- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- MA State - LP/PTP Sale - How to enter Basis & Ordinary Income Adjusted for Bonus Depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA State - LP/PTP Sale - How to enter Basis & Ordinary Income Adjusted for Bonus Depreciation

Sold all our shares of EPD LP/PTP last year. We had inherited them a couple years prior. Used help from this forum to enter the federal entries re the sale. However, I believe MA may not recognize the Bonus Depreciation. If so, how would that adjustment be entered in TT (the Sales Schedule on my K-1 has the Basis & Ordinary Income values adjusted for Bonus Depreciation in columns 10 & 11) ?

I did find one question from a prior year and it mentioned a place on a worksheet for state values. However, it looks like the worksheet may have changed or I missed the place for state information.

I appreciate any feedback. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA State - LP/PTP Sale - How to enter Basis & Ordinary Income Adjusted for Bonus Depreciation

It depends. You would increase the cost basis for the MA state return by the amount of excess depreciation that was allowed on the federal return during y our ownership period. This will reduce your gain or increase your loss on the MA tax return.

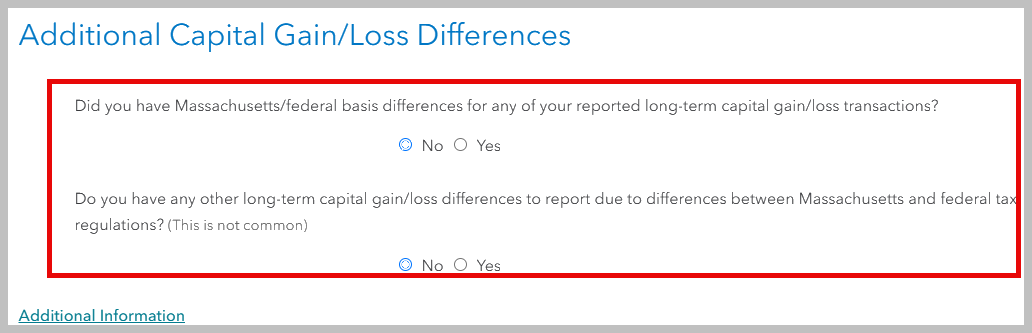

There is a place in the MA return to adjust the cost basis indicated above which will reduce your gain on the MA return (or increase the loss). Watch for the screen titled 'Additional Capital Gain/Loss Differences'.

The difference in depreciation will be the actual amount used on your federal return less the amount allowed on your MA return. This amount will be added to your cost basis for MA. It should be included in your K1 statements, but you can check with the person who prepared the K1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeff-W

Level 1

atn888

Level 2

atn888

Level 2

taxbadlo

Level 1

mjlresources

New Member