- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Amended Connecticut return for CHET contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

I amended my CT state return to include a deduction from income for a CHET contribution which decreased taxable income by $10,000. Turbo did not update tax on amended 1040X. I expected a refund. Did I miss something or is there a bug in TurboTax. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

No, this is not a bug. Connecticut Higher Education Trust (CHET) is a type of 529 plan. Contributions to a 529 plan are not deductible on your federal return, but the account can grow tax free.

CHET contributions are deductible on the Connecticut tax return and there are some estate tax benefits as well. Check the link below and expand the Tax Advantages section to see details of the tax benefits of this plan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

Thanks fore the answer but I was referring to the amended CT 1040X whose total state income tax did not change after the decrease in taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

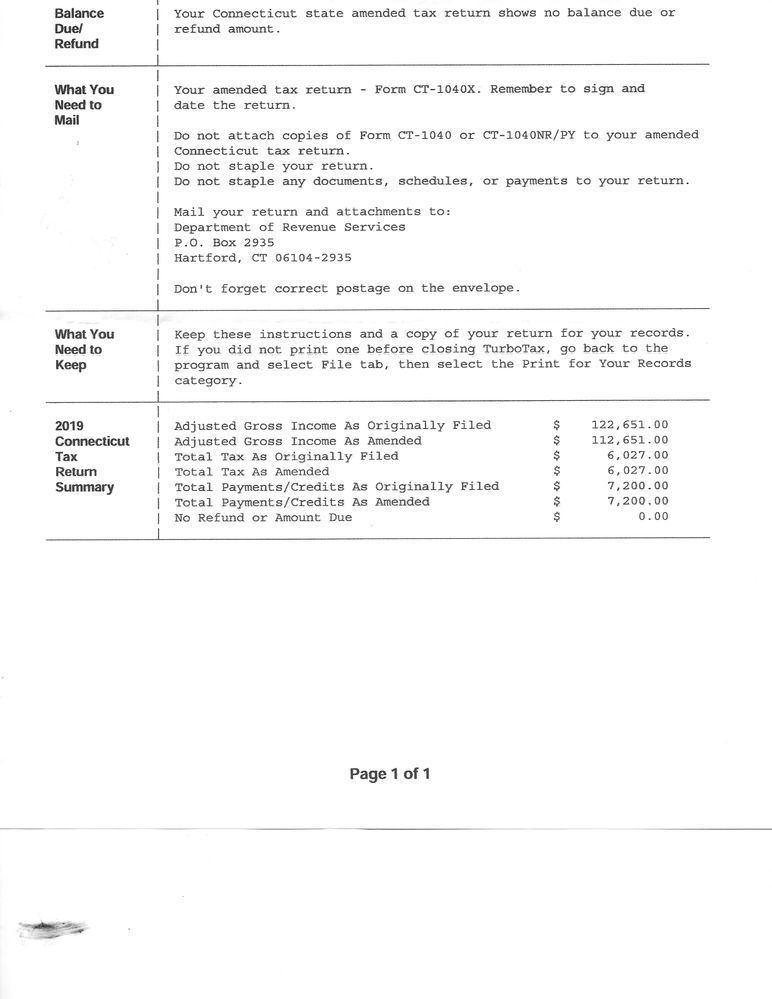

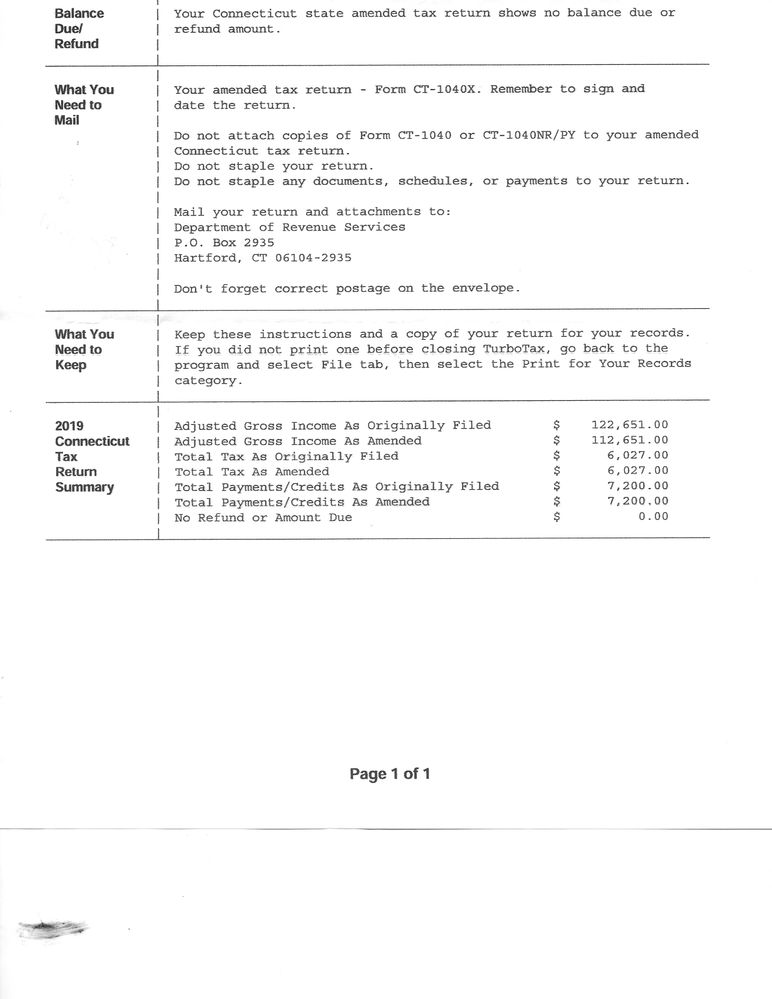

Thanks, but the question was about the amended CT return not the federal. Turbo tax apparently updated CT taxable income but not the tax due. Please see attached

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

If you have an alternative minimum tax (AMT) on your federal return (Sch 2, line 1 on your federal return), you may be subject to the same on your Connecticut return. If your Connecticut AMT is more than your regular Connecticut tax, then you would pay the AMT tax.

The Connecticut AMT is based on your federal AMT, so the CHET deduction would not affect it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

Thanks, My Federal and CT State is not subject to AMT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

You'd have to print out the state return after the amendment and compare it with the original one and see what changed. If the adjusted gross income decreased, then the tax should decrease, unless there is something like a credit that is affecting it.

You'd have to look at the tax calculation to see what changed. The tax might be less than the original tax, but then there must be something that is affecting the net tax that shows on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended Connecticut return for CHET contribution

Thanks, but did not help. I amended my CT return on Connecticut's website directly bypassing Turbotax as I could not get Premier Turbo on my PC to recalculate the state income tax no matter how many times I tried although it did change Connecticut AGI and taxable income. I followed the screens from the opening "Amended" selection through the entire interview process trying to change the state return only but to no avail.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

march142005

New Member

jliangsh

Level 2

jayduran

New Member

ramkitti

New Member

1dragonlady1

Level 1