- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Double taxed in a reciprocal state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxed in a reciprocal state

I work in both PA & WV which are reciprocal states. I am a full year resident of PA. However, I was double taxed in both states. WV only took out state taxes but PA took out state abs local. First, do I need to file taxes in both states or can I just file the double tax form in PA and get the credit. Also on the double tax form for “gross” row 1 (this is where I assume I put my gross wages from WV) and “gross” row 2 (this is where I assume I put all my wages for both states. Then the last line in row 1 “taxes owed” is this where I put the amount of state taxes WV took? And in row 2 is this where I put the amount of taxed PA took? If so, do I add both the state and local together? Also, in the beginning of the program it told me that I needed to file 2 tax returns for both states but that WV should be a “nonresident with special considerations” but the program won’t let me move forward with this box checked even though the program checked it to begin with. Any help is appreciated I am going crazy searching article after article and nothing relates to my special topic of working in both a resident and nonresident state. One last note; I am owed a return in my resident state before adding in what they took from the nonresident state. I did not know I was supposed to fill out a form so this didn’t happen. Last year the program told me I didn’t need to file a return in that state but they took money so I am assuming I am owed money from last year as well but I will figure that out after this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxed in a reciprocal state

File two taxes—a resident Pennsylvania income tax return because you are a PA resident and a West Virginia income tax return because WV tax was withheld by mistake.

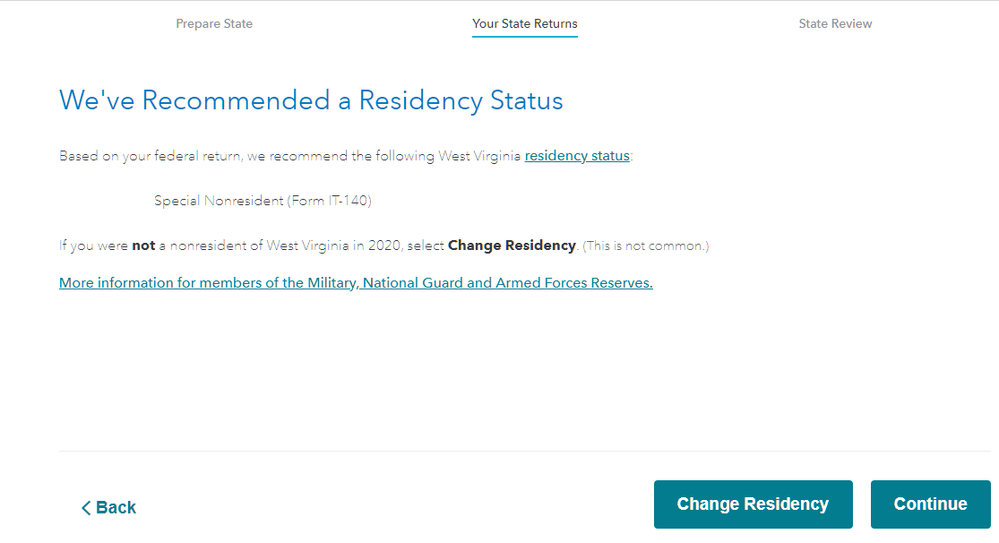

TurboTax will ask whether you want to file a Special Nonresident return (Form IT-140). Click continue. WV will refund all your withholding as long as you did not spend more than 183 days in the state. Commuting (not spending the night) does not count as a day. See page 10 of the WV Income Tax Book.

Give your employer Form WV/IT-104 to stop WV withholding. Ask to have PA tax withheld.

There will be no credit for double-taxed income on the PA-40 because you are getting all your tax from WV. Delete the double tax form. You will owe to PA because you PA state tax was withheld.

Give “Cheers” by clicking on the thumb icon

Click "Mark as Best Answer" if the post answer your question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxed in a reciprocal state

Wonderful, thank you! Would I file as a nonresident with special considerations since I only earned wages in WV (form IT-140)? Also, I put in work deductions for both WV and PA but it is telling me that my deductions are more than my earnings of $0. Why are my earnings in both states showing as zero? I have been using my phone and I’m not sure if that is why I’m not seeing the options in the drop down menu. Lastly, when I file WV do I report my earnings as $0 since I am being taxed for all my wages in my reciprocal state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxed in a reciprocal state

Yes you would file WV (form IT-140). TurboTax should get your there automatically. Just follow the directions from this screen. You'll know you did it right if your WV refund equals state tax withheld.

WV does not have a subtraction for work deductions (and you're saying you have no WV income). All your earnings should be reported to PA. If you are filing as a PA resident, TurboTax should carry over your wages even if your W-2 state code is WV. Check the PA section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Helen552

New Member

user17525953115

New Member

pedrorivera006891

New Member

juham2013

Level 3

trjpkhouse

Level 2