- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it sh...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

When you start the non-resident return or go back through it since you have already been through it, you will allocate your income to the non-resident return. Click on STATE in the left menu and go back through the WI return. Make sure it is a NON-resident return. TurboTax will ask you about each category of income and will include the amounts you allocate to WI on the WI state return. You should go through wages, capital gains, business income, etc.

How do I file a nonresident state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

Thank you for the response. I've tried to go back through, and yes I have confirmed it is a non-resident return. Still, it is showing $500 in capital gains and losses. I've played with the various input boxes and can't seem to get it to show $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

On second thought, I made <$2K gross in Wisconsin. Perhaps I don't need to file a Wisconsin income tax form at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

You do need to file Wisconsin taxes if you made any insome in that state.

- In the income page of Wisconsin - select Investments

- Wisconsin Capital Gains and Losses

- Click the Edit button next to your Wisconsin Capital Gains and Losses

- Select Yes for Do you need to make any Wisconsin adjustments?

- Enter carryovers, if none just Continue

- Then enter your Gains and Losses for short-term and long-term transactions

- To remove them from Wisconsin, enter them as negative amounts

- Continue with the state, return and review it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

I deleted the Wisconsin return and started fresh. I entered in capital gains as negatives as you suggested, and it did in fact show $0 for capital gains temporarily. However, once I enter in my Wisconsin 2020 income, it changes capital gains back to $500. It seems it's treating it as a loss, -$500

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

One more thing I noticed - the Wisconsin income is also being left out of the other state wage total being transferred to Massachusetts (I'm a MA resident)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling out Wisconsin non resident tax form... it is showing capital gains as $500 when it should be $0. How do I fully clear this out?

To exclude capital gain from your Wisconsin nonresident return:

- Go to the Wisconsin section of TurboTax

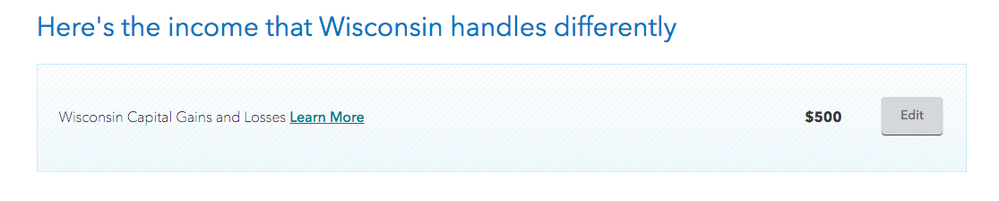

- Keep going until you reach Here's the income that Wisconsin handles differently

- Edit Wisconsin Capital Gains and Losses

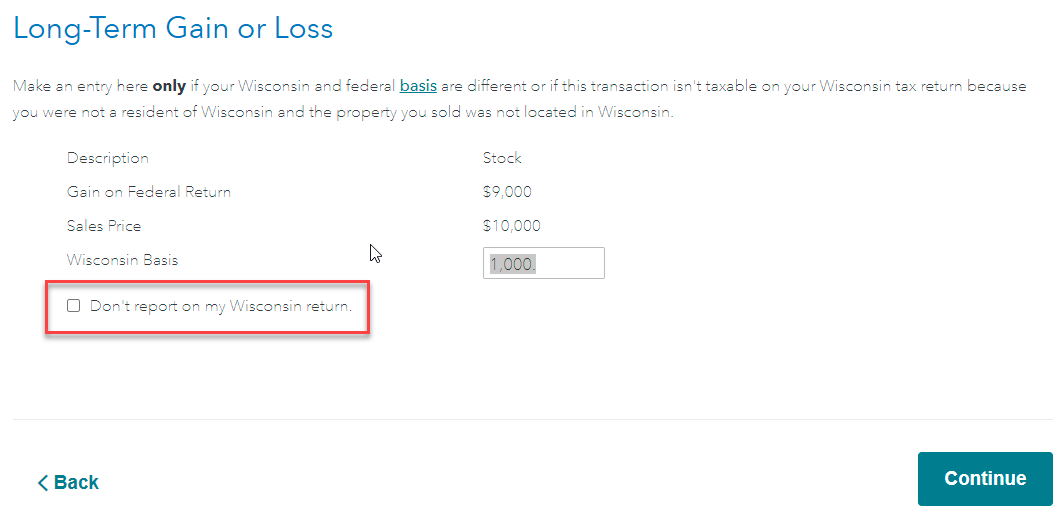

- Say YES to Adjustments for Capital Gains and Losses?

- Continue to Long-Term Capital Gains and Losses Summary then Edit.

- Check the box Don't report on my Wisconsin return.

Capital gains are not included in other state wages because they are not wages. Capital gains are 12% income in Massachusetts and reported on MA Schedule B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrosarius

New Member

user17538342114

Returning Member

dpa500

Level 2

dpa500

Level 2

rwarhol1

New Member