- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, you are correct.

Distribution Code 7 in Box 7 is a normal distribution and is treated as nontaxable to Pennsylvania if you have met the plan requirements.

See the attached link for more detailed information.

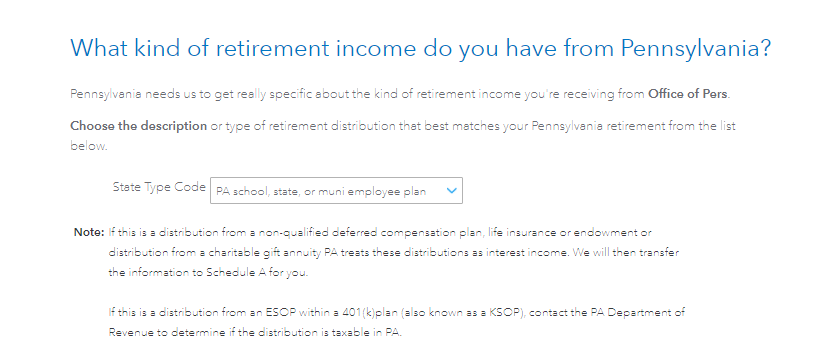

There is also a section you can answer within the Pennsylvania state section where you can indicate the income is not taxable.

At the arrow, under state tax code, you will select the option "I'm eligible, plan's eligible (no PA tax)". This will ensure your retirement is not taxed within PA.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 2, 2020

5:05 PM

787 Views