- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: 1099R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

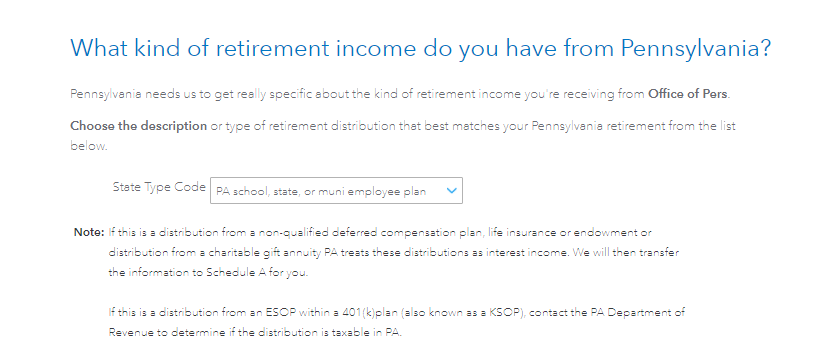

PA taxes. on my 1099R box #7 has #7 in it. It is now asking. . .What kind of retirement income do you have from PA. PA wants to be specific about what you are receiving. Most choices do not apply, but 2 choices, I'm eligible, plans eligible, (no PA TAX) or

I'm not yet eligible, plans eligible I'm 62 so I think over 591/2 is eligible, correct?

Thanks for any help, just want to be clear on whether I owe PA tax on this qualified distribution from 401k

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Yes, you are correct.

Distribution Code 7 in Box 7 is a normal distribution and is treated as nontaxable to Pennsylvania if you have met the plan requirements.

See the attached link for more detailed information.

There is also a section you can answer within the Pennsylvania state section where you can indicate the income is not taxable.

At the arrow, under state tax code, you will select the option "I'm eligible, plan's eligible (no PA tax)". This will ensure your retirement is not taxed within PA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Yes, you are correct.

Distribution Code 7 in Box 7 is a normal distribution and is treated as nontaxable to Pennsylvania if you have met the plan requirements.

See the attached link for more detailed information.

There is also a section you can answer within the Pennsylvania state section where you can indicate the income is not taxable.

At the arrow, under state tax code, you will select the option "I'm eligible, plan's eligible (no PA tax)". This will ensure your retirement is not taxed within PA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rempedon

New Member

riram

New Member

Ab-3006

New Member

ggcv42

New Member

lzarybnicky

New Member