- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Box 11 was where it was in a prior year's 1099-DIV form. Apparently that text was buried somewhere and didn't get updated to indicate the proper box 12.

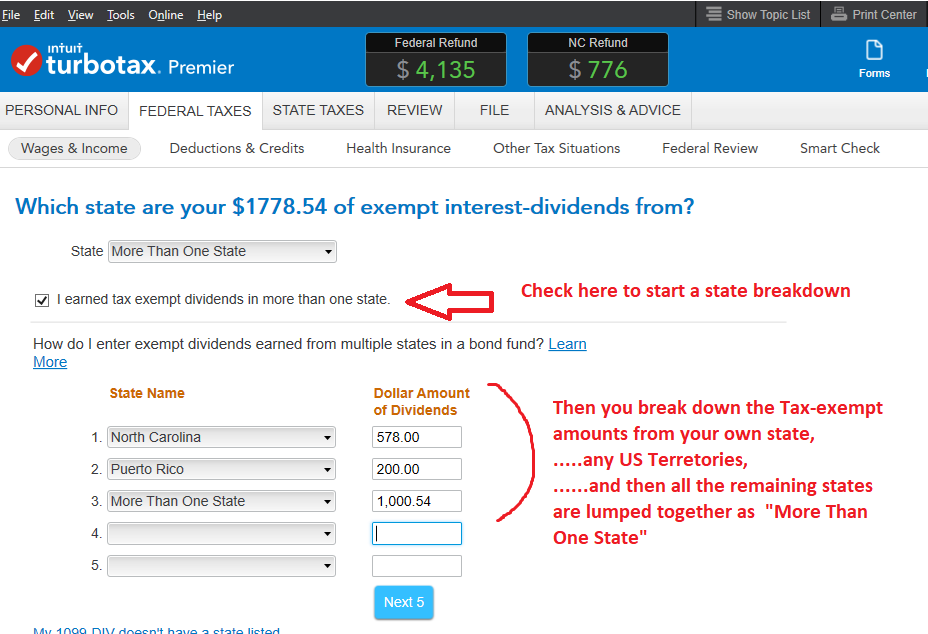

1) No matter what state you are dealing with, you are not required to break out your state's bond $$..you can just select "More than one state" (or "Multiple States" if using the Online software) for all of it...and move on.

2) Or if you break out your own State & any US Territory $$, you just indicate those two sources separately...then the remainder is lumped together as one "More than one state"" entry (i.e, you do NOT indicate every state separately). This only saves you some state taxes if the $$ from your own state ends up being a relatively large value. For instance, if the DE state breakout value was $20, and DE taxed it at 5%...that "might" have saved you $1 in state taxes.

_____________________

Example as-if you were a NC resident: