- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

I was on 5 months paid family leave when in CA, and moved to NJ in December. I am due to pay NY non-resident tax as I work in NY.

Can anyone figure out why NY is taxing 25% of my AGI?

Number of days in period of employment = 366

non-working days= 249 (115 of which are PFL)

Outside of New York= 97

Worked Outside of New York at Home =10

Effectively, my NY working days (plus WFH) = 20

With this math, NY tax rate comes out to 20/97, when in fairness it should be 20/240 ish.. ? but why is it neither but even higher at 25%

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

If your NY wage days are 20, then the rest of the income on your w2 would be 97 or if the PFML is in there, 240. It seems easier for you to determine what 20 days of pay equals and use that $ value.

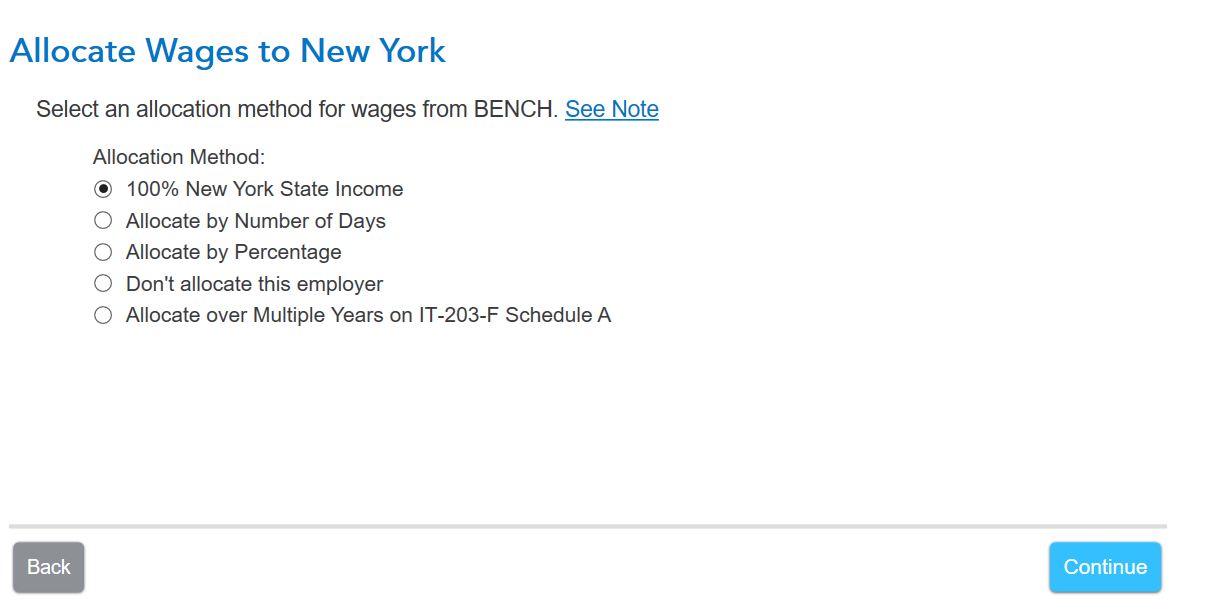

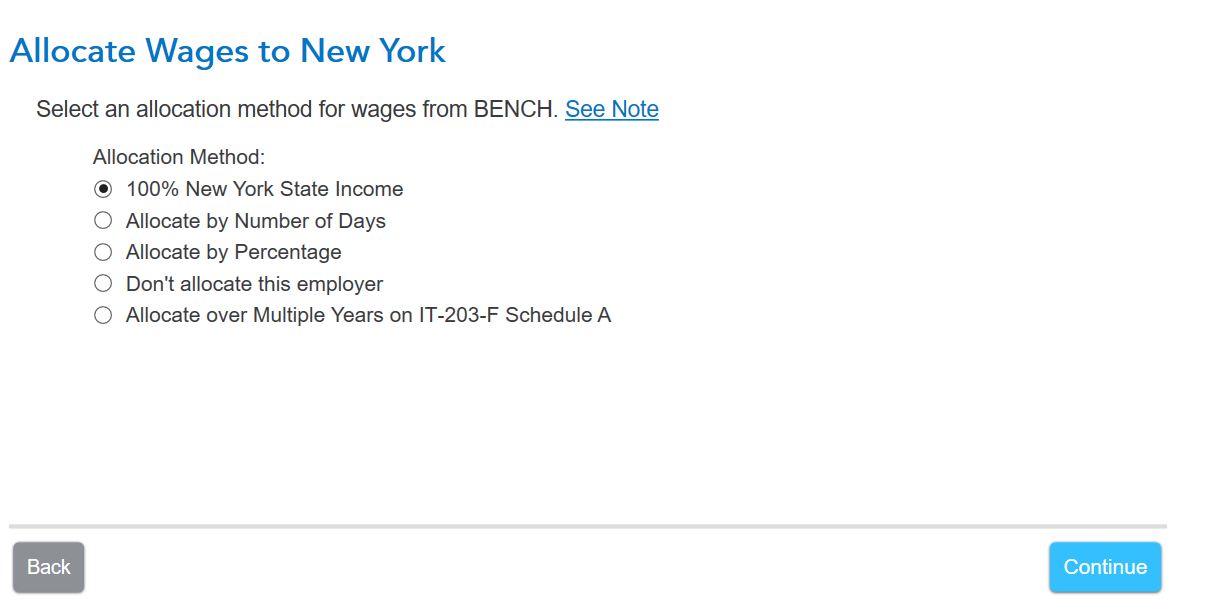

When you go through the NY program, you can allocate by days or by income percentage. On the screen before this allocation, I entered an amount for NY wages from an employer with a much higher w2 amount. Then I just said the part I entered is the 100% NY part. This method might work better for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

If you are looking at the NY % of tax liability, it should match your percentage of days in your case.

If you are looking at the tax, that is calculated differently. New York looks at your total income and determines the tax on all of your income. Then, they take the NY percentage.

For example, the numbers are bizarre and for illustration purposes only:

Earn $2,000 in NY and earn $18,000 in TX

NY says you earned 10% in NY (because 2k/20k is 10%)

NY taxes you 10% of the liability on the full amount of $20k- total earnings.

NY tax on $20k is $800

Your NY tax would be $800 x 10% earned in NY= $80.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

thank you, my question is on the pro-rated days, with the long leave, the % becomes 20/97, while typically it would be 20/240, if there was no long leave. Is that how it works?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

If your NY wage days are 20, then the rest of the income on your w2 would be 97 or if the PFML is in there, 240. It seems easier for you to determine what 20 days of pay equals and use that $ value.

When you go through the NY program, you can allocate by days or by income percentage. On the screen before this allocation, I entered an amount for NY wages from an employer with a much higher w2 amount. Then I just said the part I entered is the 100% NY part. This method might work better for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State non resident tax: how is AGI pro-rated when on a long leave during the year?

great! thanks, this is a great solution.

Alternatively, I was thinking if I input the amount of w2 (say 100k) in the prior screen, I can check the NY earned income (say 15k), and then use "Allocate by percentage" as 15%.

Days was messing my taxes, and using a % will fix this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bruno_Mesquita

New Member

rodiy2k21

Returning Member

user17538342114

Returning Member

girishapte

Level 3

marcmwall

New Member