- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- New York Partial Year Resident - Incorrect Amount Taxed by New York

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York Partial Year Resident - Incorrect Amount Taxed by New York

State Breakdown

01/01/20 - 03/22/2020: I was a resident of New York (partial year).

- 01/01/20-01/31/20: I worked in NYC.

- 02/01/20-03/22/2020: I worked in NJ.

03/23/2020-12/31/2020: I both lived and worked in GA.

New York Earnings

- $13,559.86: 100% of my first W-2 was earned in NY while living in NY

- $35,769.11: 7% of my second W-2 was earned in NJ while living in NY

Total earned while living in NY: $49,328.97

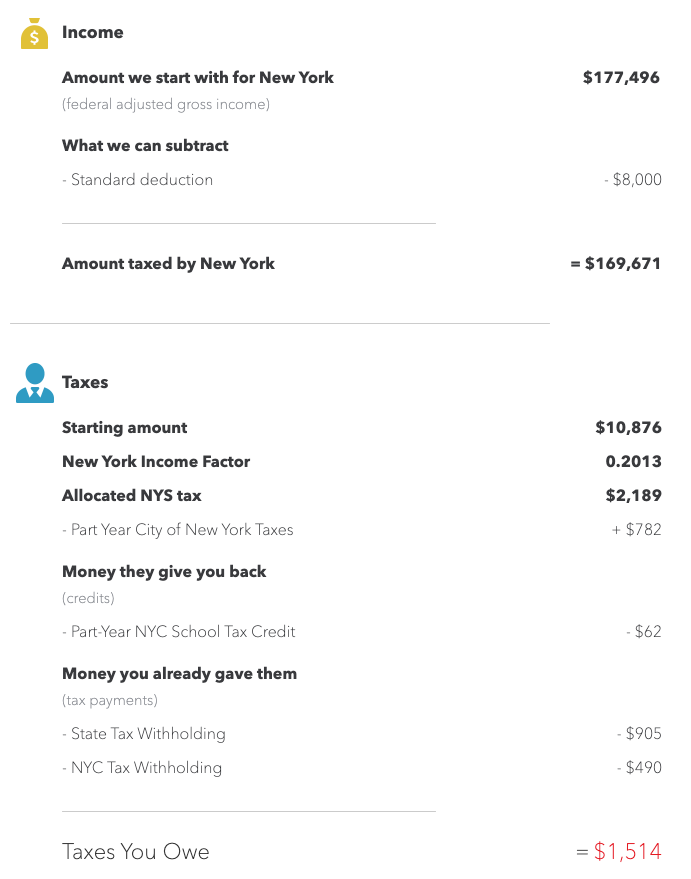

While working on New York State in TurboTax, I indicated that 7.0% of the second W-2 was earned in New York, however as seen below, New York is taxing me on 96% of my Federal AGI. I understand that New York uses my annual wages to determine tax % but there is absolutely no reason New York should be taxing income earned in another state from a non-New York source.

(NJ and GA both worked fine and show a small refund.)

How do I fix this??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York Partial Year Resident - Incorrect Amount Taxed by New York

You are correct. New York uses your annual wages to determine tax % but income earned in another state from a non-New York source should not be subject to New York State tax. Here is a TurboTax article that explains how to file a part-year resident tax return. Please follow the steps carefully and if you aren't able to resolve the issue you had above, please let us know.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

pennyshu08

New Member

KI2024

New Member

bartleby

Level 2

Luna_Tax

Level 3

in Education