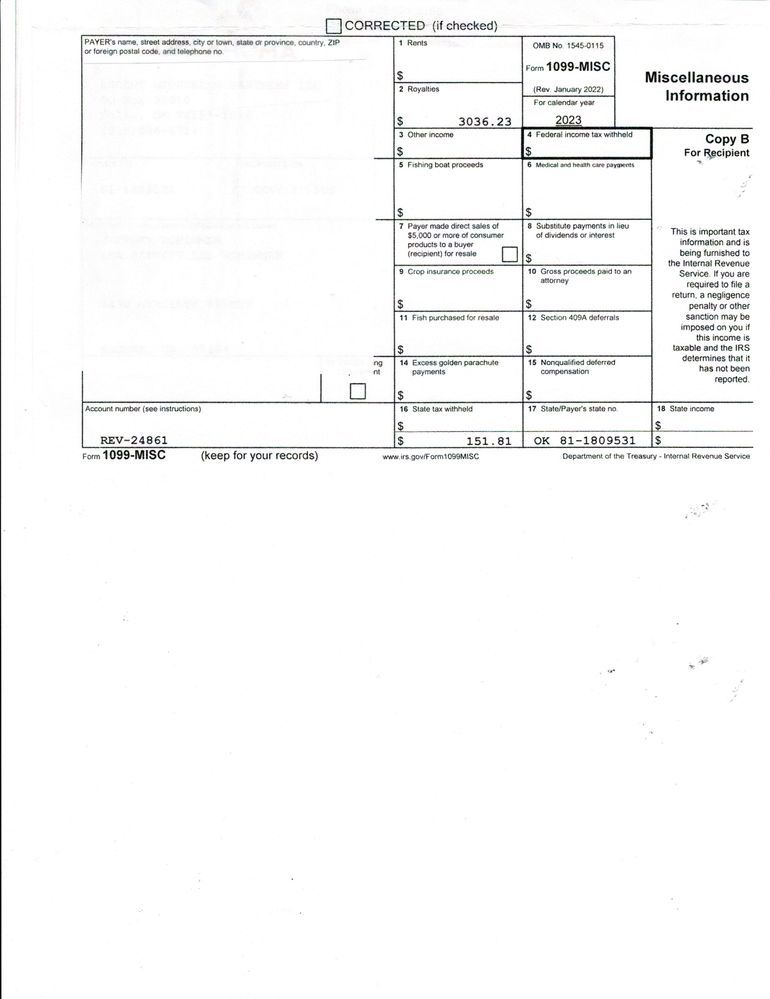

Your issue doesn't seem to be capital gains. It appears that the difference is the $3,036. Oklahoma is adjusting that as taxable, whereas your return had zero listed on Line 1 (Oklahoma source income). Since the royalties are taxable to the state, the adjustment made by the state is correct.

You are required to allocate the Oklahoma sourced income items to the state on the screens, Oklahoma Income. If no number is entered under the Oklahoma amount, then nothing will be on the return as taxable.

Go back through the screens and allocate your royalty income to Oklahoma. An example of this screen is attached below. In this example, I entered a royalty of $5,000 and there was a depletion deduction taken. The total nets out to $4,250. This amount flowed to the Oklahoma nonresident return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

Can you clarify what the issue is? Did you file your Oklahoma return? If so, was your return adjusted by Oklahoma?

Or are you trying to complete your return and have a questions on the input?

If your return was already filed, the state of Oklahoma should mail you information explaining any changes made to your tax returns as filed.

Oklahoma does offer a site to track your refund on this website.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

As my original post said, I submitted the TurboTax printed form to OK and OK said they were not correct. Yes OK adjusted the return. I would like to know why TurboTax did the forms wrong. And what they should have been. I paid extra for OK non resident and it should work correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

In order to assist you, we will need more information about your situation as we cannot see your return or the adjustment letter from Oklahoma. Please provide that information so we can assist you further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

[PII removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

[PII removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

I removed the scanned paperwork you posted as your social security number was visible. Please give me a brief description of what Oklahoma adjusted. The letter should tell you what the $30 adjustment was for.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

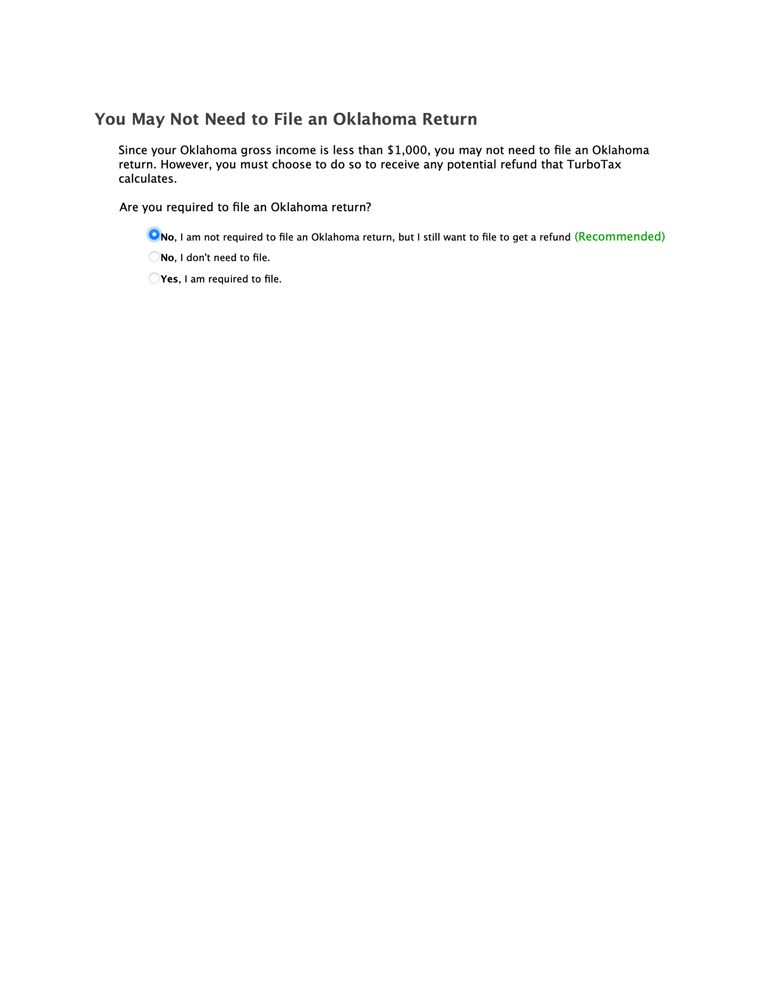

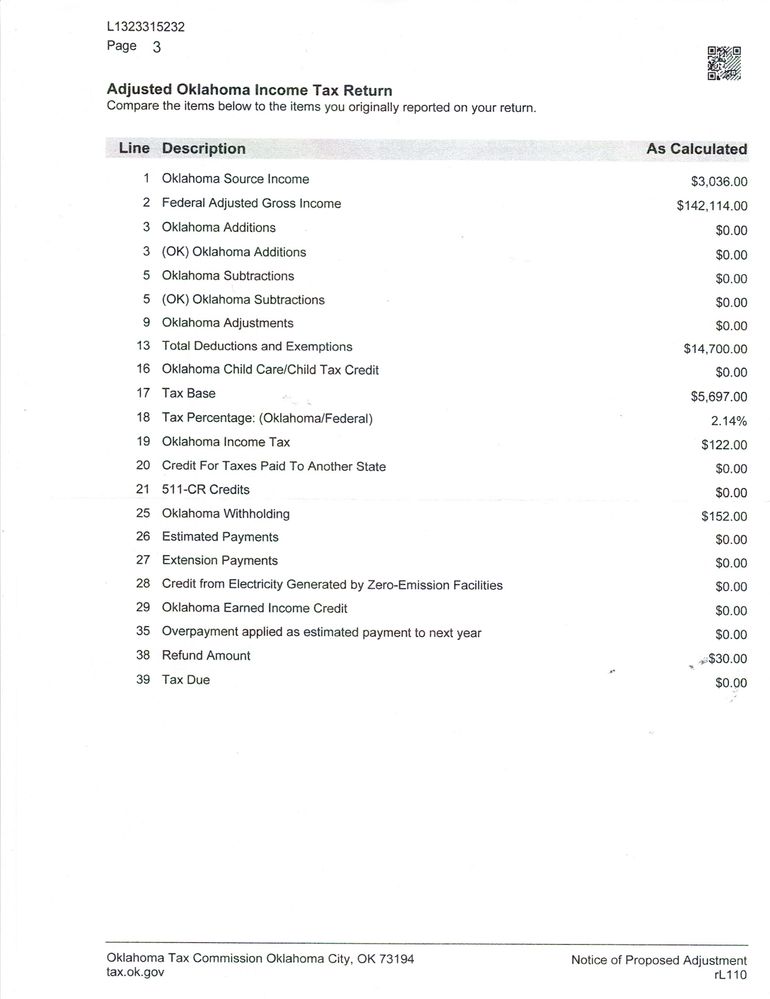

OK. Here are the forms I am talking about. Sorry. For some reason the last page didn't upload so I added it. Page 3 from Oklahoma has several lines entered that were not in the Turbotax form. I also wonder why on 511-NR the Not required to file box is checked. On the Capital Gain Deduction section of 561-NR, box A3 doesn't give a valid option. That's an Oklahoma problem but it would be nice to know what I should enter for a value since Turbotax keeps saying it's in error if I don't enter something. Thanks for your help.

Jeff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

The box is usually checked on the 511-NR if you are not required to file, but have had Oklahoma tax withheld or paid an estimated payment to the state.

Per the 511-NR instructions, except as otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019, every nonresident with Oklahoma source gross income of $1,000 or more is required to file an Oklahoma income tax return.

Can you clarify how much your Oklahoma source income was for 2023? If under $1,000 and you had Oklahoma tax withheld or paid an estimated payment, then that box should be checked. Did you see the screen below when you were going through your Oklahoma return?

Regarding 561-NR, here are the property types per the instructions:

Enter the number in the box which corresponds to the type of property sold:

- 1. The sale of stock in a qualified Oklahoma corporation.

- 2. The sale of an ownership interest in a qualified Oklahoma company, limited liability company, or partnership.

- 3. The sale of qualified real property located within Oklahoma.

- 4. The sale of qualified tangible personal property located within Oklahoma.

- 5. The sale of qualified intangible personal property located within Oklahoma as part of the sale of all or substantially all of the assets of an Oklahoma company, limited liability company, or partnership or an Oklahoma proprietorship business enterprise.

- 99. For lines 2-5, enter a “99” if the net gain/loss is from the sale of more than one type of property.

Everything from your Schedule D will flow to your Oklahoma return. If it isn't an Oklahoma capital gain, you have to exclude it. You exclude it by entering the gain as zero. This should exclude it from the 561-NR. Please see the original solution in this post.

Regarding your previous post, please tell me what lines were adjusted. I deleted your forms as your social security number was visible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

As per the 1099, the Royalties were over $1,000. Is this not considered income? At any rate I selected the Top No and the Bottom Yes to see what would happen and the X is still in the Not Required to file. This is more a curiosity question but probably doesn't impact why the TurboTax fields are wrong.

I went to the article you referenced and it looks like deversd was supposed to be there best answer. I can get to the Oklahoma button below the Personal Info but nothing else matches what they describe after that.

Regarding 561-NR, here are the property types per the instructions:

Enter the number in the box which corresponds to the type of property sold:

Again, not sure why the options are only for OK since the OK Capital gains should all be zero. Turbotax did set the values for OK to zero so it should be OK but I was hoping you might recommend a good value for A3. My guess would be 1 because it was stocks, even though they were not OK stocks.

Here is what I got back from Oklahoma.

The reason I blacked out my personal information on the turbotax forms was so you could see what Turbotax filled out. In summary,

511-NR

1. OK zero

2. both set to adjusted income

13. zero

17. zero

18. a blank, b blank % blank

19. zero

25. both $152

31. $152 not listed on OK adjusted

32. zero not listed on OK adjusted

33. $152 not listed on OK adjusted

34. $152 not listed on OK adjusted

38. $152 $30 on OK adjusted

Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

Your issue doesn't seem to be capital gains. It appears that the difference is the $3,036. Oklahoma is adjusting that as taxable, whereas your return had zero listed on Line 1 (Oklahoma source income). Since the royalties are taxable to the state, the adjustment made by the state is correct.

You are required to allocate the Oklahoma sourced income items to the state on the screens, Oklahoma Income. If no number is entered under the Oklahoma amount, then nothing will be on the return as taxable.

Go back through the screens and allocate your royalty income to Oklahoma. An example of this screen is attached below. In this example, I entered a royalty of $5,000 and there was a depletion deduction taken. The total nets out to $4,250. This amount flowed to the Oklahoma nonresident return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 511-NR from Turbotax Premier forms not correct

Thanks That seemed to take care of it. I am surprised that Turbotax didn't bring this income across automatically since it's identified as being from Oklahoma. I have made myself a note for next year. Thanks for your efforts. Nice job!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

knelso4

New Member

Sumipriya1

Returning Member

Tony81266

Level 1

jrneuville

Returning Member

jowatt

Level 1