- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

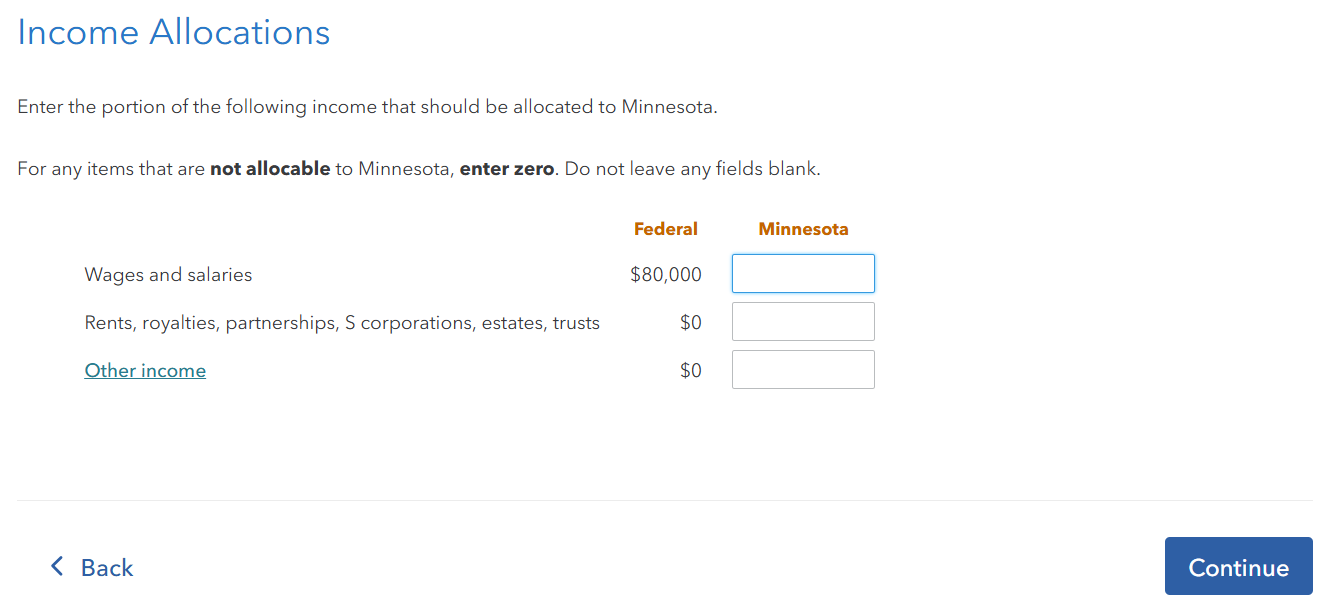

If you've set your residency in Minnesota as part year resident, you should be able to allocate your income between Minnesota and non-Minnesota income. After going through the first several screens, you will get to a screen that says you're going to allocate income.

Note: If you lived in another state and worked in Minnesota, all of your income would still be taxable to Minnesota as Minnesota taxes nonresidents on Minnesota source income.

On the next several screens, you'll enter only the amount you earned form Minnesota sources in the second column.

March 4, 2025

3:44 PM