- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

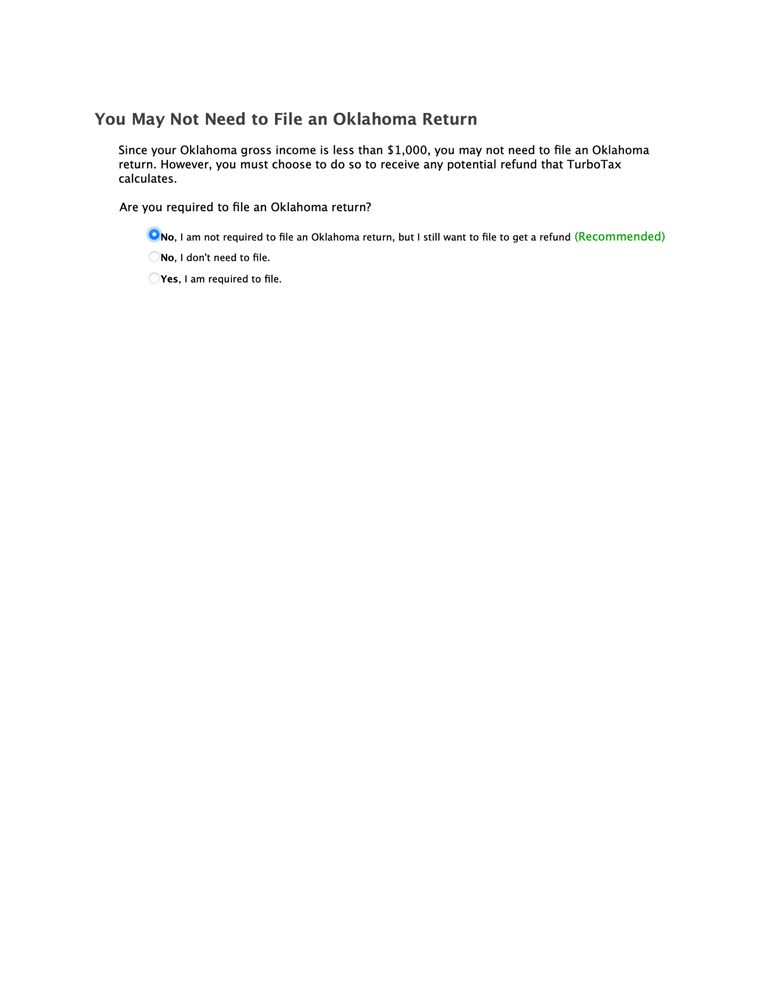

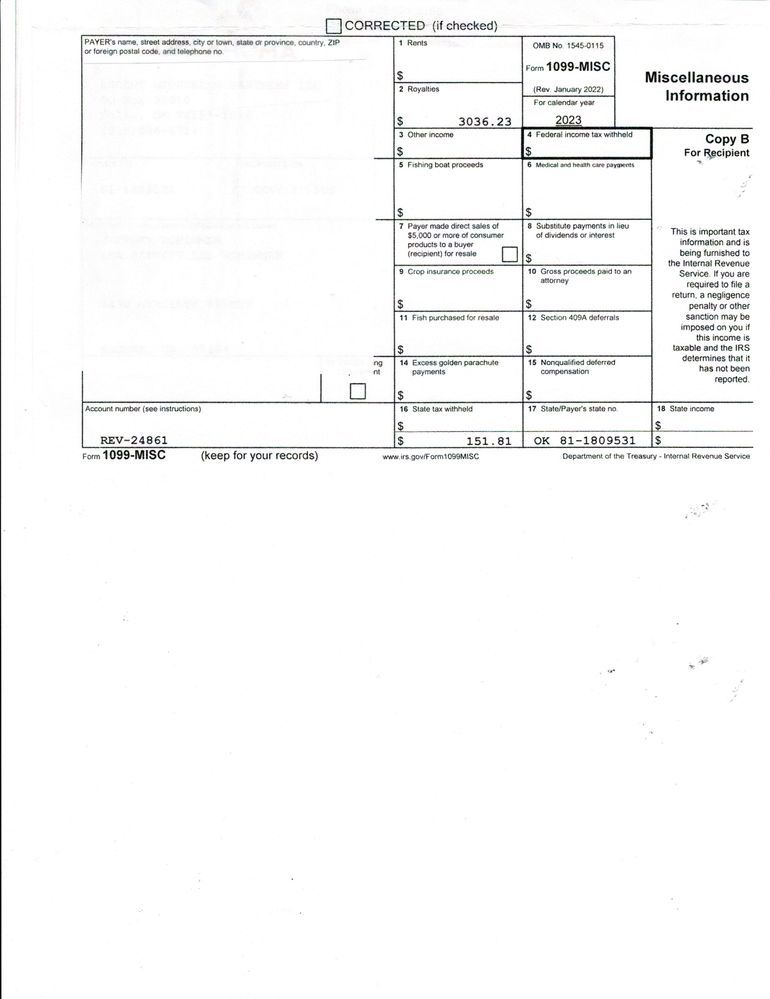

As per the 1099, the Royalties were over $1,000. Is this not considered income? At any rate I selected the Top No and the Bottom Yes to see what would happen and the X is still in the Not Required to file. This is more a curiosity question but probably doesn't impact why the TurboTax fields are wrong.

I went to the article you referenced and it looks like deversd was supposed to be there best answer. I can get to the Oklahoma button below the Personal Info but nothing else matches what they describe after that.

Regarding 561-NR, here are the property types per the instructions:

Enter the number in the box which corresponds to the type of property sold:

Again, not sure why the options are only for OK since the OK Capital gains should all be zero. Turbotax did set the values for OK to zero so it should be OK but I was hoping you might recommend a good value for A3. My guess would be 1 because it was stocks, even though they were not OK stocks.

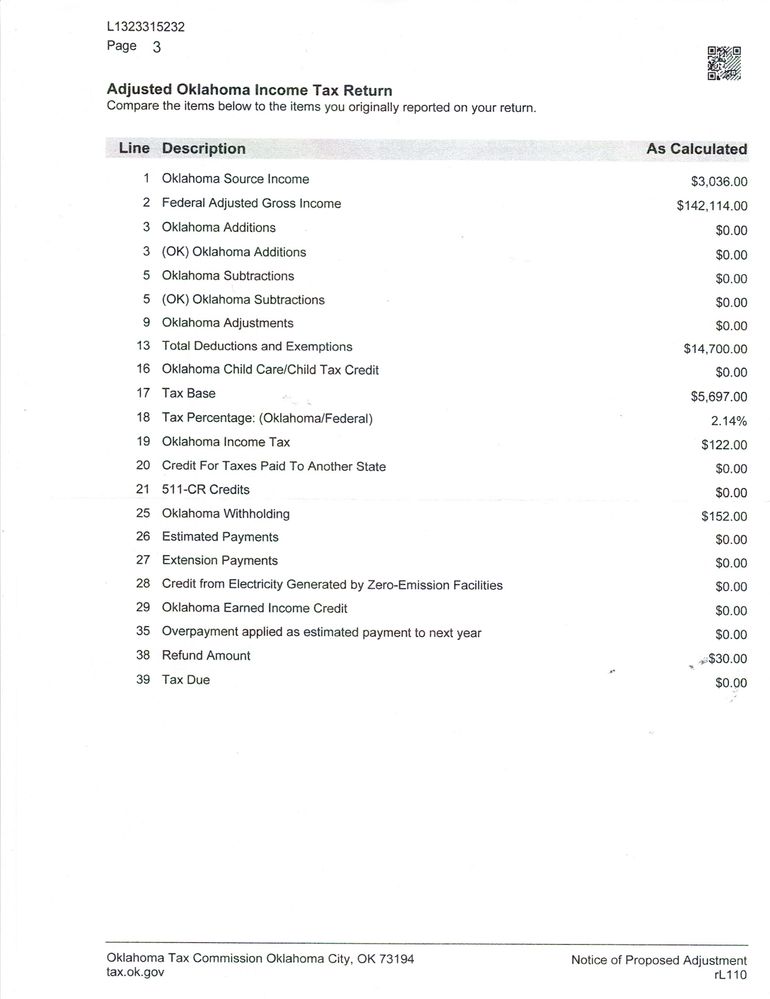

Here is what I got back from Oklahoma.

The reason I blacked out my personal information on the turbotax forms was so you could see what Turbotax filled out. In summary,

511-NR

1. OK zero

2. both set to adjusted income

13. zero

17. zero

18. a blank, b blank % blank

19. zero

25. both $152

31. $152 not listed on OK adjusted

32. zero not listed on OK adjusted

33. $152 not listed on OK adjusted

34. $152 not listed on OK adjusted

38. $152 $30 on OK adjusted

Hope this helps.