- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Changing Primary Filer in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing Primary Filer in TurboTax

My wife was a part-year resident of MI and I was a non-resident of MI. We filed Federal married-filing-jointly. Hence we need to file MI state tax the same way. She had some dividend/interest income which attributes to her time in MI. But since I am the primary filer, TurboTax does not prompt me to enter dividends/interest amounts for MI state tax return. If I change myself to part-year resident, I get a prompt to enter the MI amount of dividends/interest. Is there any way to file with my wife being primary filer for MI state return instead of me so that the TurboTax treats the MI state tax return as part-year resident? Or is the current way the right way?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing Primary Filer in TurboTax

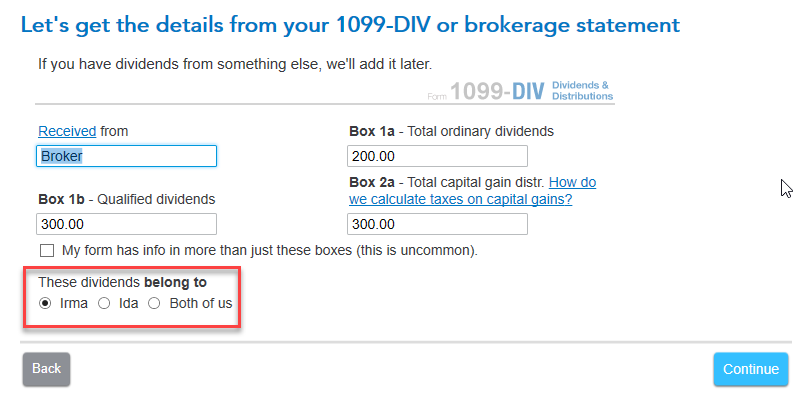

Check your interest and dividend entries in TurboTax. Make sure they are assigned to your wife. If they are, TurboTax should allow you to make adjustments on a joint MI non-resident return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing Primary Filer in TurboTax

I have already done that but no help.

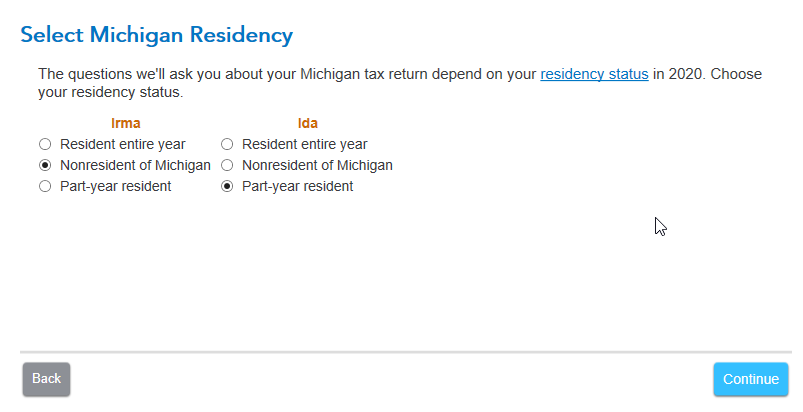

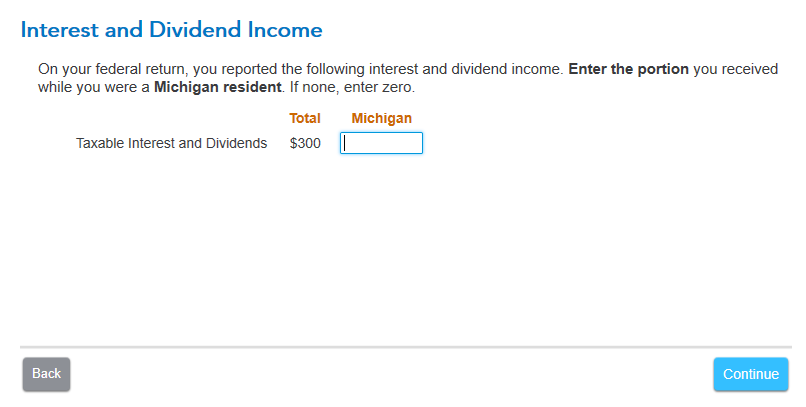

In your case you have selected the dividends for the non-resident (Irma) and you still get the Interest and Dividend income in MI state return.

If I change myself to part-year resident (irrespective of my wife's residency), TurboTax asks me to enter Interest and Dividend from MI else it does not.

It also asks me to enter Interest and Dividend from MI if I switch the primary filer in MyInfo to my wife and she is marked as part-year resident of MI. So it seems to be somehow determined from the state residency of primary-filer.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sakher-x

New Member

Raph

Community Manager

in Events

hjw77

Level 2

howverytaxing

Returning Member

HollyP

Employee Tax Expert