- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Incorrect assignment of 1099R retirement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Turbo Tax took the info I downloaded from my Massachusetts Teachers Retirement Pension 1099R and put it into line 4b as an IRA distribution, instead of on line 5b as a pension which it has done for the past 10 years. It doesn't changes the Federal taxes I have to pay, BUT it dramatically changes the refund I'm SUPPOSED to get from Massachusetts. Massachusetts does NOT tax Teacher's retirement pensions, but because Turbo Tax puts in on Federal as a IRA it IS being taxed on my state return! A previous suggestion was, "Did you accidentally check the 'This is an IRA' box" I have gone back over the return several times but don't see ANY such box. How can the pension monies be taken OUT of 4b and correctly moved to 5b?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

The box to check that indicates the distribution is from an IRA is on the Form 1099-R input screen. It is right after you enter the information from box 7 for the distribution code shown on your 1099-R.

Use these steps to go back to the Form 1099-R section of your return and edit that Form 1099-R to see if the box was checked in error:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-R” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-R”

- Click on the blue “Jump to 1099-R” link

If the problem persists, try deleting and re-entering the Form 1099-R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Tried 3 times to reset, but it STILL puts the pension as an IRA, meaning it dumps my Teacher's pension onto line 4b instead of 5b! It then does the same on my Massachusetts' tax return and makes that money TAXABLE when Massachusetts does NOT tax it's Teacher's pension funds! This is VERY frustrating and annoying. This was NEVER a problem in year's past!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

from RaifH

When you input your pension into the federal area of the return, did you indicate that it was from a tax-exempt source for the state of Massachusetts? To do this:

- Verify your 1099-R entry under Federal > Wages & Income > Retirement Plans and Social Security > IRA, 401 (k), Pension Plan Withdrawals (1099-R)

- If this is a tax-exempt pension in the state of Massachusetts, it should fall under one of the categories of Qualified government retirement distributions listed on the Where is your distribution from? screen.

- Continue through the remaining 1099-R screens.

If you do it this way, the system should automatically exempt it on the state return and should clear the error you are encountering. If you entered everything correctly the first time, you may want to try to delete it and re-enter the information manually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

This is the 3rd time I've responded. This "update" was from RaifH and said "It should fall under one of the categories of Qualified government retirement distributions listed on the Where is your distribution from? screen" However, there is NO "Where is your distribution from ? screen!!!!!" THEREFORE, it ALWAYS brings it up as a Keogh distribution! Turbo Tax appears to miss that VERY important step!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

To clarify. What is the distribution code in Box 7 of your 1099R?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

It is "7- Normal Distribution"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

These are the steps you should be seeing:

1. In the Personal Info/My Info, enter your home state as Massachusetts (this is true, right?).

2. Go to Wages and Income.

3. Go to Retirement Plans and Social Security.

4. Go to IRA, 401(k), Pension Plans.

5. Tell TurboTax you will type the 1099-R yourself.

6. Tell TurboTax that you have a 1099-R, not a CSA-1099-R or a CSF-1099-R or a RRB-1099.R.

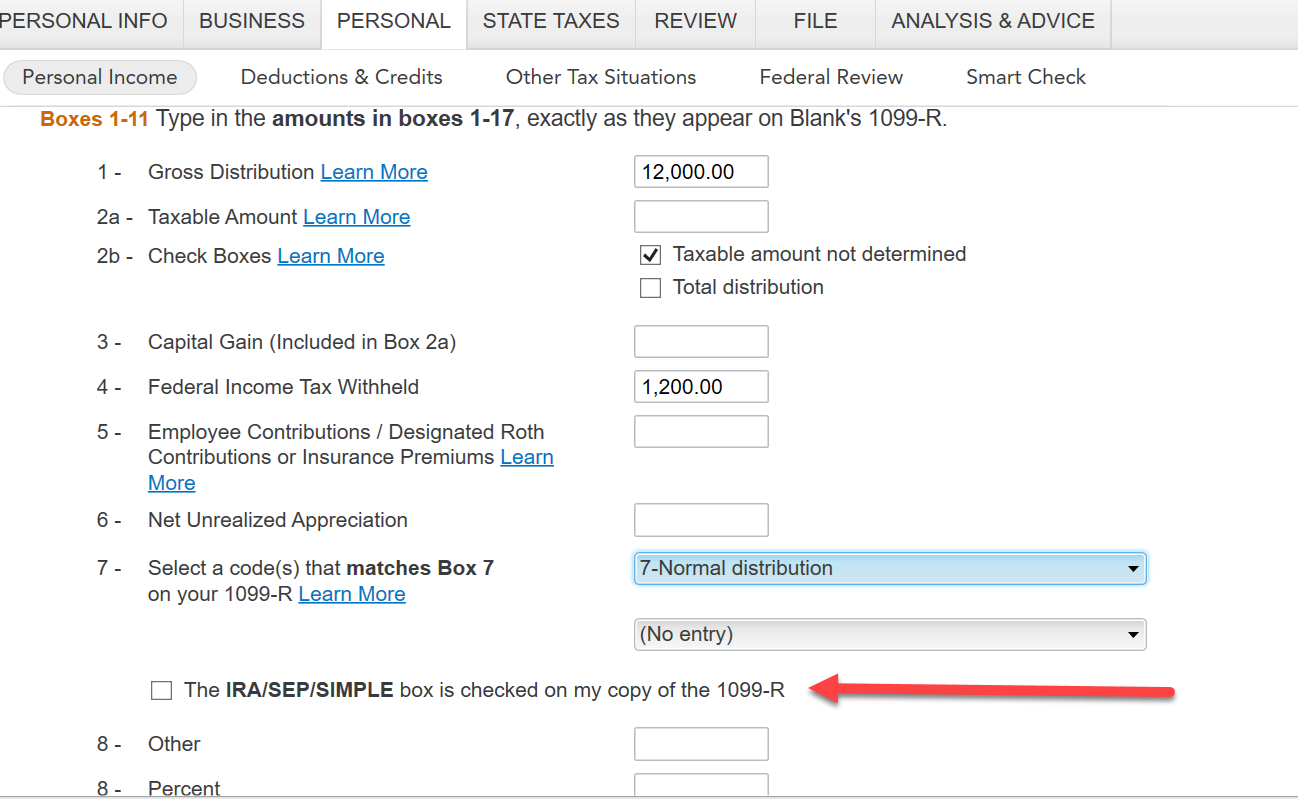

7. Enter the data from your 1099-R. The example below is just some made-up data. See the right arrow? That points to the box that you should NOT check.

8. The next screen will ask you to confirm that the IRA box is not checked.

9. Say "No" to the next screen that asks if you were employed as a Public Safety Officer.

10. On the next screen - which appears only for Massachusetts residents - make sure that the first bullet point for Qualified government retirement distribution is checked, and that the three boxes at the bottom have been filled in with information from the 1099-R (if any).

11. Then TurboTax will go on to ask if this is a qualified plan (it almost certainly is), in order to determine how much of the plan is taxable on the federal return. If you made no after tax contributions to the plan while you were working, then the entire distribution will be taxable on the federal return.

OK, now where do you find that your experience if different?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Thanks, Bill!

However, there is NO difference, but TT still enters it as a line 4b "IRA distributions" and NOT a line 5b "Pension and annuities". Which makes NO difference for Federal but messes up my State return.

Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Are you saying that you are seeing that Massachusetts input screen about "Massachusetts Special Handling" and TurboTax still thinks that it is an IRA?

If so, then I would like you to send us a sanitized version of your return. "Sanitized" means that all the personal data has been redacted.

You do this by sending us a "token" (a number that identifies your sanitized return in our database).

To send us a token, please do the following:

TurboTax Online:

Click Tax Tools in the menu to the left.

Click Tools, and then

Click Share my file with Agent.

A pop-up message will appear. Click OK to send the sanitized diagnostic copy to us.

Provide the token number that is generated onto this thread.

TurboTax Desktop:

Select Online menu if the customer is using Windows. Select “Help” if using a Mac.

Select Send Tax File to Agent.

A pop-up message will appear, and the customer will select, Send. If using Mac "Send Tax File to TurboTax Agent"

Note: Desktop will save a file to your computer unless you uncheck the box.

Another message will appear. Provide the token number that is generated onto this thread.

Finally, please enter at the bottom of your response "@" and "BILLM223" without the space in between so that I will be notified.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Bill,

The token number is 945483.

Thanks again for your help!

Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

I am puzzled. It's a bit difficult to see what is happening on your return, because the sanitation process obscures quite a bit, but I see four 1099-Rs, every one of which is listed on the federal return as a pension, not an IRA.

From what I see, three of the four 1099-Rs show to be from tax-exempt sources (I assume that that is correct), however, in the Massachusetts interview, there is a series of screens dealing with pension income. There is one screen that says "Pension Adjustment - Federally Taxable" and the number in the box is primarily that of your largest 1099-R, not the sum of the three 1099-Rs that appear to be tax exempt. Did you put that number there? If TurboTax preloaded it, why did you not change it when you saw it?

Instead of being in the 1099-R interview (where this sort of problem usually is), I would look in the Massachusetts interview at the various screens dealing with your pensions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

Hi again Bill!

I went back to the actual form for the MA Teacher's Retiement Form 1099-R. Line B4 has the full $57,440.76 listed as "Amount of this distribution that may be rolled or converted to a Roth IRA"

NONE of this WAS converted to a Roth IRA, but it won't let me erase it from that line even though I listed it as "a normal distribution." and NOT an IRA . I also looked at the "IRA Contributions Worksheet" and it is NOT listed there. So how does it end up listed as an IRA?

Moving on to the State Tax Forms, in the "Final Review" Turbo Tax says "Form 1" is not done and I have to complete it. In the Section 3 "Pensions and Annuities Smart Worksheet" the "Commonwealth of MA Teacher's Retirement" lists the amount as $57,242. That is in box 2a "Taxable amount" not the gross distribution. However, it does list the full $57,441 gross distribution as a "Tax exempt portion of pensions and annuities" (in RED)The final Line 4, "Taxable pensions and annuities" is the taxable amount of $43,956 WITH an "explanation statement the says, "Tax-Exempt Qualified Pension Plan." I'm not sure WHAT they want me to do to correct the error????

When I looked back at the 2020 return, the 1099-R for my Teacher's Retirement, the full amount was in B4 "Amount of this distribution that may be rolled or converted to a Roth IRA."

The 2020 MA return had a VERY different Form 1. My RMD's were ALSO listed as tax exempt and ONLY my wife's RMD was taxable. That significantly lowered our MA taxable income, and gave us a MA refund of $2,339 for 2020 vs. $470 this year. That's what set off my alarm bells for possible problems with the 2021 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

"I went back to the actual form for the MA Teacher's Retirement Form 1099-R. Line B4 has the full $57,440.76 listed as "Amount of this distribution that may be rolled or converted to a Roth IRA""

1099-R? Line B-4? Are you looking at a TurboTax worksheet or a Massachusetts form or what? There is no Line B4 on the 1099-R.

Did you auto-import this 1099-R, or did you type it in? If you auto-imported it, please print a copy, then delete the 1099-R and re-enter it by hand.

In fact, if you auto-imported any 1099-Rs, please do the same, because your descriptions are very odd.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect assignment of 1099R retirement

The first paragraph refers to the FEDERAL 1040-SR form page 1 that covers income. I printed out the copy directly from TT. My mistake was putting B4 instead of 4b. Does that clarify?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

barbnich

Level 2

danemer

New Member

WI 1

Level 3

bmihalovits

New Member

mc257

New Member