This didn't link to my prior post.

I'm an OH resident who received both a federal K1 and a NRK-1 (pa41) due to estate pass through interest. I am struggling to report this estate income to PA and mark it taxable. Simply reporting the NRK-1 into the federal section under the estate section fails to push the information into a taxable status for PA state.

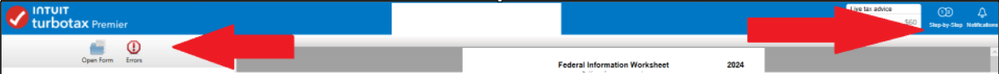

Continuing with the NRK-1 that I received from PA, the interest for this estate passes through to be reportable as income to me for federal and PA state purposes (but not OH). As seen in the pic above, can I search for FORMS in the upper right then after this opens on the upper left open SCHEDULE J in the PA section which allows me to report the NRK-1 information?? This appears to allow me to credit this to PA state and it appears to calculate correctly. Is there a power user that can confirm or reject this method?

Also how do I designate that I'm only 50% responsible for this income? Or is the 50% already calculated and the information in boxes of my NRK-1 is reduced to MY 1/2 of the estate pass through.

Thanks in advance

mike

I can enter my federal K1 information in the estate section of the federal section - this is NOT reportable to PA as an out of state resident.