- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

Hi,

I'm using TurboTax 2019 and trying to file taxes for my California LLC that is S corp elected. TurboTax gets stuck at the "California S Corporation Information Worksheet" saying that "CA corp no" field is empty, although the LLC number is in the CA SOS field. CA LLCs don't have a 7 digit corp number, they only have an SOS number: https://www.taxact.com/support/22697/2019/california-business-entity-identifying-number.

Any suggestions?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

Resolved! I called the State of California Franchise Tax Board and they told me that if an S-Corp elected LLC is filing taxes for the first time it can do one of the followings:

1) File state taxes as LLC and attach the S corp election document

2) File state taxes as S corp, enter all zeros, ones or nines into the CA corp ID field and attach the IRS S corp election acceptance letter

The board will send you a CA corporate id to use during next year's filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

Hello,

how did you attach the s-corp election confirmation to California return. I couldn't find a way to attach the document in Turbotax business.

Also, with all 1s in the corporation number, was the e-file accepted fine? Appreciate your help. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

The State of California Franchise Tax Board says that if an S-Corp elected LLC is filing taxes for the first time it can do one of the followings:

1) File state taxes as LLC and attach the S corp election document

2) File state taxes as S corp, enter all zeros, ones or nines into the CA corp ID field and attach the IRS S corp election acceptance letter

The board will send you a CA corporate id to use during next year's filing.

So, as you can see, the CA corporate # is required, so if this is not your first year of filing the CA 100S, then you may need to call CA FTB to get a CA corporation #.

CA FTB says that an S corporation is a corporation that elects to be taxed as a pass-through entity.

A CA Corporation is required to have a corporation #.

If you make an election for your LLC to be taxed as an S corporation, then you take on all the requirements of an S corporation for tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

Hi,

Thank you for the response. This is my first year of filing. I am using TurboTax business desktop software. I don't see any option attach the IRS S corp election acceptance letter for e-filing. In California it is mandatory to e-file for the business tax returns prepared by software. Any thoughts on how to attach the S corp election acceptance letter?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

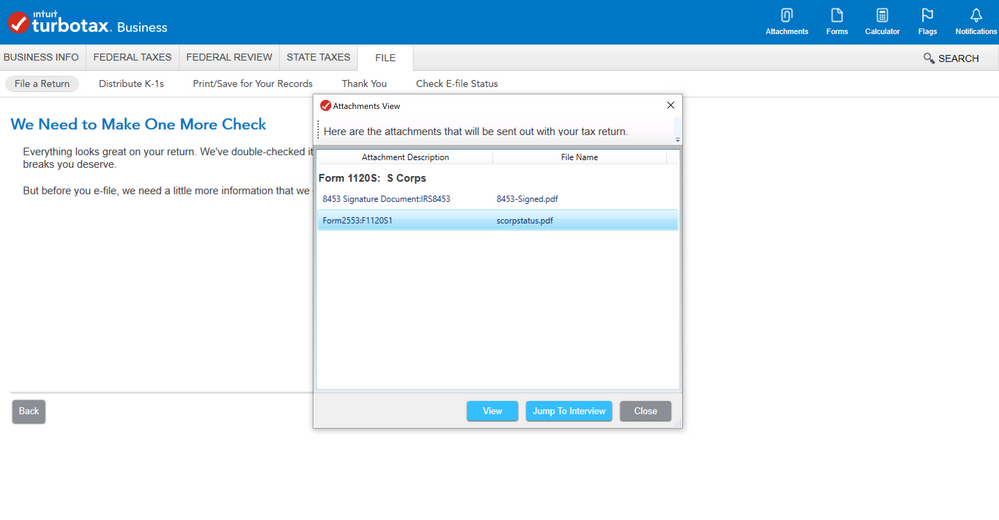

I have already e-filed the Federal Return(1120S) and was able to attach scorp election acceptance letter. The same attachments are still available. When I do e-file California Return(100S), are these attachments also sent out?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

To elect to be an S-Corp, Form 2553 is required. On the state side, look for 2553 in print view. If the form is not present, then you may have to send the return to CA by mail. TurboTax should attach the form to the state once the Federal has been produced and attached.

Here is a TurboTax article about the S corp election.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file California LLC (S corporation elected) due to empty "CA corp no" field

I contacted with CA FTB officer at [phone number removed]*2*5*2 in 2020

Being advised to to either

>Mail first year 100S and wait for assigned Corp number

They might ask for S Corp acceptance from IRS

>Each software has different restriction . I use Professional Proseries

I efiled anyway and input number 4444444 (not able to input 9999999 as indication of temporary and restricted by my software)

I attached explain letter

>Upon to this date, my client has not had assigned CA Corp number yet but they have IRS acceptance letter. I will attach this letter to CA FTB and wait for assigned CA Corp number this year again

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kelsey-peoples

New Member

rsherry8

Level 3

CCNELSOCHAVE

New Member

grethlara1

New Member

Gbird101

Level 1