- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

If your NY wage days are 20, then the rest of the income on your w2 would be 97 or if the PFML is in there, 240. It seems easier for you to determine what 20 days of pay equals and use that $ value.

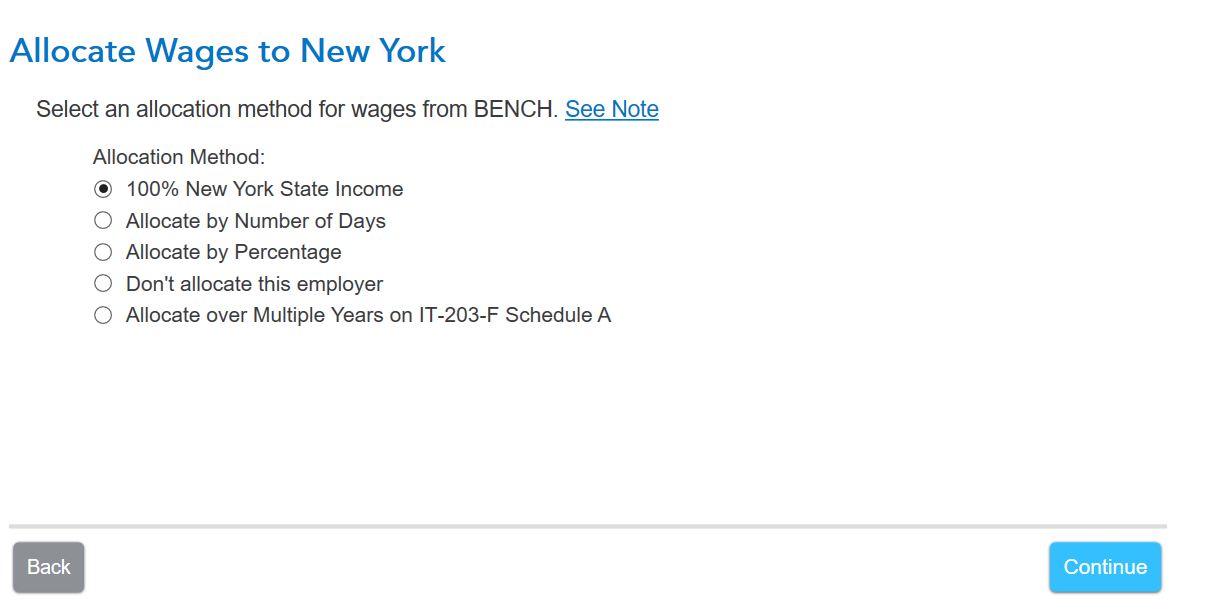

When you go through the NY program, you can allocate by days or by income percentage. On the screen before this allocation, I entered an amount for NY wages from an employer with a much higher w2 amount. Then I just said the part I entered is the 100% NY part. This method might work better for you.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 8, 2025

8:00 PM