- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

I'll get right to it - I live in VT, and work from home (basically exclusively, minus a week-long visit to the office twice per year) for a company in NJ. Last year, when turbotax asks "did you make money in any other state?" I answered "no" because I hadn't - I earned all my income while in my residence state, VT.

This year, however, my W2 is much different, and my employer did not withhold state tax for my residence state (or not nearly enough). Here are my numbers for 2018/2019 to compare:

Here are my state wages and state income tax withholdings from my 2018 W2:

BOX 16 (state wages):

VT: $49,774.24

NJ:$0.00

BOX 17 (state income tax withheld):

VT: $2,216.14

NJ:$30.33

Here are my state wages and income tax withholdings from my current/2019 W2:

BOX 16 (state wages):

VT: $0.00

NJ: $59,400.00

BOX 17 (state income tax withheld):

VT: $396.78

NJ: $913.80

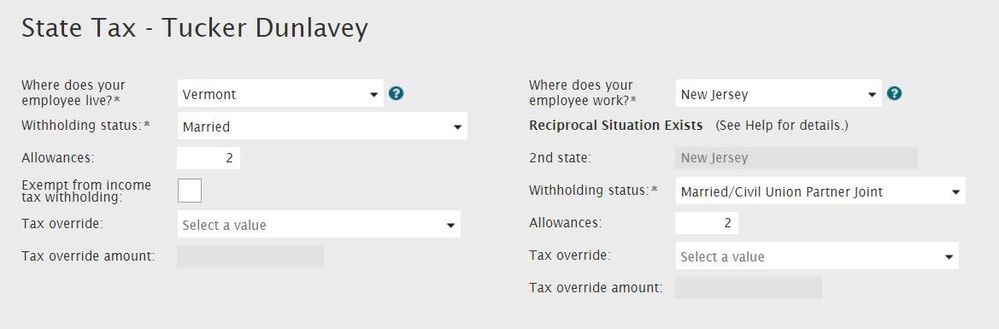

Essentially, nothing was held in 2018 for NJ state tax, besides $30, which was returned to me in-full. On my current return, it's showing that I'll owe VT $800 in state taxes. We changed payroll providers in 2019, and I think this is when things became messed up. I asked HR, and they sent a screenshot of how the new payroll is setup, which I'll attach below. You can see they stated that I live in VT but work IN NJ. I think it should be I live in VT AND work in VT. Our CPA said I can offset the amount by saying yes to "i made money in another state", and by stating I live in VT and work in NJ, and this is true, I just want to make sure I'm not out of line in doing so.

Help, please!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

Your payroll is set up correctly. You are a resident of Vermont who works in New Jersey. Your income is taxable to both New Jersey and Vermont. However, you are entitled to a credit on your Vermont tax return for taxes paid to another state.

Per the New Jersey Division of Taxation, all wages earned by a nonresident of New Jersey, who is employed by a business located within the state, are considered New Jersey source income for income tax purposes.

Most states assess tax on nonresident income based on the amount of time worked in that state. However, there are 5 states: Delaware, Nebraska, New Jersey, New York, and Pennsylvania where nonresident "telecommuter" income is taxed based on where the business (employer) is located. Please click on this link for more information.

Since you are a resident of Vermont, all of your income is taxable to Vermont. If you pay taxes to another state, you are entitled to credit on your Vermont return for taxes paid to another state. This prevents you from being double-taxed on the same income.

When preparing your return in TurboTax, you will need to indicate that you made money in another state (New Jersey) while you were a resident of Vermont. You will need to prepare a nonresident return for New Jersey and a resident return for Vermont.

Please complete your nonresident New Jersey return first, to ensure that your state taxes are calculated correctly. Then complete your resident Vermont return last.

Please click on the following links for more information.

TurboTax Help Article - How to file nonresident state return

Instructions for New Jersey Nonresident Return - See page 3 and page 5 (Line 15: Wages)

Vermont Department of Taxes - Credit for taxes paid to other states

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

Your payroll is set up correctly. You are a resident of Vermont who works in New Jersey. Your income is taxable to both New Jersey and Vermont. However, you are entitled to a credit on your Vermont tax return for taxes paid to another state.

Per the New Jersey Division of Taxation, all wages earned by a nonresident of New Jersey, who is employed by a business located within the state, are considered New Jersey source income for income tax purposes.

Most states assess tax on nonresident income based on the amount of time worked in that state. However, there are 5 states: Delaware, Nebraska, New Jersey, New York, and Pennsylvania where nonresident "telecommuter" income is taxed based on where the business (employer) is located. Please click on this link for more information.

Since you are a resident of Vermont, all of your income is taxable to Vermont. If you pay taxes to another state, you are entitled to credit on your Vermont return for taxes paid to another state. This prevents you from being double-taxed on the same income.

When preparing your return in TurboTax, you will need to indicate that you made money in another state (New Jersey) while you were a resident of Vermont. You will need to prepare a nonresident return for New Jersey and a resident return for Vermont.

Please complete your nonresident New Jersey return first, to ensure that your state taxes are calculated correctly. Then complete your resident Vermont return last.

Please click on the following links for more information.

TurboTax Help Article - How to file nonresident state return

Instructions for New Jersey Nonresident Return - See page 3 and page 5 (Line 15: Wages)

Vermont Department of Taxes - Credit for taxes paid to other states

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

Please refer to: Do I need to file a nonresident return for an out-of-state employer?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

Please refer to this help article: Do I need to file a nonresident return for an out-of-state employer?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

helenehallowell

New Member

dabbsj58

New Member

geraldessary

New Member

SB2013

Level 2

bees_knees254

New Member