- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

I work and pay taxes in the state of Maryland, but I reside in PA. My employer is the State of Maryland and will not allow me to pay into PA, so I claim 0 and have Maryland taxes taken out to use to pay into PA. It helps with not getting hammered with a large tax bill at the end of the year when I file in PA. When I file Nonresident through TurboTax it has shorted my Maryland return 2 years in a row for about $300 and I cannot figure out why. Example I'm paying in $6000 and when I complete the state portion it says my return is $5800. I'm at a loss trying to figure this out and google isn't helping so any information would be very much appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

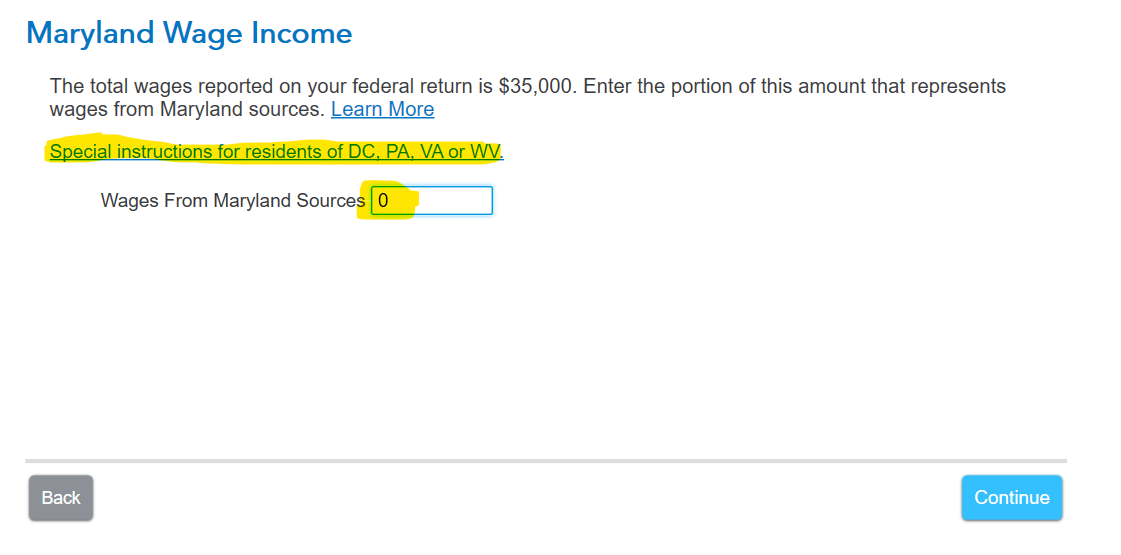

Let's start at the beginning. You enter the MD return and nonresident. When it asks for MD wage, you enter zero. Then for Non-Maryland income Allocation 3500, you enter the full amount in every column to match the federal. When you look at the MD tax return, you should see zero wages with your full refund of tax paid in. Is this what you are seeing?

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing? which includes the following two options

Related:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

First off thank you so much for the help and response. I searched last year and could not find out why they were withholding money and this year I couldn't figure it out, so thank you so much. I did have 0 from wages on the form 505, where the money is being deducted is on line 42 Maryland tax after credit. Are they possibly charging me a percentage to withhold money (claim 0) since I live in PA and don't pay into Maryland? I was under the impression that they are reciprocating states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

Yes, Maryland (MD) is a reciprocal state for Pennsylvania (PA). Enter the W-2 as it is however made sure all of your wages are taxed to PA.. If there is no MD withholding, then you do not need to file the MD return. File all wages to PA and enter only PA withholding as shown on your W-2.

You must obtain a refund from MD and pay the necessary tax to PA including all income ONLY if there is MD tax withheld.

A reciprocal agreement, also called reciprocity, is an agreement between two states that allows residents of one state to request exemption from tax withholding in the other (reciprocal) state. This can save you the trouble of having to file multiple state returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

Thank You Diane! So, I work for the State of Maryland who will not allow me to withhold taxes for PA. since that's the case I withhold from MD state tax, so I have a lump sum of money to pay into PA during tax time. My wife and I file jointly but I file PA for her state tax and Maryland for mine so I can complete the 505, should I be filing into PA instead of MD? If so how does MD know to pay me out all the taxes paid in? I apologize if that's confusing, I just don't understand why they are withholding money for a Maryland tax after credit (line 37) on the form 505.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

You must file MD to receive your refund since you live in PA. You can file your PA jointly, because you must pay the tax to PA since you are a PA resident. Your PA tax will not change on a joint return because all of the income for both of you is taxable. As you know they use a flat rate.

In TurboTax you need to do two things; first file the nonresident state return of MD for a full refund. TurboTax knows this is a reciprocal state for a PA resident. Next, file the PA return as full resident for each of you separately or together.

When the returns are filed through e-file, MD should know to release all of your refund. If necessary you can mail the MD return with a copy of your PA return as resident. Be sure to mark the MD return as a nonresident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

@Zachary0301 --

Complete Maryland Form MW507 and submit it to your employer. Her's a link to the form:

https://roads.maryland.gov/OOA/2024-MD-Withholding-Form-MW507.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

Unfortunately, the same thing happened to me last year, but I didn't realize the amount paid in to MD was $400 more than what was returned to me. I called MD and they told me fill out an amendment form because I am owed that money, and it should have not been withheld. I've tripled checked all the information I was given here from the experts and it's still the same. Last year I thought I was an input error on my part but I'm starting to believe it is something in TurboTax. I think you are right I may have to mail in. Again, thank you very much for taking the time to help and relieve my headache!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

Thank you Tom, can I still pay taxes into MD and receive a refund if I fill this form out? If so, am I able to submit this week to receive the full MD refund or will it apply next tax season?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

The form is for tax year 2024. It's purpose is formally to inform your employer that you are a PA resident and thus exempt from MD state tax withholding (and also from MD local tax withholding if you meet the criteria to check boxes 6 or 7).

The link I previously gave you is for the version of MW507 that is specific to MD state government employees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

Thank you again Tom. Since I was not aware of form MW507 for year 2023, does this mean I'm more than likely out the $267 again this year? I really do feel like this is a turbo tax issue, nothing on my W-2 say withhold $267, everything has been filed as a Maryland Non-resident so I would assume the program should pick that up. I spoke to Maryland tax office last year and they did inform me this was an error and needed to be amended. Unless I get the live assisted version, I don't know how I can really diagnose. I guess I could try another platform like H&R block even though I already paid for TurboTax. I've been using TurboTax for 4 years now and this just started happening with my state taxes last tax season. Do you think it's worth getting the live version? That will put me close to a total of just paying someone to do these for me lol Sorry for the rant and all the questions, I really appreciate your expertise. @TomD8

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

No, you are not out the money. MD will refund the money to a nonresident living in PA. File your 2022 return by mail to MD and include a copy of your PA return. They will refund the money.

It's a choice you can make about using TurboTax Live, however I believe you can simply mail a copy of the Maryland (MD) return if you do not see a full refund on the return you are ready to e-file. Whatever you decide, you can file the return and make sure to send a copy of your PA return with the MD return.

- If necessary you can mail the MD return with a copy of your PA return as resident. Be sure to mark the MD return as a nonresident.

The Form TomD8 is referring to can be printed and provided to your employer for 2024 so that no MD tax is withheld in the future since you are a PA resident.

[Edited: 02/05/2024 | 10:24 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work in and pay taxes in the state of Maryland but reside in PA and it wont a give me a full refund.

On the non-resident MD tax return, show the MD withholding but be sure to allocate zero income to MD.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ineverdream0

New Member

pennyshu08

New Member

mjbfhc

New Member

gabriel-rigon

Level 1

ctcowboy33

Level 1