- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Can you clarify which information on Schedule 1 you had to enter manually? This will help determine which interview screen was required to populate the form automatically.

In TurboTax, Schedule 1 is generated automatically if there are Montana adjustments entered. I did a mock return and Schedule 1 populated correctly for the lines I tested. However, since there are many possible adjustments, I want to look into the specific lines from your return. Please tag me in your response so I can look into this further.

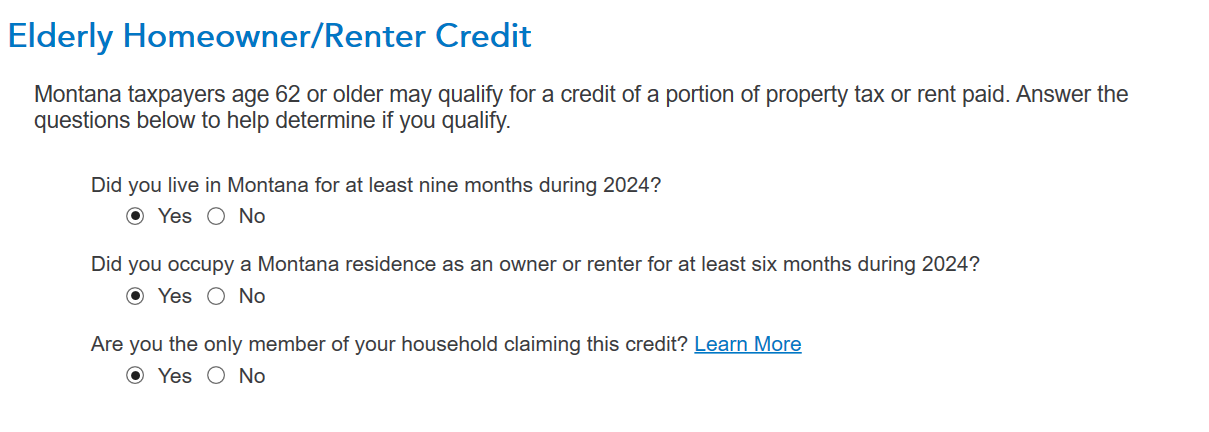

In regards to the Montana Elderly Homeowner/Renter Credit, TurboTax calculates this credit automatically based on the date of birth entered in the return, as well as the selections on the Elderly Homeowner/Renter Credit screen (see screenshot below). I did not have any issues toggling between the Yes and No options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"