- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York Partial Year Resident - Incorrect Amount Taxed by New York

State Breakdown

01/01/20 - 03/22/2020: I was a resident of New York (partial year).

- 01/01/20-01/31/20: I worked in NYC.

- 02/01/20-03/22/2020: I worked in NJ.

03/23/2020-12/31/2020: I both lived and worked in GA.

New York Earnings

- $13,559.86: 100% of my first W-2 was earned in NY while living in NY

- $35,769.11: 7% of my second W-2 was earned in NJ while living in NY

Total earned while living in NY: $49,328.97

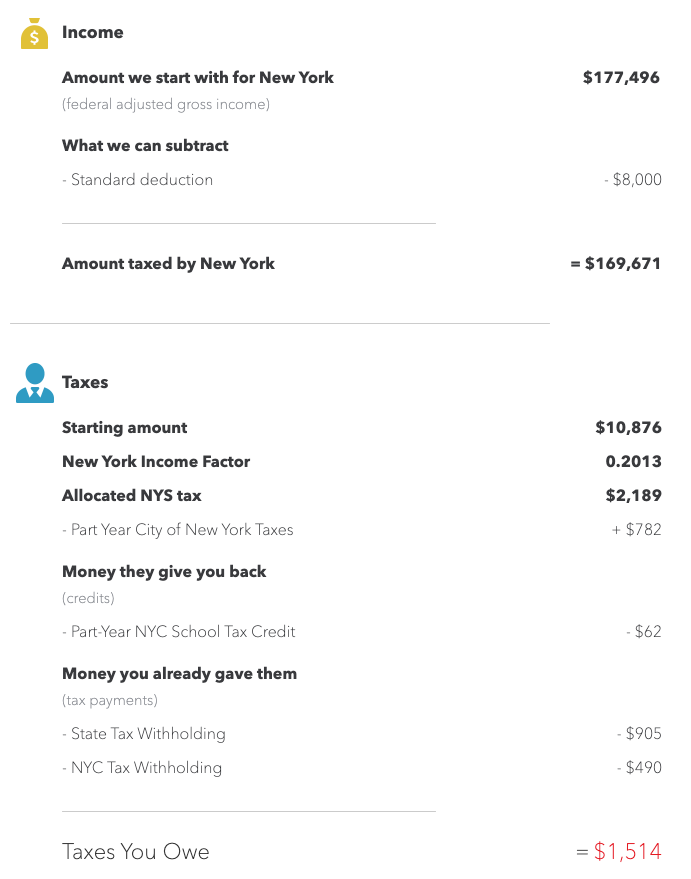

While working on New York State in TurboTax, I indicated that 7.0% of the second W-2 was earned in New York, however as seen below, New York is taxing me on 96% of my Federal AGI. I understand that New York uses my annual wages to determine tax % but there is absolutely no reason New York should be taxing income earned in another state from a non-New York source.

(NJ and GA both worked fine and show a small refund.)

How do I fix this??

Topics:

March 22, 2021

3:42 PM