- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

It depends. You would increase the cost basis for the MA state return by the amount of excess depreciation that was allowed on the federal return during y our ownership period. This will reduce your gain or increase your loss on the MA tax return.

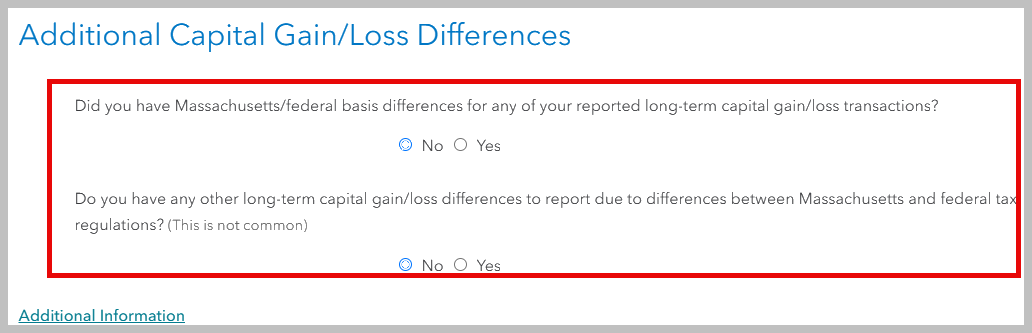

There is a place in the MA return to adjust the cost basis indicated above which will reduce your gain on the MA return (or increase the loss). Watch for the screen titled 'Additional Capital Gain/Loss Differences'.

The difference in depreciation will be the actual amount used on your federal return less the amount allowed on your MA return. This amount will be added to your cost basis for MA. It should be included in your K1 statements, but you can check with the person who prepared the K1.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2025

1:47 PM

981 Views