in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- our NYS pensions are being taxed through turbotax for the first time. Why is this happening?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

our NYS pensions are being taxed through turbotax for the first time. Why is this happening?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

our NYS pensions are being taxed through turbotax for the first time. Why is this happening?

Your pension income is not taxable in New York State when it is paid by: New York State or local government. the federal government, including Social Security benefits. certain public authorities. In addition, NY allows a $20,000 exemption if you are over the age of 59 ½ or turn 59 ½ during the tax year, you may qualify for a pension and annuity exclusion of up to $20,000.

- See NY Information for retired persons for full details.

This can be handled in the New York (NY) State portion of the tax return interview.

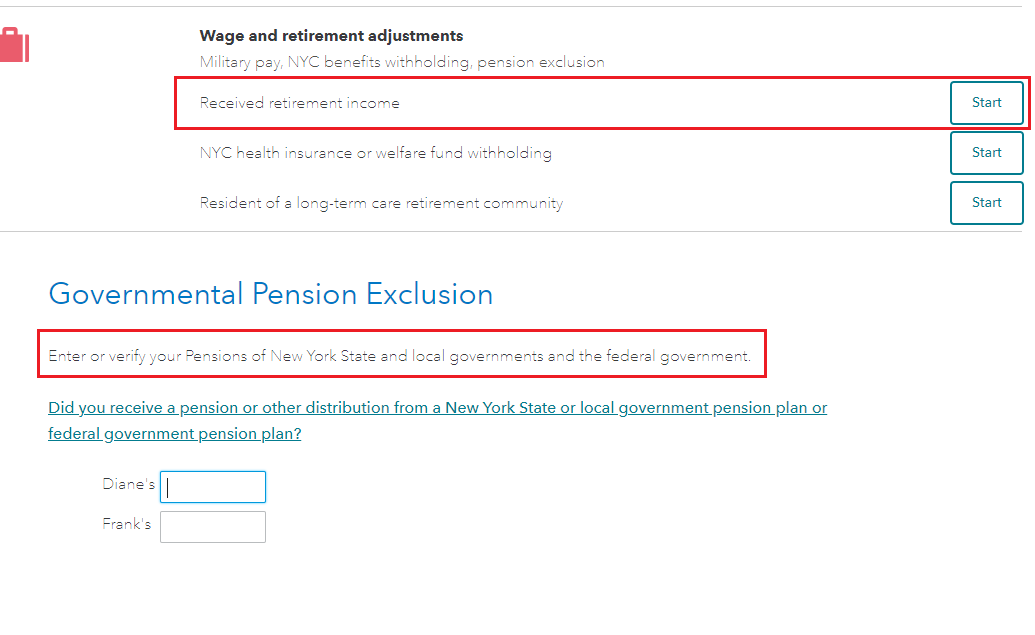

- When you reach the Changes to Federal Income screen >: Scroll to Wages and Retirement Adjustments

- Select Received retirement income > Start

- Answer the questions on each screen

- On the screen titled Governmental Pension Exclusion enter the taxable amount to exclude for the NY return

- The next screen will show you the Pension Deduction Summary

- See the image below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajs813

Returning Member

bb66

Level 1

Lukas1994

Level 2

marcmwall

New Member

user17524963565

New Member