- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple States—partnership adjustments for state level differences

Hello,

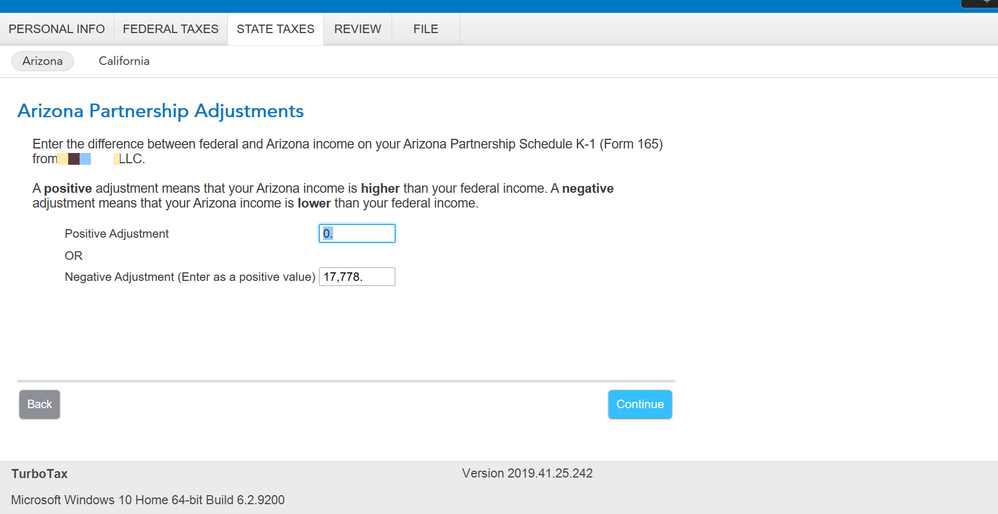

I am a resident of Arizona and I have a partnership interest in California (non-resident). When filing my tax return for Arizona I am prompted with the option to "Enter the difference between federal and Arizona income" for this partnership that is based in California. See screenshot. Should I apply a negative adjustment here for the full income amount since this is a California partnership and will be included in my California tax return?

Topics:

April 12, 2020

11:03 AM