- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

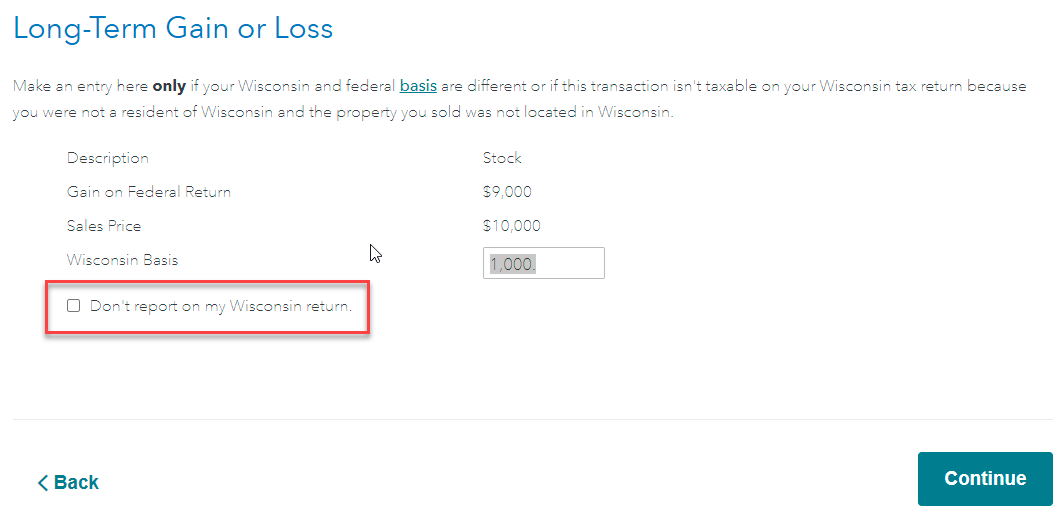

To exclude capital gain from your Wisconsin nonresident return:

- Go to the Wisconsin section of TurboTax

- Keep going until you reach Here's the income that Wisconsin handles differently

- Edit Wisconsin Capital Gains and Losses

- Say YES to Adjustments for Capital Gains and Losses?

- Continue to Long-Term Capital Gains and Losses Summary then Edit.

- Check the box Don't report on my Wisconsin return.

Capital gains are not included in other state wages because they are not wages. Capital gains are 12% income in Massachusetts and reported on MA Schedule B.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 5, 2021

4:19 PM