in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Michigan - MESP education saving program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

Turbo tax error:

For the Michigan - MESP education saving program contribution, Turbo tax does not calculate the MAX deductible $ amount correctly ($5000 or $10000 depending on filing jointly or not). If one contributes more than these limits, TurboTax assumes the whole contribution is deductible, which is a mistake. Please advise.

Second Turbo Tax error:

Similarly, why would TurboTax deduct MESP withdrawals from income. What is the legal basis for that?

Please confirm these are TurboTax mistakes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

When you enter an amount for the MESP contribution that is greater than the maximum allowable deduction, TurboTax generates an error and asks you to change your entry so that you fall under the $5,000/$10,000 maximum contribution. [See Screenshot #1, below.]

According to the Instructions for the MI-1040 (p.14), line 21 Miscellaneous Subtractions include: "Any portion of a qualified withdrawal from an MESP account, including the MAP, or ABLE account to the extent included in federal AGI."

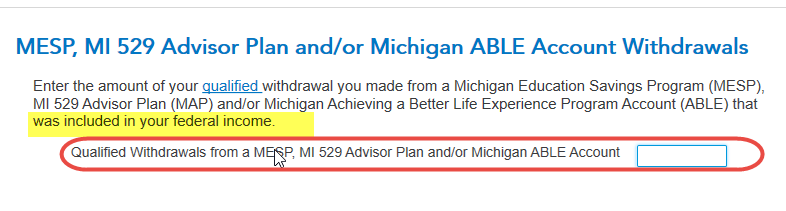

TurboTax asks you to indicate the amount of withdrawal that was included in your federal AGI. If the amount was not included in your federal AGI (because it was used for education expenses, for example) it should not be entered on this screen. [See Screenshot #2]

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

Thank you for the clarifications. I did not get the error messages but your reply clarifies my concerns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

Thank you for your clarifications.

However, where on the Turbot Tax indicate or ask the important question about whether or not the withdrawal should go into this section?? I had the same doubt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

Are you asking where to make these entries?

Get into the Michigan interview and navigate to the screen that is titled "Here' the income that Michigan handles differently".

Scroll down to the subheading Education and click on the section you want to start on.

@ytischler

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

One issue and one problem/bug: Since the Federal 1040 was created by Turbo Tax, Turbo Tax should know if the AGI included any income from a 529 distribution? TurboTax should not have to then ask in the State 1040 to add any withdrawal that was included in the Federal 1040.

I had incorrectly entered the MI 529 withdrawal amount that creates an entry on Schedule 1 Line 21. This then deducts the 529 withdrawal as income but the income was never reported in the AGI. However, TurboTax does not allow me to correct this entry to $0.00?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

This is exactly the problem I'm running into this year. Did you ever find a solution to this? We took out the exact amount to pay for our child's college. But TT is counting all of it as taxable income plus a 10% penalty. If I manually delete the "income" from the 529 account, then my tax liability goes up!? - somehow I suspect the tax credit is rolled into this, but it does not seem correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan - MESP education saving program

If you withdrew from a college savings plan an amount that was entirely used for education expenses, you don't need to enter the 1099-Q into your return. Just save it for your records.

Here's more info on Form 1099-Q.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zinj

Level 3

os691

New Member

in Education

catkik

Level 3

in Education

CzarSosa

Level 2

FineTuningDan

Level 2

in Education