- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: DE state taxes - working from home (PA)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DE state taxes - working from home (PA)

Hi, I live in PA, work in DE but worked from home during the pandemic. Does that affect my DE (or PA) state taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DE state taxes - working from home (PA)

Yes, Delaware issued guidance regarding the treatment of wages for remote work in 2020. It's complicated.

March 22 through May 31: Treat all days actually worked from a home outside of Delaware as days worked outside of Delaware, i.e. exempt from DE income tax.

From June 1: Report days worked from home as days worked outside of Delaware if your employer directed you to work from home and directed that employees were not permitted to work at the Delaware location or alternatively if the employer strongly encouraged remote work but required an employee seek advance permission to return in person.

Once you were again permitted discretion to return to offices within Delaware in person, you may NOT report days worked from home as days worked outside of Delaware if you continued to work from home by your own choice.

In other words, you income is exempt from DE tax until your office reopened. In the DE section of TurboTax, you can change the amount of DE wages to match the amount that is NOT exempt from DE tax if your employer reported your total income on W-2, Box 16 as DE wages.

TECHNICAL INFORMATION MEMORANDUM 2021-2

As a Pennsylvania resident, all your wages—whether earned in PA or DE is subject to PA income tax. You can claim a tax credit for tax paid to DE on your PA return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DE state taxes - working from home (PA)

This information is very helpful, thank you very much!

Yes, my employer reported all my income on W-2, Box 16 as DE wages.

1) How do I calculate the right amount of DE income? (we were only given discretion to return to the office in May of this year, so as per the DE guidance you shared only Jan 1 - March 21 should count as DE income in 2020)

2) I have already filed my taxes, for Federal plus both DE and PA, how to I submit a revised filing?

Do I need to correct all 3 filings, including Federal, or just DE and PA?

Since taxes paid in DE count as a credit in PA, now I will owe taxes to PA on the revised filing. Will there be penalties? Can I avoid that given the circumstances?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DE state taxes - working from home (PA)

Hi ruizesquide,

You only have to amend your state tax returns because you are adjusting the amounts reported to Delaware and Pennsylvania. Your total income (federal) is the same so there is no need to amend federal.

To amend state only see I need to amend my state return. TurboTax will automatically state the federal amend process. You can cancel that later or just not print the federal amended return which will show no change (the simplest solution).

Delaware

To amend your Delaware nonresident return:

- EDIT Delaware

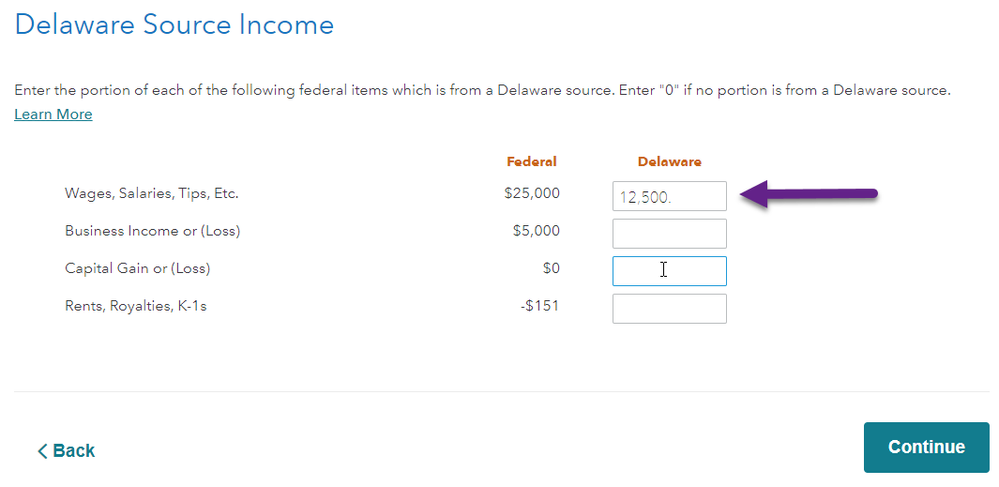

- Go to Delaware Source Income and change the amount in the Delaware column to the amount you earned from January 1 – March 21, 2020.

Pennsylvania

To amend your Pennsylvania resident return:

- CLICK on Your State Returns at the top

- EDIT Pennsylvania

- Go to Taxes paid to other state(s) summary and EDIT

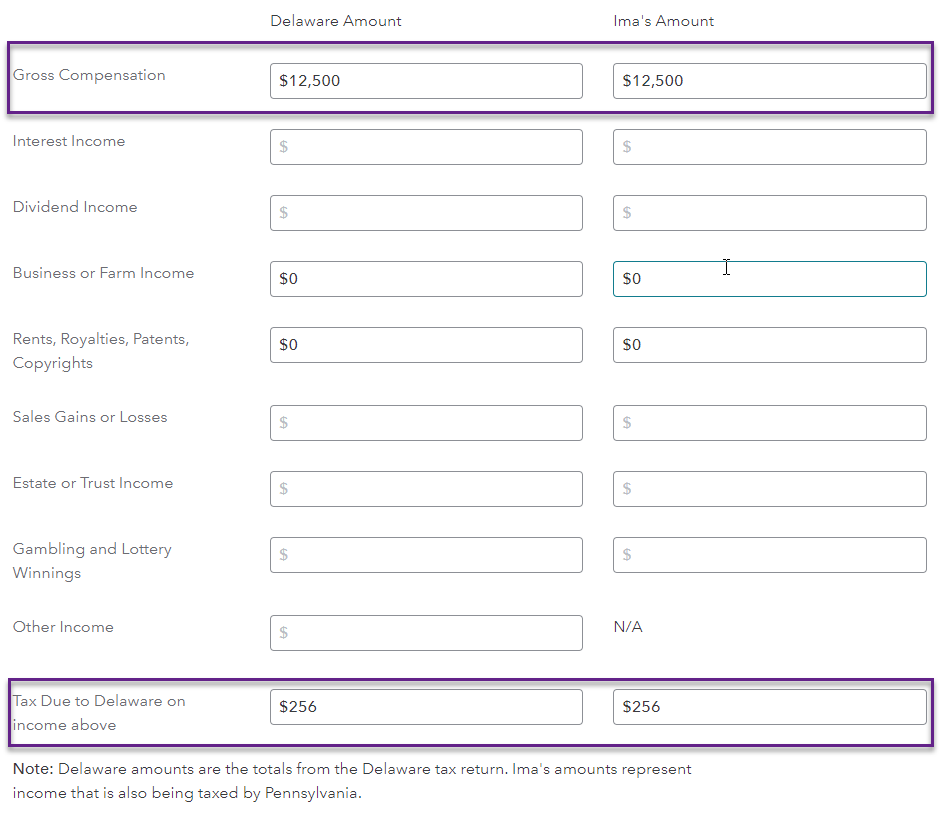

- On Do you have any double-taxed income from Delaware? make sure the DE amount matches what you changed (TurboTax should have automatically updated this)

- Then check the Tax Due to Delaware on income above. This number should have also been updated.

When you are through, finish the amend process. Print and mail your returns. I suggest sending your returns by certified mail with return receipt so you have proof that you filed.

IMPORTANT: You may want to include in your amended Delaware mailing a copy of any emails/letters from you employer stating that you were required to work from home and another showing that you were only given the option to return in 2021. It’s not necessary, but it may help with processing if you provide proof of the dates.

Include an unsigned copy of your DE return with PA because you are changing the amount of tax paid to DE and PA needs proof in the form of a state return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

branmill799

New Member

meenakshimishra

Level 2

etoovic2002

New Member

joeylawell1234

New Member

in Education

user17515633536

New Member