- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NYS 1099-R box14 says exempt and box16 says NY

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

Fed Return: Turbo Tax says to leave box 16 blank if the 1099-R says exempt in box 16. However box 16 on 1099-R says NY. 1099-R box 14 says exempt. Both box 14 and 16 on Turbo Tax say to enter a number if anything is entered. I can leave box 14 blank but if I leave both boxes blank the amount from box 2a fills in box 16.

State Return: Bottom line is Turbo Tax is calculating an amount owed to New York State, a sizable one, and I am a retired New York State employee and am supposed to be exempt from paying New York State taxes on both pension and social security.

So whatever is being carried over to the state return is incorrect and causing an amount owed to New York State. How can I correct this ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

If your 1099-R is exempt, please leave Box 14-16 empty when inputting your pension into TurboTax. In addition, please make sure that you picked the correct classification if your 1099-R is fully exempt.

If using TurboTax desktop software, you can follow the steps below:

- Open your return.

- Click on Personal Income, under the Personal tab.

- Click Edit next to the 1099-R you want to correct.

- Enter the information as shown on your 1099-R.

- Answer the questions on the next two screens.

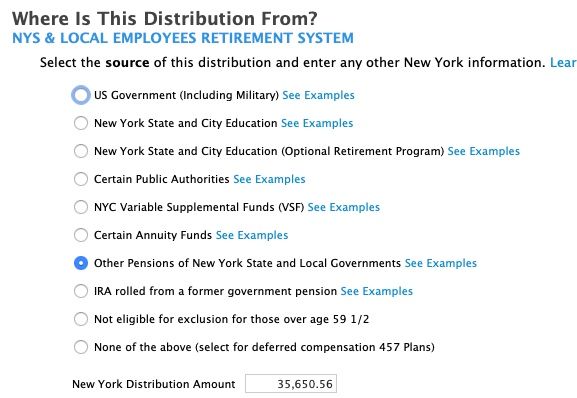

- Make sure the correct source of your 1099-R is selected. In addition, keep the NYS distribution amount as the full pension distribution. It will be shown as deducted fully on a later screen.

- Click on From a qualified plan on the screen Was this distribution from a qualified plan?

- Answer the required minimum distribution questions on the next screen.

- Finish answering the questions about your 1099-R.

- Once you are back to your federal 1099-R summary screen, click on State Taxes tab above.

- Click on Edit for New York.

- The next screen should be your pension summary screen and will show your pension fully deducted.

If using TurboTax online, please follow these steps:

- Open your return.

- Search 1099-R in the search box.

- Click the Jump to 1099-R on the top of the search results.

- Add a 1099-R if you haven't already or click Edit next to the 1099-R you want to correct.

- Enter the information as shown on your 1099-R.

- Answer the questions on the next screens.

- Make sure the correct source of your 1099-R is selected.

- Answer the on-screen instructions.

- Once complete, click on State on the left hand side.

- Edit your resident return.

- Continue until you get to the page You Just Finished Your New York Return.

- Click on Start or Update to Adjustments to Federal Income under Changes to Federal Income.

- Click on Received Retirement Income under Wage and retirement adjustments.

- Click continue.

- Enter the pension exclusion, if not already populated.

- Click continue.

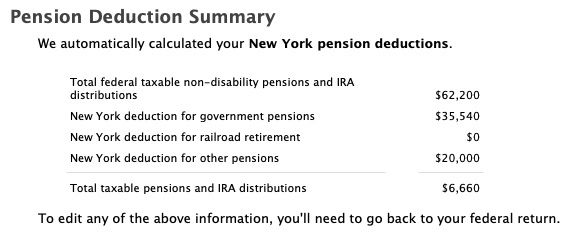

- Your deduction should show as zero amount taxable to NYS on the Pension Deduction Summary page.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

I am using TT Premier.

I didn't mention that in my original post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

I left TT boxed 14 through 16 blank. It didn't work.

I selected "none of the above" as the classification. Maybe that is the problem.

What is my classification ? I was never in deferred compensation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

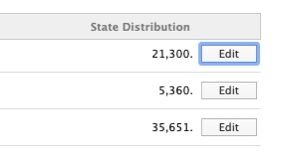

Your boxes for your 1099-R should look exactly as the picture I have posted below.

Now, on the following page titled, Where is your distribution from?, are you selecting Retirement distributions from: New York State?

Your pension income is not taxable in New York State when it is paid by New York State or the local government. By classifying it as "None of the above", it will flow to your state return as taxable.

Next, click on State and continue through the screens until you get to Changes to Federal Income. Click Start next to Received Retirement Income.

Continue through the screens and your full pension will be excluded under Government Pension.

Hopefully these screenshots provide the guidance you need to complete your return. Please comment if you are having any further issues.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

Problem solved.. I corrected the retirement distribution.

Thanks to all

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

I am a little confused. The 1099-R is from NYS & local Employer Retirement Systems. I entered the information as the form has it, removed everything in boxes 14-16 as stated. The source I used "other pensions of New York State or governments". It went from owing 204 to getting 1550 from New York State. It is exempt from New York State Tax. I'm just not sure I chose the right source. If I use 457 it has the person I am doing taxes for owing. Any suggestions. Scoured the internet to see if I have the source correct or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

If it is a pension from NYS or local governments and states exempt on the 1099-R, then you would mark the first option as shown in the picture I posted above. If you do not choose the correct option, then the NYS return will most likely default to only deducting up to $20,000 from the state tax return. This would create the difference in tax as you have described.

Per New York State, qualified pension benefits or distributions received by officers and employees of the United States, New York State, and local governments within New York State, are exempt from New York State, New York City, and Yonkers income taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

Hi

Sorry again to be a bother with this, but I don't think it is set up correctly yet, perhaps I am reading wrong. I have entered 3 1099-R's. See the screen print below. The $21,300 & the $5360 are NOT Exempt from NYS Taxes. The $35,651 IS EXEMPT.

I selected this for the source as you suggested and that's where the $1050 tax refund came from. I also put in the FULL amount in box 1, not the from 2a.

But I think it is still not correct. I see a $20,000 state deduction, not the 35,650.56. See below. Any help would be welcomed! thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

If your $35,651 pension is exempt, then it would be deducted as a government pension (as shown in the third picture you attached on Line 2).

The other two pensions, totaling $26,600, are not fully exempt. If this is for a different taxpayer (spouse of the taxpayer who had the exempt pension), then up to $20,000 can be deducted. Per NYS, taxpayers over age 59 1/2 can deduct up to $20,000 of certain federal, NY state or local government pensions and certain IRAs on their New York return.

The math for this calculation is correct as $62,200- $35,540 - $20,000 = $6,660.

Please see Publication 36 for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

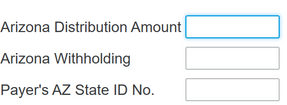

What if I get this from NY, but live in another state (AZ)? What should I enter here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

If you were an Arizona Resident in 2021, the 1099-R distribution amount belongs to Arizona, even if your pension is received from another state.

Your pension income is taxable only in your resident state. You do not need to report your pension income in any state other than your resident state.

@Anjan

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

How do I get to that next page for “changes to federal income page”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

Not quite what really happens. If you leave 14 - 16 blank and select "Other Pensions of New York State and Local Governments" AND keep clicking continue and cycle back and look at it when you are done (maybe tow times, you will see. The first box 15 will fill itself in with the state no matter how many time you delete it and the amount in box 16 will fill itself in even if you delete it from the "Where Is This Distribution Coming From Screen" screen. The amount of that screen will also continue to refill itself with the amount. The check box also keeps resetting itself to "US Government (including military)." At that point, you might as well give up and fill in the second box 15, "Payer's State No." When you are done, box 14 is the only box blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYS 1099-R box14 says exempt and box16 says NY

If you are attempting to make your New York State Retirement flow through to your New York State Tax Return as nontaxable pension income this is how you should do it.

Try deleting and reentering your Form 1099-R. Make sure it is entered exactly as shown.

Follow these steps to delete your 1099-R in TurboTax:

- Go to Form 1099-R

- Select the trash can next to your 1099-R and then answer Yes

To enter your Form 1099-R, Go to to Form 1099-R and answer any questions. You can import, upload, or manually enter your form.

Note: It is very important that you check the box for Retirement Distributions from a NYS Optional Retirement Program in the Federal Section of your return, when entering your Form 1099-R. This will flow through to your New York State return and ultimately make this income nontaxable.

Here’s how to review your pension information on your New York state return:

- Open (continue) your return in TurboTax

- First, make sure you’ve correctly entered your 1099-R info on your federal return

- Select State from the left menu

- Select Start or Continue next to your New York state return

- Follow the on-screen instructions until you reach Changes to Federal Income. On this screen, select Start next to Received retirement income

- On your Retirement Distributions Summary, select Edit next to the pension you’re reviewing. If no more info is needed for your state return, you’ll see the message We don’t need any further information about the retirement distribution

- If New York needs more info for your pension distributions, answer the questions on the following screens, until you return to your Retirement Distributions Summary. Select Done

- Continue through the screens until you reach your Pension Deduction Summary. Here you’ll see the amount of your pension distribution that’s taxable in New York state. This amount doesn't include your exclusions, but don’t worry–TurboTax will figure that out for you.

Click here for information on deleting your Form 1099-R in TurboTax.

Click here for information on entering your Form 1099-R in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rgswaffle

Returning Member

slizTT

Returning Member

momo_18

Level 2

timmichelle

Level 3

Bonhoch357-

New Member