- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

These are the steps you should be seeing:

1. In the Personal Info/My Info, enter your home state as Massachusetts (this is true, right?).

2. Go to Wages and Income.

3. Go to Retirement Plans and Social Security.

4. Go to IRA, 401(k), Pension Plans.

5. Tell TurboTax you will type the 1099-R yourself.

6. Tell TurboTax that you have a 1099-R, not a CSA-1099-R or a CSF-1099-R or a RRB-1099.R.

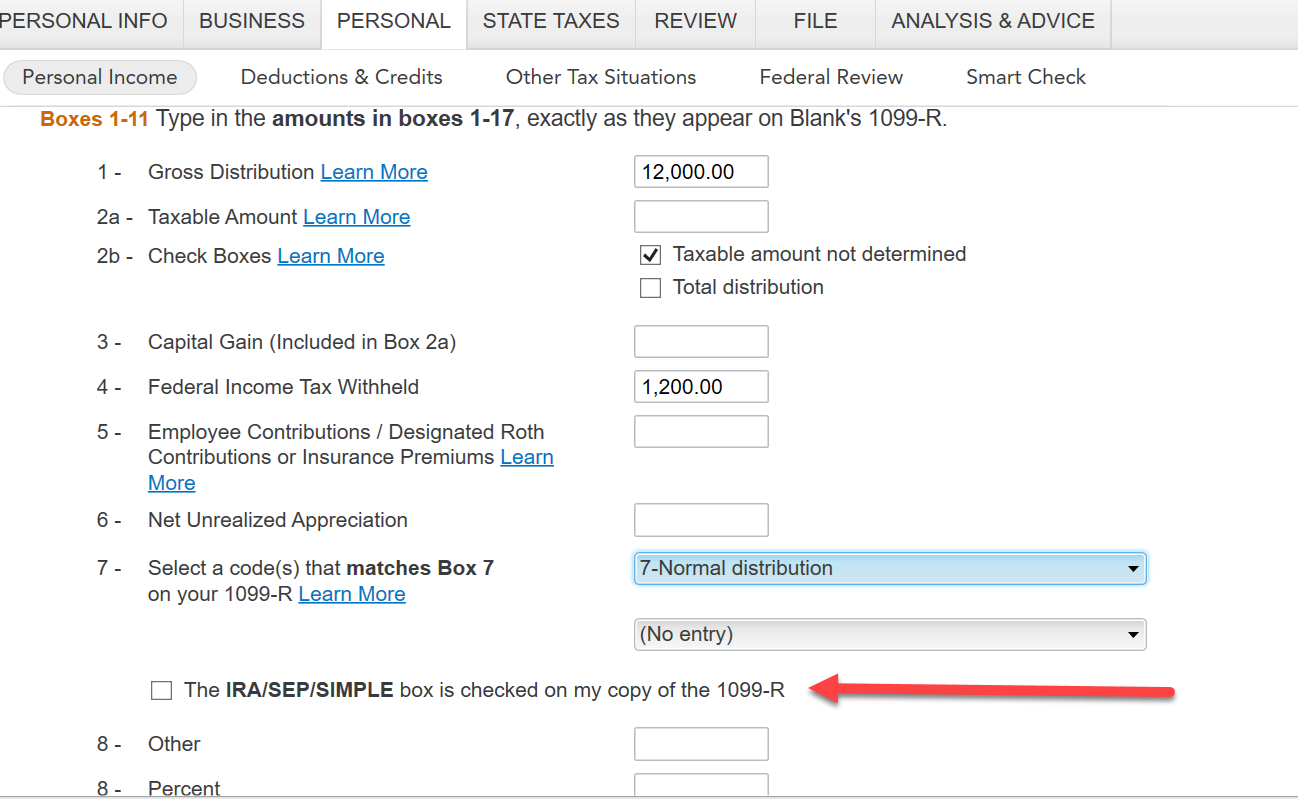

7. Enter the data from your 1099-R. The example below is just some made-up data. See the right arrow? That points to the box that you should NOT check.

8. The next screen will ask you to confirm that the IRA box is not checked.

9. Say "No" to the next screen that asks if you were employed as a Public Safety Officer.

10. On the next screen - which appears only for Massachusetts residents - make sure that the first bullet point for Qualified government retirement distribution is checked, and that the three boxes at the bottom have been filled in with information from the 1099-R (if any).

11. Then TurboTax will go on to ask if this is a qualified plan (it almost certainly is), in order to determine how much of the plan is taxable on the federal return. If you made no after tax contributions to the plan while you were working, then the entire distribution will be taxable on the federal return.

OK, now where do you find that your experience if different?

**Mark the post that answers your question by clicking on "Mark as Best Answer"