- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: 1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

TurboTax asks that because even though they are exempt Federally, some states will tax exempt interest/dividends from another state. But Washington has no state income tax, so it's moot.

The popup help for that screen says "You can select More than one state and continue if you live in a state with no income tax (such as AK, FL, NV, SD, TX, WA, WY)."

EDITED:

See my next comment with 2 screen images that show you 2 ways to get to the choice "multiple states", which will let you continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

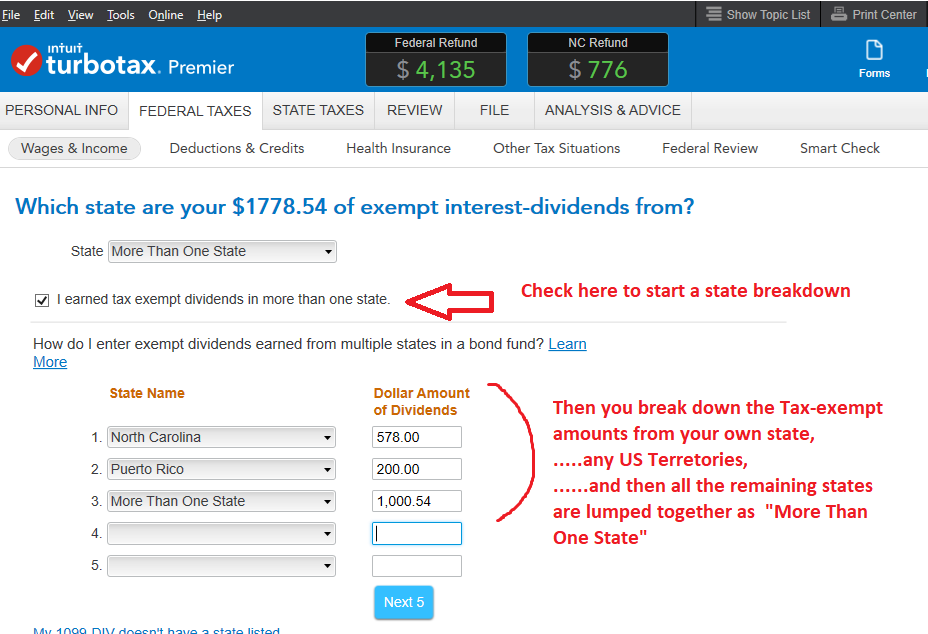

@ kevinntax I've added a second image, that will show you that actually, you can get to the choice "multiple states" either way there, and the end result should be the same for your situation in Washington state, which has no state income tax. See these 2 screen images:

.

.or

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

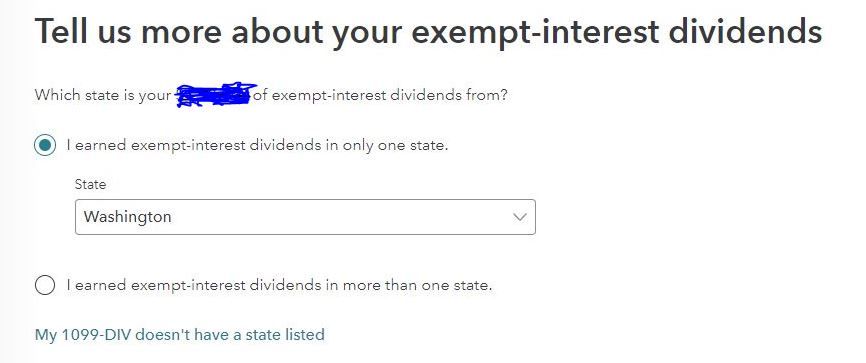

I selected Washington on one of the questions. See picture. Was this incorrect? I wasn't sure if this was asking about the states which the mutual fund invests in muni-bonds or the state that I lived in. Maybe I should have picked "I earned exempt-interest dividends in more than one state" and picked "multiple states". I didn't see it or understand it. I've already submitted my tax return to the IRS. But, not sure if matters since I live in WA state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

@ kevinntax wrote:I selected Washington on one of the questions. See picture. Was this incorrect? I wasn't sure if this was asking about the states which the mutual fund invests in muni-bonds or the state that I lived in. Maybe I should have picked "I earned exempt-interest dividends in more than one state" and picked "multiple states". I didn't see it or understand it. I've already submitted my tax return to the IRS. But, not sure if matters since I live in WA state.

You should be OK, even though it technically may not be the correct choice, since I assume you don't know if any, partial, or all of the tax-exempt dividends were paid by Washington to the mutual fund. Often a bond fund has multiple states. But the choice of state there ultimately has no impact on the Federal return, where the dividends will be tax-exempt. The popup program help says:

"Even though these dividends or interest won't be taxed on your federal return, we still have to ask about them because most states will tax dividends or interest that are paid by another state. Exempt-interest dividends are usually interest payments on state or municipal bonds."

"You can select More than one state and continue if you live in a state with no income tax."

That's because it's moot in those states.

I admit that section is confusing. TurboTax is asking about the states that paid the tax-exempt interest to the mutual fund; i.e., which states the dividends were from. A lot of mutual funds get tax-exempt interest from several states, and often the broker or mutual fund company provides a tax supplement showing the breakdown for that fund by states and amounts, or has one on their website. However, this is not relevant in a state with no income tax. That's why for folks in no-income-tax states, the instructions tell how to bypass and continue by choosing "multiple states."

Even if you had chosen another state by accident, Washington state will still not tax it, since Washington does not tax personal income and doesn't even have a state return on which to tax it. So you should be OK with what you filed, since it does not affect your Federal return.

NOTE: I'm a fellow user and long-time forum volunteer--not a tax expert or TurboTax employee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

i live in Maryland and had the same question. i had dividends from multiple states and U.S. possessions. can I just answer the question with the "multiple states" answer and end it there or do I need to go further and identify which states and the amounts? and if I do list the states and the amounts, my 1099-DIV lists the individual states but only percentages as well as "U.S. Possessions", but TTx doesn't have a selection for "U.S. Possessions" but actually lists the individual possessions. what do I do for U.S. possessions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

If you had dividend income from Maryland, then when you enter the Maryland dividends, they would be exempt from Maryland Tax. It wouldn't matter which other states or possessions you listed, as that would not affect your Maryland or federal tax. So, for possessions you could just pick one and enter all the dividends listed for possessions in the category.

If you don't have any Maryland dividends, you can choose "multiple states" and move on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

Where do you find which state your exempt interest-dividends are from? I see Vanguard municipal bond funds but it does not list a state>

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

not sure if this applies to everyone but i found my state percentage on my 1099-DIV towards the back where details are usually listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

I live in Massachusetts. So do I list Masschusetts for where the exempt interest-dividends are from or do I list the state that is listed under Payer's Name and Address on my 2020 tax reporting statement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

When the program asks where the dividends are from, you can list what is in your details sheet provided by broker. Only the portion earned in the state where you file taxes is relevant. If none of it is from your state, you can enter multiple states and move on.

If x% is from MA, do the math and enter that portion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

"The popup help for that screen says "You can select More than one state and continue if you live in a state with no income tax (such as AK, FL, NV, SD, TX, WA, WY).""

@kevinntax I'm still confused. What if I DON"T live in one of the states with no income tax (I live in Delaware), and I have tax exempt 1099-DIV income from multiple states including US Possessions. What do I do then? I selected the option for income from more than one state, and entered each one ensuring that the total match my total for tax exempt income, but TurboTax returns an error message for each line in which I've listed a state and its amount saying that the amount does not equal the total amount listed on line 11 of my 1099-DIV. MY 1099-DIV does not have a line 11. The tax exempt amount is listed on line 12.

Any help would be appreciated. This is frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

Box 11 was where it was in a prior year's 1099-DIV form. Apparently that text was buried somewhere and didn't get updated to indicate the proper box 12.

1) No matter what state you are dealing with, you are not required to break out your state's bond $$..you can just select "More than one state" (or "Multiple States" if using the Online software) for all of it...and move on.

2) Or if you break out your own State & any US Territory $$, you just indicate those two sources separately...then the remainder is lumped together as one "More than one state"" entry (i.e, you do NOT indicate every state separately). This only saves you some state taxes if the $$ from your own state ends up being a relatively large value. For instance, if the DE state breakout value was $20, and DE taxed it at 5%...that "might" have saved you $1 in state taxes.

_____________________

Example as-if you were a NC resident:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

I have a related question. I live in Massachusetts. I have $204 of exempt-interest dividends -- from my 1099-DIV. Using info from my broker, I calculated that $29 came from Mass. So I entered $29 for Massachusetts, and the remainder, $175, with "Multiple States". Is that correct?

The issue is that when I look at my Massachusetts return, it looks like TurboTax has transferred over the total $204,instead of $29 to the Mass. Schedule B. Is that correct? Or it is a bug in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div says I had tax exempt interest dividend. Entered in TurboTax. It asks me which state interest was earned. No idea. I live in WA state. How do I continue?

That's a possible bug. (A few similar instances of the same problem)

Go back and delete that 1099-DIV entirely. The entire form.

Then re-enter it manually and see if that gets it correct.

__________________________

When you get to the page that asks what state the $$ came from....be sure to NOT do anything with the top selection box .....select the second bullet point only and divide up your $$ as you did before.

_____________

If that doesn't work, post back and I'll show another way (for folks using the Desktop software).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jcrouser

New Member

smiklakhani

Level 2

jjon12346

New Member

jstan78

New Member

xiaochong2dai

Level 3