- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- In state of Colorado form Sales Tax and deductions worksheet date I entered do not let it go thru

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In state of Colorado form Sales Tax and deductions worksheet date I entered do not let it go thru

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In state of Colorado form Sales Tax and deductions worksheet date I entered do not let it go thru

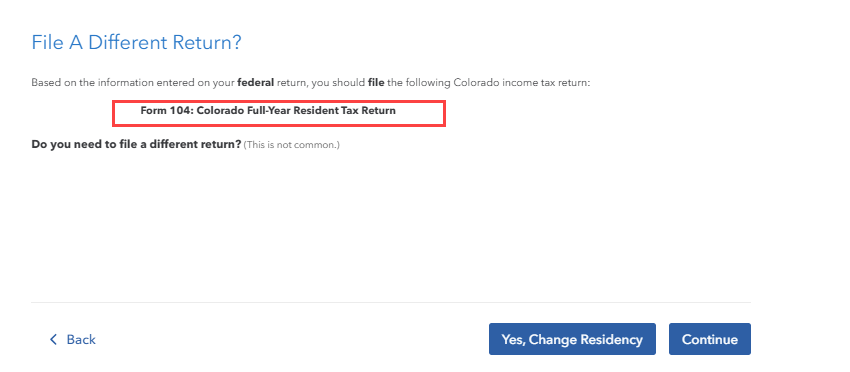

You should only enter dates you lived in Colorado if you were a part-year resident. Part-year residents do not qualify for the sales tax refund, and it sound like you were a full year resident. Delete the entries, and make sure you have selected resident. This can be seen as soon as you start your Colorado return.

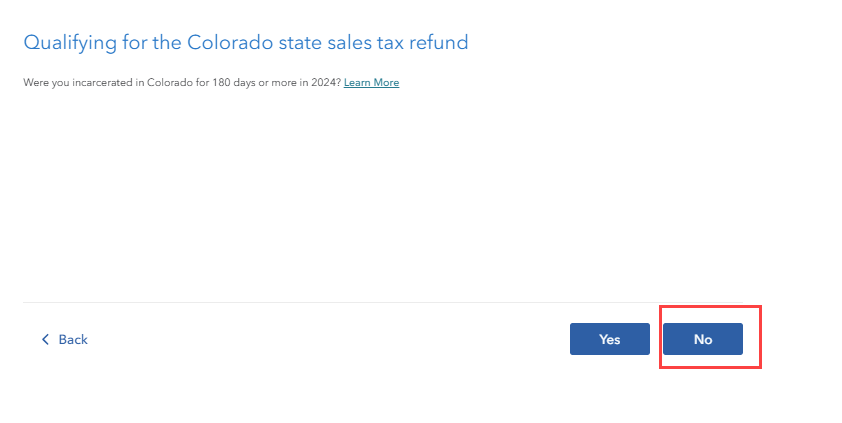

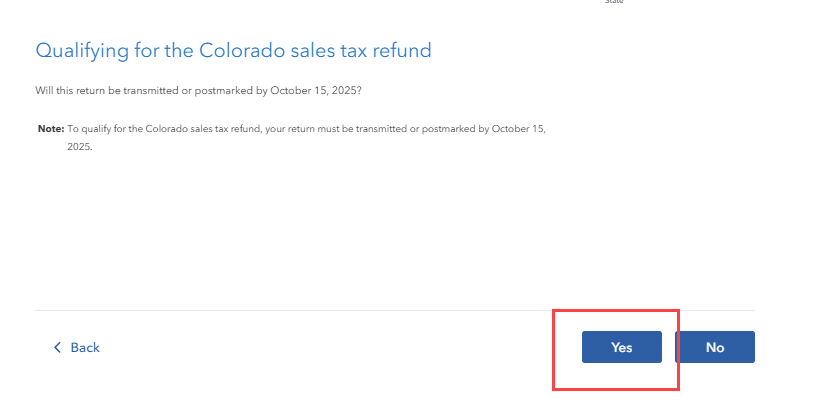

Next, continue through the state screens until you arrive at Qualifying for the Colorado state sales tax refund page, select No, if that is accurate. (You can't have been incarcerated in Colorado for 180 days or more during the tax year and qualify for TABOR.) Lastly, select Yes on the Qualifying for the Colorado sales tax refund screen to indicate you will file your tax return on or before the extended due date of 10/15/25. If you qualify, the You're getting the Colorado sales tax refund! screen should generate. Select Continue to move on with your return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

CTinHI

Level 1

Random Guy 1

Level 2

dgjensen

New Member