- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I read on another thread Turbo tax advised someone yesterday of a fix as of March 12th. I believe they are just stringing along their customers with no actually “fix it” date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

The response I just got from Denetria, a product support specialist for TT:

"As of now, there is no exact date that this form will be updated. The estimated date is Mid-March."

I followed up with the question: Can TurboTax guarantee that a fix will be in place prior to the filing deadline for state returns? Response:

"That is the latest date. And yes of course the form will be fixed before the filing deadline. The state forms 8915-E are a bit behind. You can check back later on today, updates to the site typically take place in the afternoons."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I been fighting with Turbo tax for weeks to get this Covid 19 distribution fix for both Federal and State. The Federal form 8915-E was released by the IRS on 2/12 and Turbo tax implemented it correctly on 2/26 to 2/27. As far as I'm concerned the Federal portion is still good and you can pay all of the taxes in one year (look for 2020 check box within 1099-R questionnaire) or pay the amounts evenly across 3 years, not 2 years, but 3 years split.

I repeat: you complete form 1099-R as usual and the Covid fix questions will follow, i.e. the 1/3 split or 2020 full tax payments. Make sure you have updated the desktop software.

Now on to the bigger issue: the NYS Pension/Annuities/IRA - Turbo tax has no intention of fixing this issue and has done a terrible job of communicating to customers when this issue will be fixed. At best you'll get 1/5 customer service reps that won't drag you through a bunch of useless fixes and updates that do nothing.

My next email will be to the NY State Attorney General Letitia James.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

@TravisTractor just got off the phone with Ashley in TT support.... states engineers are actively working on this issue and there is NO time frame of when this will be completed. She advised me to file my taxes and then amend them later. I advised her I will NOT go through all that complicated mess just because TT software is having an issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

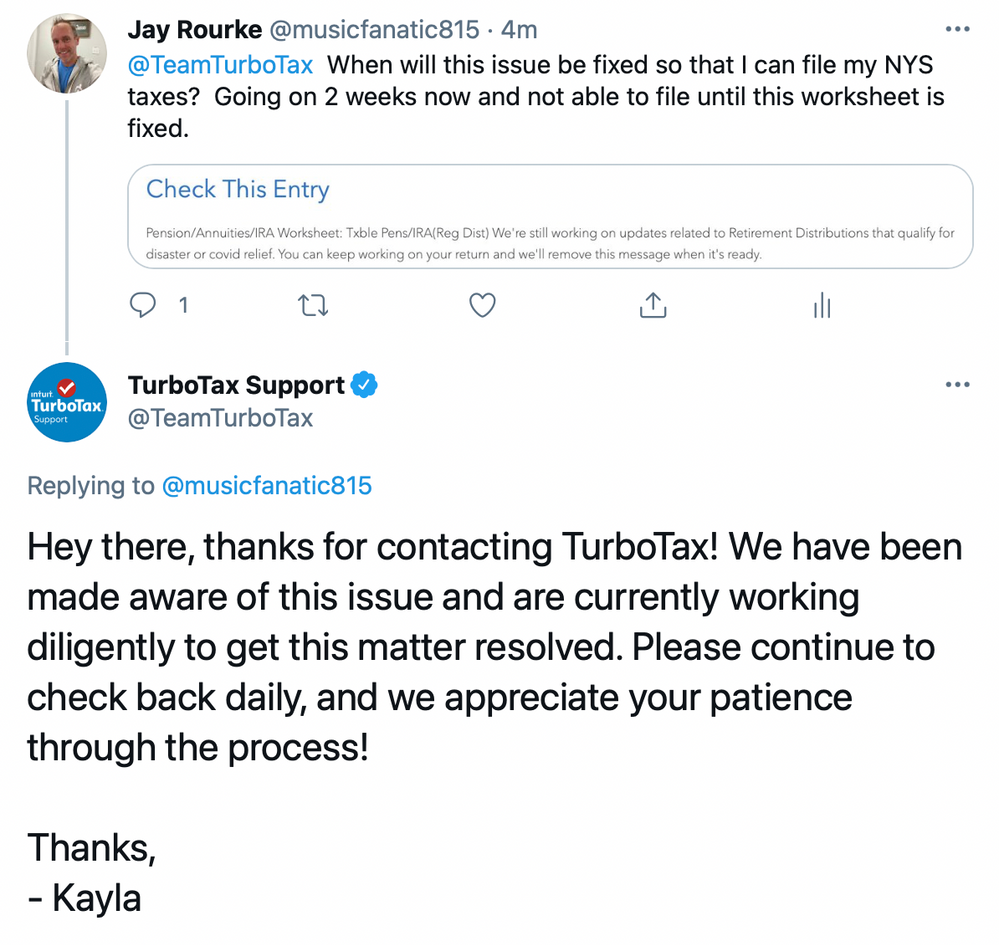

@TravisTractor this was the response I received from TurboTax Support on Twitter!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

@Anonymous God I hope so. This is just one of a long list of issues I've had this year with TT. It's almost like there is no QA over there before going live.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I Firmly believe that it sad when you can file your Federal Tax return have it approved and a refund sent to you in the time that it takes to resolve a simple tax form. Thanks TurboTax and NYS!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I dont understand why this is taking so long. Here i am trying to file my taxes in time before the stimulus passed because 2020 agi is lower than 2019. Cmon turbo tax we are all waiting for this. You already took our money and we ended loosing bacause we missed out on the early filing discount too!! Grrrrr

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

To file federal taxes separately from state:

In the toolbar all the way to the left, click on "File" (below review).

Click on "Continue".

You should see a screen listing three steps. Click on "Start" in step three. (Get ready too save and file)

Then click "File by mail".

On the following screen you will be offered different filing methods for each respective return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I just tried E Filing NYS and couldnt, so I chose to file by mail for NYS. Yet Turbotax already charged me to efile in NYS. What a great racket they have going.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

TT now has an official post on this issue:

If you withdrew from retirement because of COVID-19 and have Form 8915-E on your federal return, you may have gotten a “Check this Entry” message stopping you from filing your state return.

We’re working hard to incorporate this new form into all the states in TurboTax. To ensure that your return is accurate, check back after March 19 to file your return. We should have it ready by then!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

It's now March 8. I am still getting the same message

Still unable to file my New York State Tax returns. I was told to mail them in so I printed them and on the forms was written the warning that it's illegal to mail them in NY if they were prepared using a software program such as Turbo Tax. Yes, there is an exception if Turbo Tax doesn't have the software. Except that they do, they just haven't activated it so that it will compute the COVID retirement distribution according to the rules of the Cares Act, on my tax forms. It didn't even print when I tried to print and mail in my tax returns.

I was told to use another tax software. So I spent hours redoing my taxes using another program, FreetaxUSA has the IT 558 form. So I use it and complete my taxes but I can't send it in. Why? Because I have already filed my federal returns with Turbo Tax and FreetaxUSA won't let me file my NY State taxes by itself. So now I'm stuck. I can either mail it In and wait 30 days or wait for Turbo Tax to add the IT558 form. I called New York State Department of Taxation. They said Turbo Tax is the only tax preparation company they know of who does not have the IT 558 in a usable form on their platform. It's a Turbo tax problem I was told. No, it's MY problems and no one at Turbo Tax is willing or able to solve it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

I'm pretty sure the issue most people on this thread are facing has nothing to do with New York state Form IT-558, if you took an early retirement withdrawal from a 401(k) or similar account for COVID-related reasons. That's all on federal Form 8915-E, which has to be appropriately converted into NY state Form 8915-E, but apparently has not yet been converted accurately.

IT-558 seems to have more to do with business gains/losses for shareholders or owners, but I'm not a tax expert, so don't quote me on that. More to the point, according to TurboTax's list of available state forms, IT-558 is both available and e-fileable (at least on the online/web version for individual tax returns), so if that is the issue/situation you're facing, it should be brought up separately with the TurboTax support team so they can start an investigation into it and start working on a fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS Pension/Annuities/IRA worksheet missing - holding up e-filing

Sorry @suect1987. I looked into this a little more, and you were right, Form IT-558 does apply to COVID-related retirement withdrawals, as per this post: https://ttlc.intuit.com/community/state-taxes/discussion/what-is-new-york-state-form-it-558-turbotax...

Still not sure if that's where the state filing error is happening, since people from a bunch of different states are seeing it (not just NY), but yeah, maybe that is part of it. I just hadn't heard it referenced as the problem, but rather the transfer of info from federal 8915-E to state 8915-E.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mtgguy

New Member

nirbhee

Level 3

TEAMBERA

New Member

abcxyz13

New Member

ericbeauchesne

New Member

in Education