- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- missing Montana schedule 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing Montana schedule 1

Can not see or print form 2 schedule 1 for Montana state tax

How can I print Montana form 2 adjustment form schedule 1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing Montana schedule 1

Can you clarify which information on Schedule 1 you had to enter manually? This will help determine which interview screen was required to populate the form automatically.

In TurboTax, Schedule 1 is generated automatically if there are Montana adjustments entered. I did a mock return and Schedule 1 populated correctly for the lines I tested. However, since there are many possible adjustments, I want to look into the specific lines from your return. Please tag me in your response so I can look into this further.

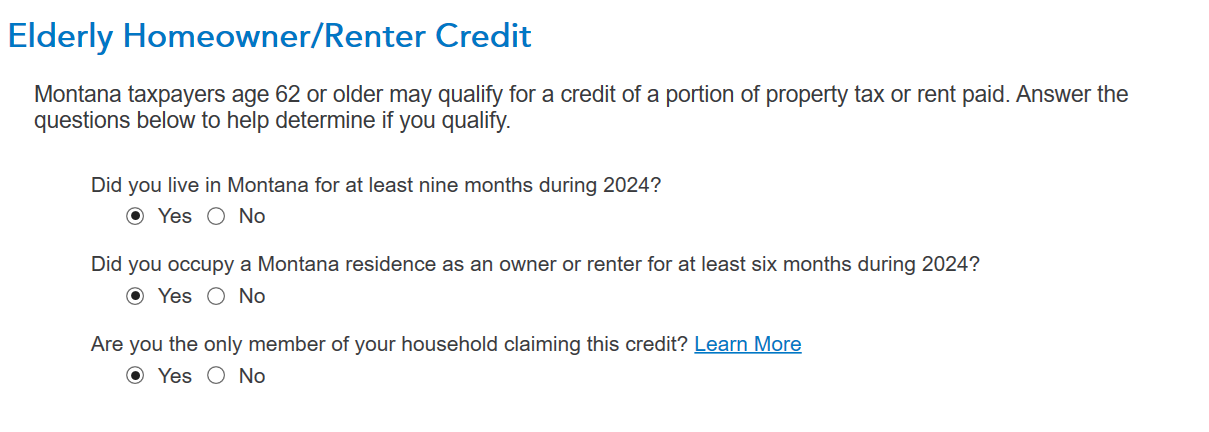

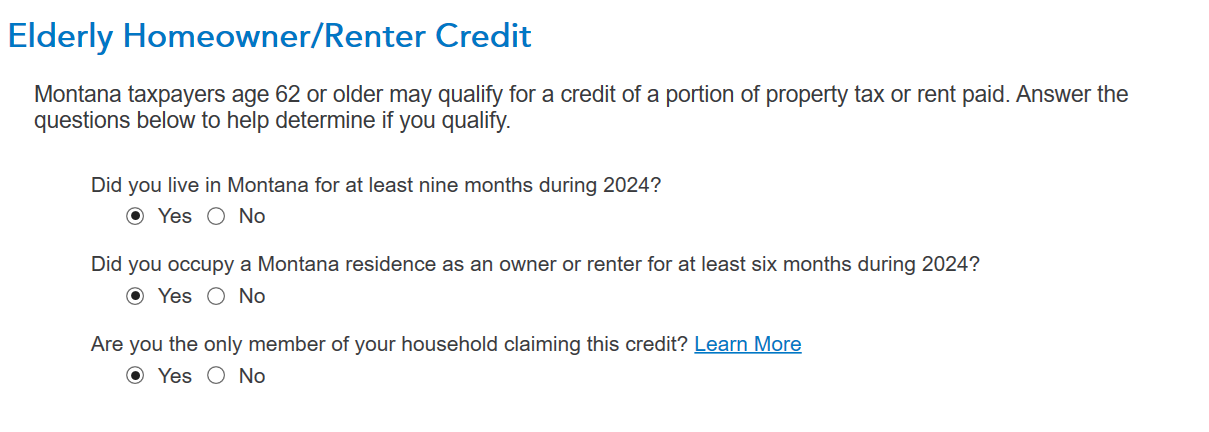

In regards to the Montana Elderly Homeowner/Renter Credit, TurboTax calculates this credit automatically based on the date of birth entered in the return, as well as the selections on the Elderly Homeowner/Renter Credit screen (see screenshot below). I did not have any issues toggling between the Yes and No options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing Montana schedule 1

You can access Montana Form 2 Schedule 1 (Adjustment Form) directly from the Montana Department of Revenue website. Go to the Forms & Instructions section, select Form 2, and download Schedule 1 as a PDF. Once downloaded, you can view, print, or fill it digitally.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing Montana schedule 1

The whole purpose of purchasing TurboTax is for it to fill in the values and print the proper forms.

If I download the form from the state, it still has to be filled in by manual calculations. The state program feature also has problems, as when it asked if I qualified for elder credits, it queried if I was a resident of more than 9 months , click yes or no. It did not have the an no box, there was no way to correct the response.

After using TurboTax to mail in to file the state return, as flowing the steps laid out. I got a response from the department of revenue that the forms were missing.

If I have to manually download and manually calculate values, what is the purpose of even using TurbotTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing Montana schedule 1

Can you clarify which information on Schedule 1 you had to enter manually? This will help determine which interview screen was required to populate the form automatically.

In TurboTax, Schedule 1 is generated automatically if there are Montana adjustments entered. I did a mock return and Schedule 1 populated correctly for the lines I tested. However, since there are many possible adjustments, I want to look into the specific lines from your return. Please tag me in your response so I can look into this further.

In regards to the Montana Elderly Homeowner/Renter Credit, TurboTax calculates this credit automatically based on the date of birth entered in the return, as well as the selections on the Elderly Homeowner/Renter Credit screen (see screenshot below). I did not have any issues toggling between the Yes and No options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gregeye

Returning Member

twalstadt

Returning Member

rsubr11

New Member

butterflyrina

Level 2

barbnich

Level 2