- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Multiple States—partnership adjustments for state level differences

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

Hello,

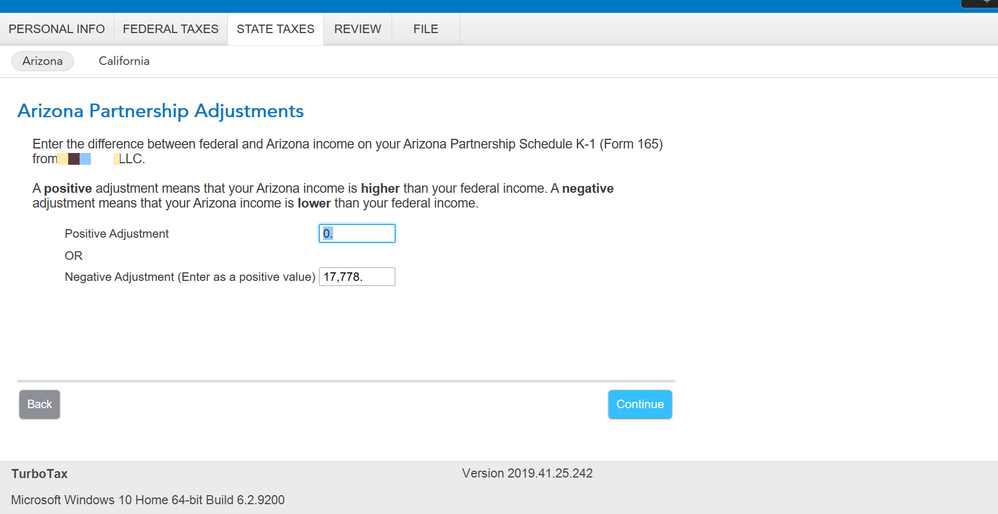

I am a resident of Arizona and I have a partnership interest in California (non-resident). When filing my tax return for Arizona I am prompted with the option to "Enter the difference between federal and Arizona income" for this partnership that is based in California. See screenshot. Should I apply a negative adjustment here for the full income amount since this is a California partnership and will be included in my California tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

It depends. If you were issued an Arizona Partnership Schedule K-1 (Form 165) and there are any differences in Income listed, you will need to list the differences on this screen.

If you were not issued an Arizona K-1 (Form 165) or there are no differences in the income from the Federal Form K-1, you will not make indicate any differences on this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

Hi

Thanks for your response @KarenM90 . Just clarify... I received a California K1 from this partnership interest along with a federal K1. I did not receive an Arizona K1. In addition there are no differences from my California and federal K1.

Based on your reply please confirm that I will not indicate any differences here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

Because you did not receive an Arizona Form 165 Schedule K-1, there is no adjustment for you to enter.

The Arizona instructions are specific to the Arizona Form 165 Schedule K-1. Your partnership is a California partnership, and presumably did not operate in Arizona and thus was not required to file Arizona Form 165. In other words, no Arizona Form 165 Schedule K-1, no difference to enter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

I understand that there is no difference for the Arizona return, however, form AZ 140PY then taxes me on the California income. Is this correct or do I need to adjust this on another screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

Since you were a part-time resident, AZ will tax you on any income earned while an Arizona resident, including the K-1 from the partnership. As you go through both the AZ and CA returns, you will be asked how much of the income is attributable to each state. You will be taxed by the appropriate state for the portion earned in their state.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

traxstarslzzfx

New Member

traxstarslzzfx

New Member

gofast24

New Member

firecracker6953

New Member

Marka1308

Level 1