- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

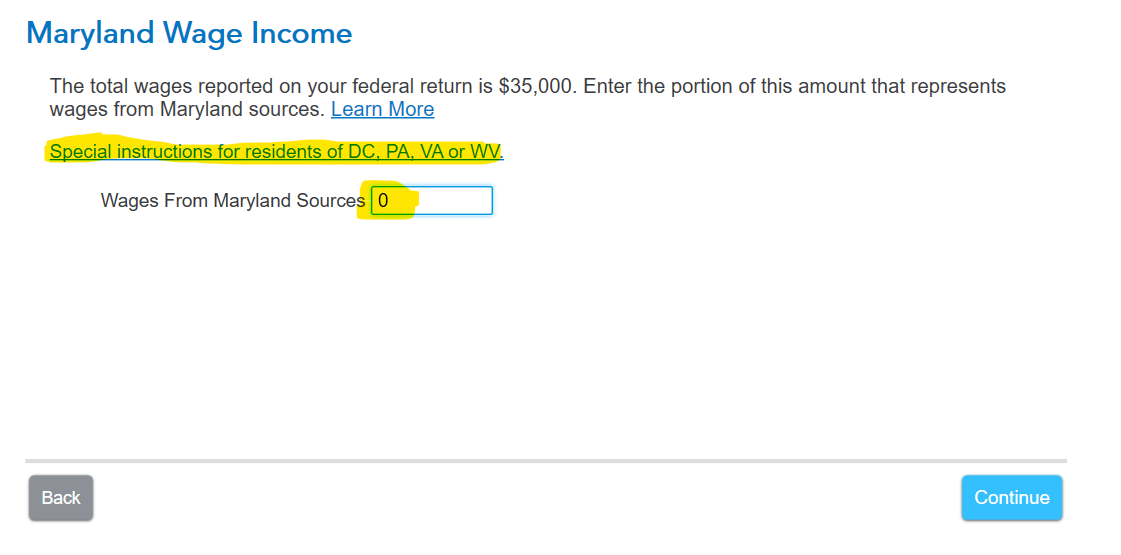

Let's start at the beginning. You enter the MD return and nonresident. When it asks for MD wage, you enter zero. Then for Non-Maryland income Allocation 3500, you enter the full amount in every column to match the federal. When you look at the MD tax return, you should see zero wages with your full refund of tax paid in. Is this what you are seeing?

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing? which includes the following two options

Related:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 2, 2024

3:25 PM