- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: CT 14% pension subtraction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

Starting in 2019, Connecticut allows a 14% subtraction of pension and annuity income. I don't see this in the CT return in TurboTax. The pension deduction shown is the 25% teacher's pension subtraction. How can I enter this??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

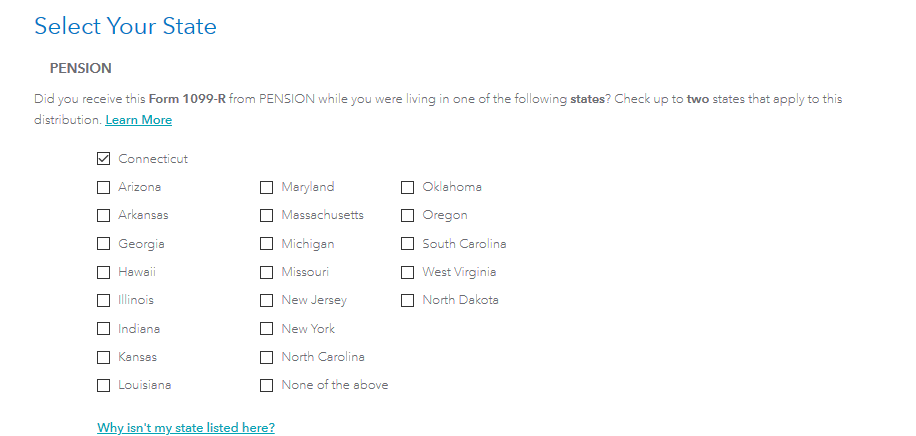

In the federal tax section of TurboTax, after you enter the 1099-R, you can Select your State- by indicating Connecticut here, it will calculate the correct subtraction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

I never saw the screen asking which state the 1099-R retirement income was from. I just reviewed TurboTax Federal steps and I still do not see it. I also do not see where the deduction was applied to my CT State Tax return. Please tell me the steps to find the screen so I can be sure TurboTax figured the pension subtraction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

I found the entry carried over to CT State under "CT-1040 p3,4" near the bottom of page 3, "Pension subtraction smart worksheet".

Thank you, I am all set now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

For 2020 the amount of the reduction to pension income is 28%. I cannot find the place on the 2020 return to select the state, so Turbo Tax didn't give me the deduction. Were is the place to indicate the state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 14% pension subtraction

@john11840 TurboTax now does this calculation automatically. You do not have to to anything.

The 28% pension subtraction will appear on CT-1040 line 48b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

richard-aderibig

New Member

Johnscrivner

New Member

Johnscrivner

New Member

user17725687268

New Member

dnc49

New Member