- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- M1NR form addition to turbotax to only pay tax in MN while a resident of MN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

For the past tax year, I was a resident of 2 states, one of which was MN. In Turbotax, the portion of the year that I was not a MN resident is being included in the state taxes for MN (therefore leading to a higher amount owed to MN than there should be). With this in mind, how can I ensure the M1NR is added correctly so that only income earned in MN while I was a resident of MN is taxed for MN? Of note, according to Taxes Paid to Another State Credit | Minnesota Department of Revenue "For the portion of the year you are a Minnesota resident, you are taxed on income you receive inside and outside of Minnesota. When you live in Minnesota but work in another state, Minnesota taxes your out-of-state income." (from this link at MInnesota Department of Revenue). Therefore, I should not be paying taxes on the portion of my income made in another state when I was a resident of another state. It appears there is a glitch in the TurboTax software or (more likely) there is another section I missed that allows for the addition of the M1NR form to ensure only income from my time as a Minnesota Resident is taxed for Minnesota.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

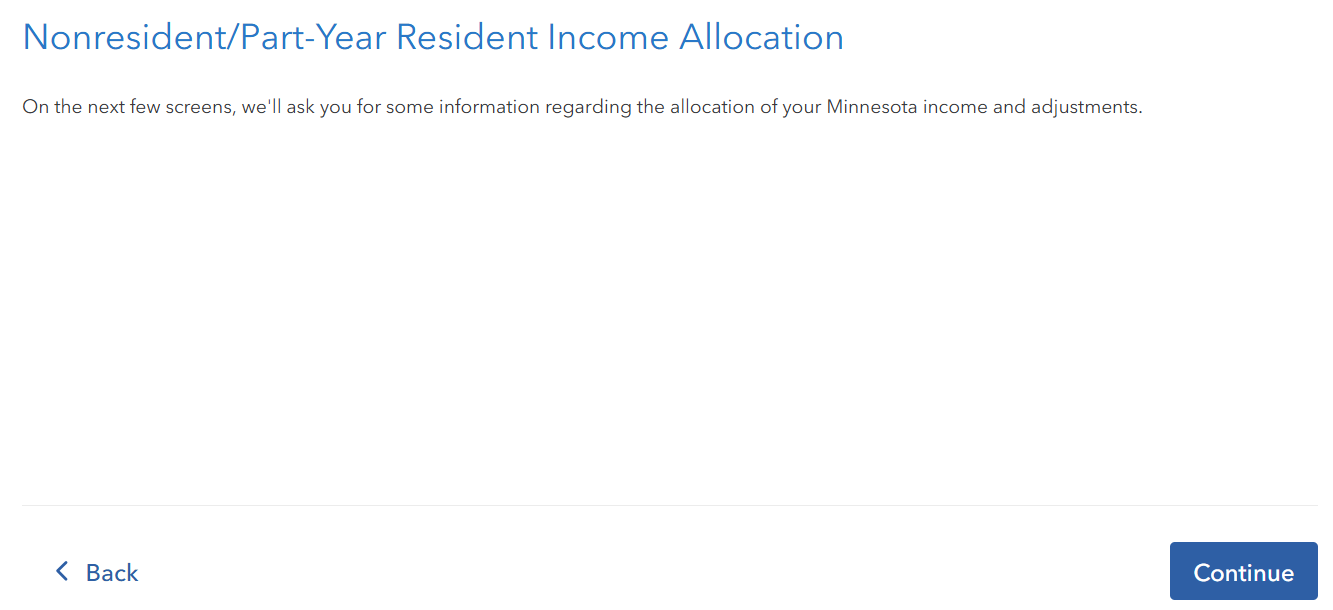

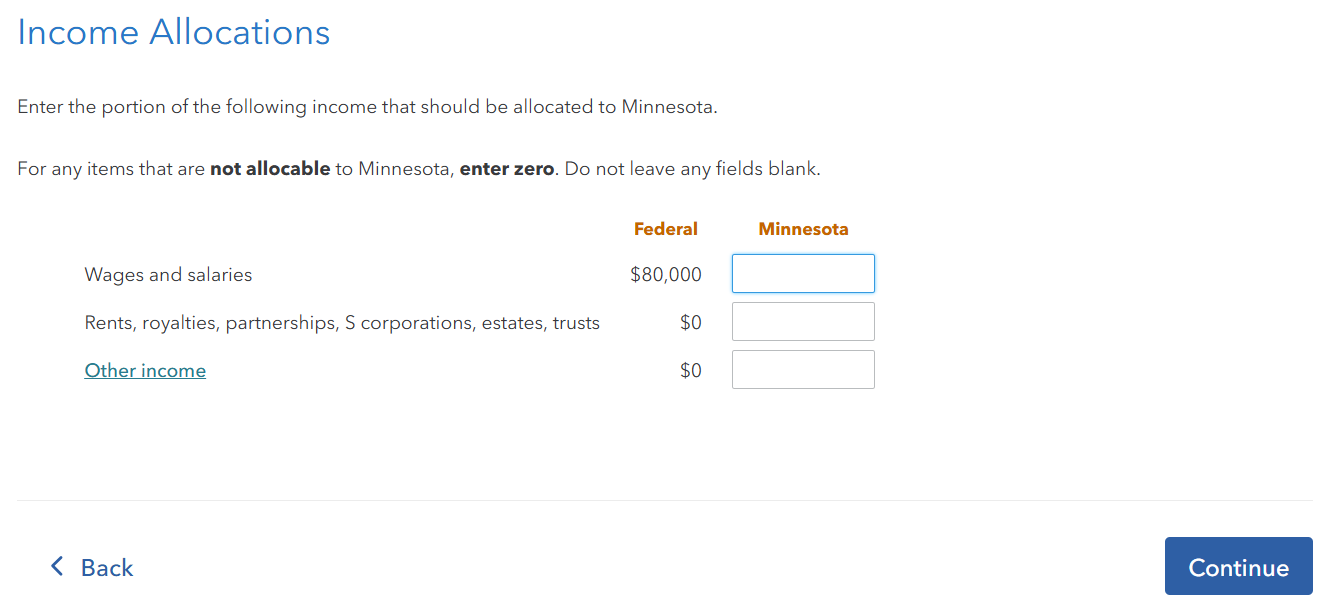

If you've set your residency in Minnesota as part year resident, you should be able to allocate your income between Minnesota and non-Minnesota income. After going through the first several screens, you will get to a screen that says you're going to allocate income.

Note: If you lived in another state and worked in Minnesota, all of your income would still be taxable to Minnesota as Minnesota taxes nonresidents on Minnesota source income.

On the next several screens, you'll enter only the amount you earned form Minnesota sources in the second column.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Hi Kesha,

Thanks for showing this as well! When I have filled in only the portions of my income that are MN based in these boxes, the taxes for MN still end up being on all of my income rather than only the MN specific portion of it. Any idea why that might be the case or other things I should try? Or if there is another place I can adjust what portions of my income is taxed by MN?

I really appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

If you'd like, we can look at your return and see exactly what you see to help come to a resolution. The return will be scrubbed and won't include any of your personal details.

If you're using TurboTax Online:

Once you're logged in to your account,

- on the left hand panel, click on Tax Tools and then choose Tools

- on the pop up window, select Share my file with Agent

- you'll see a message saying you'll give us a copy of your tax return. Your personal information will be changed so we can't see any private information.

- click okay and you'll get another message with a token

If you're using TurboTax Desktop:

- Click on Online in the top menu of TurboTax Desktop for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number and state then place in this issue.

- We can then review your exact scenario for a solution

Please reply to this message with your token so that we can further assist you. Let us know all other states, if any, that are included on the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Hi Kesha,

My token is 1283065. The only other state included in the return is Colorado.

Thank you for the help, I really appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Thank you for sending over your token.

Minnesota determines tax for nonresidents and part year residents by first calculating how much tax they would have to pay on their full year income, regardless of where it was earned. Then, the state calculates an income percentage that's calculated based on the amount of income earned within Minnesota versus the amount of income earned all year. This income percentage is applied to the full year tax liability to prorate the tax based on how much income was earned within the state.

In your case, about 56% of your income was earned in Minnesota based on your entries. This percentage has been applied to your tax liability, so you are only being taxed on just over half of your inome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Hi Kesha,

Just to confirm (as I believe I may be confused) when looking at the Minnesota Taxable Income under the taxes and credits summary, it states that the MN taxable income I have is equivalent to the federal taxable income I have for the full year, not just the part that is specific to Minnesota. I had assumed in this section, it would only show the part that is MN specific, but this might be like you say where it is first calculating the entire income for the full year, and then doing the percentage for MN. If possible, can you explain what percentage of the total Minnesota taxable income is my part year income tax (from what I have been reading, I assume it's around 5%)? That may help me better understand how that part year income tax is calculated. Thank you for the help; I really appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Yes, the Minnesota taxable income shown on your state tax summary will be based on your full-year income. After prorating the tax based on the income you earned in Minnesota, your effective tax rate is roughly 3%. This is the actual tax you pay divided by the full-year taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

Hi Kesha,

That makes sense. Are you able to tell me what the tax rate is on my Minnesota specific income (rather than the % based on my full year taxable income?). If I use the 56% of my total taxable income, then the MN tax I owe currently is about 6% of the total income I made while in MN. Does that seem correct to you? Thanks for the help and the clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

M1NR form addition to turbotax to only pay tax in MN while a resident of MN

That's correct, it would be about 6%.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

melillojf65

New Member

marcmwall

New Member

dpa500

Level 2

derrickbarth

Level 2